Pi Network Price Surges as AI-Powered KYC Goes Live: 2025 Breakthrough

AI verification tech finally delivers where human compliance teams falter—Pi Network's price responds with bullish momentum.

KYC Meets Machine Learning

The network deploys artificial intelligence to streamline identity verification, cutting processing times from days to minutes. This isn't just incremental improvement—it's a fundamental shift in how blockchain projects handle regulatory hurdles.

Market Response Triggers Rally

Traders flock to PI as the AI system demonstrates real-world utility, bypassing traditional bottlenecks that plague legacy financial systems. The timing couldn't be more perfect—just as traditional finance institutions spend millions on outdated compliance frameworks.

While Wall Street still debates blockchain adoption, Pi Network executes. Another reminder that in crypto, working technology beats theoretical advantages every time. Even if the suits won't admit it over their $1000 lunches.

Pi Network’s new AI feature boosts demand as CEXs' reserves drop

Nicholas Kokkalis, co-founder of PI Network, announced in an X post on Tuesday that the AI-enabled KYC verification is live. The renewed process will allow Pi network users, commonly referred to as Pioneers, to activate the mainnet wallet before the previously required 30 mining sessions. It is worth noting that this KYC verification will only unlock the mainnet wallet for Pioneers and not the mainnet PI token migration.

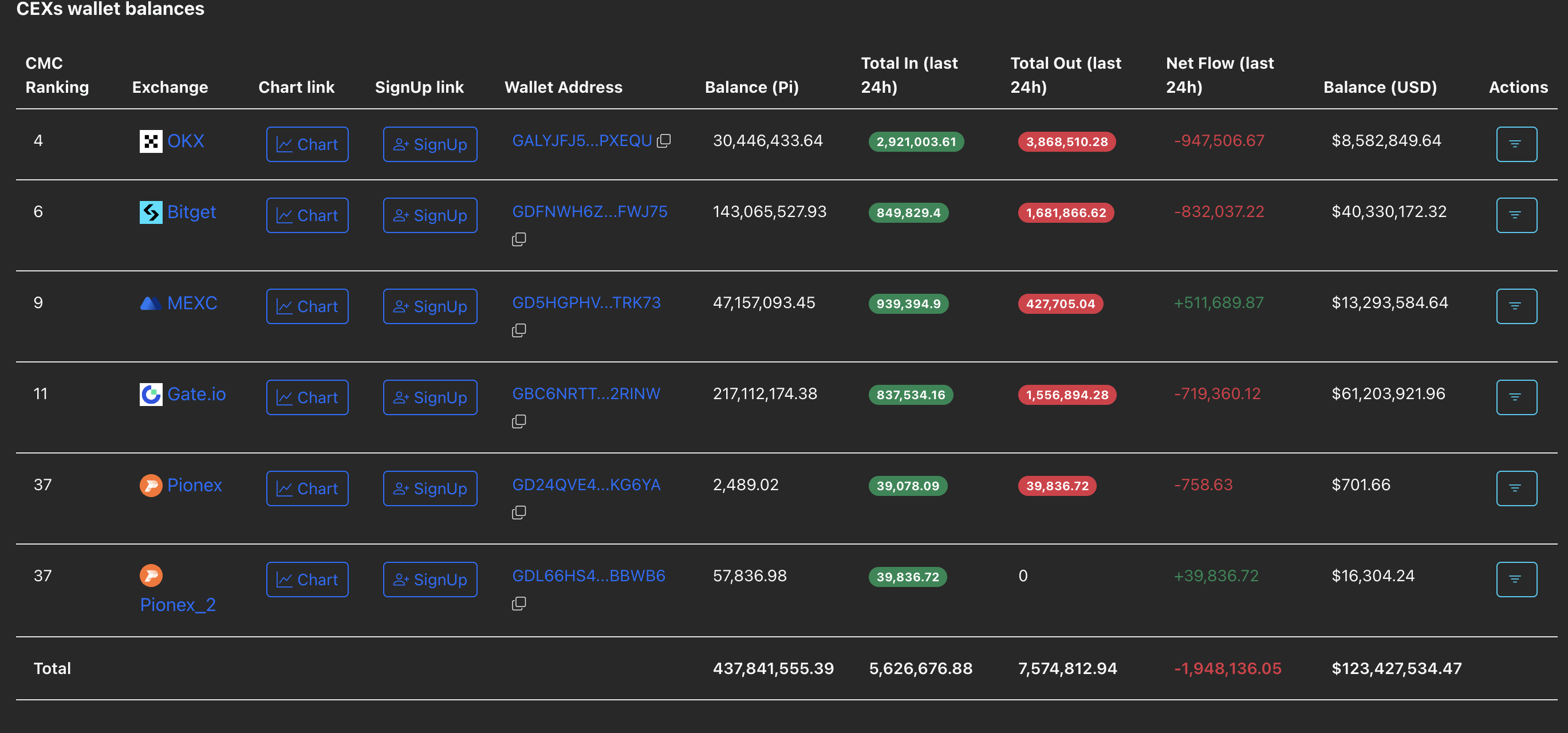

With the new feature and discounted prices, PiScan data shows that the demand for PI is gradually increasing. CEXs' wallet balances record a net outflow of 1.94 million PI tokens over the last 24 hours, following the NEAR 8 million net outflow previously reported on by FXStreet on Tuesday. This second consecutive day of net outflow suggests that the pioneers are accumulating at discounted rates.

CEXs wallet balances. Source: PiScan

Pi Network stabilizes after sharp drop, hints at potential recovery

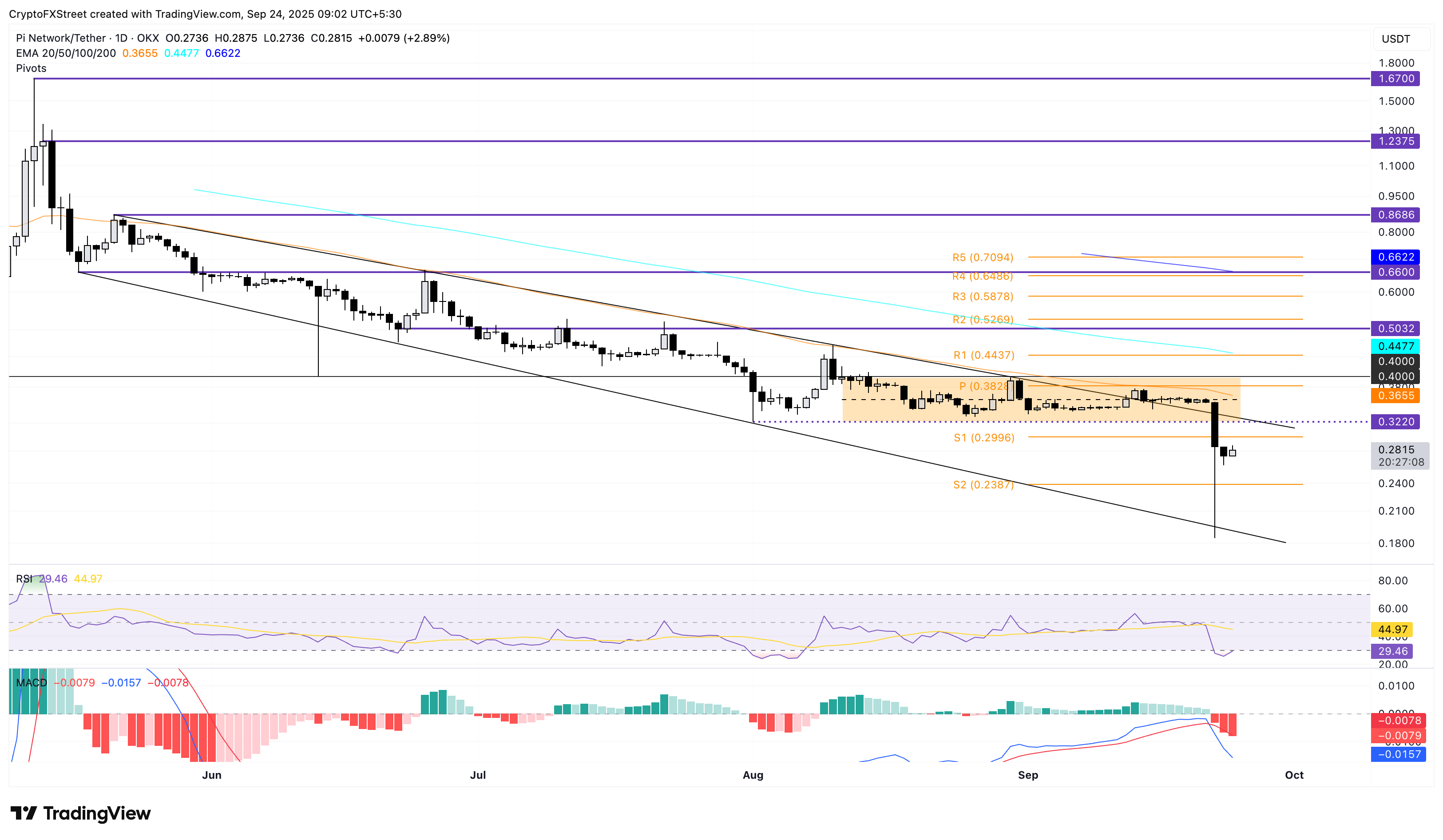

Pi Network trades above $0.2800 at press time on Wednesday, following the 4% drop on the previous day. The intraday recovery hints at further growth as PI stabilizes after the 19% drop on Monday.

A potential bounce back could challenge the overhead resistance trendline at $0.3220. To reinstate an uptrend, PI should reclaim the 50-day Exponential Moving Average (EMA) at $0.3655.

Still, the momentum indicators on the daily chart indicate a bearish trend, as the Moving Average Convergence Divergence (MACD) declines into negative territory after crossing below its signal line on Monday. The successive rise in red histogram bars indicates a boost in bearish momentum.

Additionally, the Relative Strength Index (RSI) at 29, pointing upwards, remains in the oversold region as selling pressure is gradually cooling off. If RSI resurfaces above the oversold boundary line at 30, it could signal a fresh recovery in PI.

PI/USDT daily price chart.

Looking down, if PI extends the declining trend, the S2 pivot level at $0.2387 could act as the immediate support floor.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.