BTC Price Prediction 2025: Will Bitcoin Triple by 2030 Amid Market Volatility?

- Technical Analysis: Is BTC Showing Bullish or Bearish Signals?

- Market Sentiment: What's Driving Bitcoin Prices in 2025?

- Key Factors Influencing BTC's Price Movement

- BTC Price Prediction: Where Next for Bitcoin?

- Frequently Asked Questions

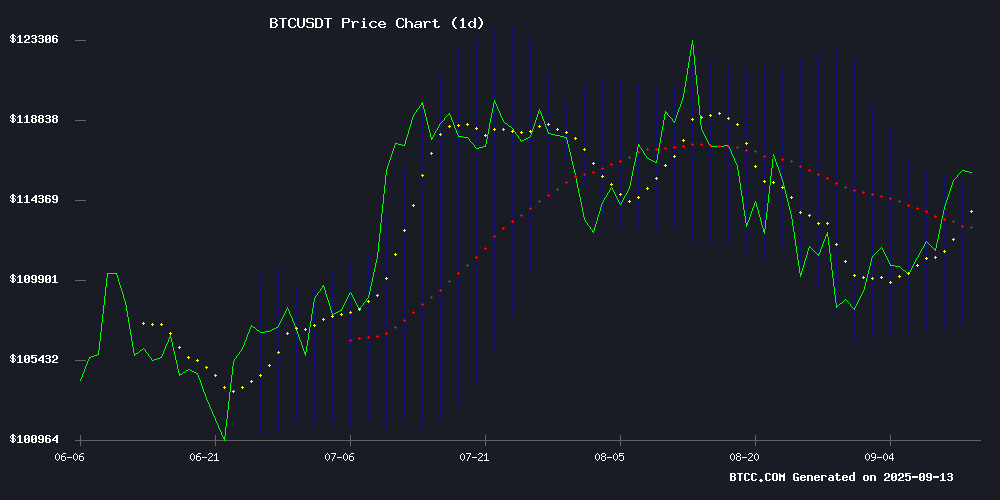

As bitcoin trades at $115,385.77 on September 14, 2025, investors are weighing bullish technical signals against mixed market sentiment. Our analysis reveals BTC holding above its 20-day moving average ($111,524.91) while facing short-term consolidation pressures. With institutional interest growing and predictions of $333,000 by 2030, we break down the key factors every crypto investor should consider in today's volatile market.

Technical Analysis: Is BTC Showing Bullish or Bearish Signals?

Bitcoin's current price action presents a fascinating technical picture. Trading at $115,385.77, BTC sits comfortably above its 20-day moving average of $111,524.91 - typically a bullish indicator. However, the MACD reading of -862.30 suggests we might see some near-term consolidation before any major moves upward.

The Bollinger Bands tell an interesting story too. With the upper band at $115,925.62 and the middle band matching the 20-day MA, BTC is essentially testing resistance levels as we speak. "This setup suggests BTC could break through if buying pressure sustains," notes our BTCC analyst team, "but traders should watch for rejection at these levels."

Market Sentiment: What's Driving Bitcoin Prices in 2025?

Current market sentiment feels like a tug-of-war between bulls and bears. On one side, we've got growing institutional interest - rumors about a potential U.S. strategic Bitcoin reserve won't quit, and corporate treasury shifts continue making headlines. On the other, security concerns and miner struggles keep injecting notes of caution.

The geopolitical landscape isn't helping either. Bitcoin held steady at $116K despite former President Trump's latest NATO rhetoric, proving crypto markets might be maturing beyond their knee-jerk reaction days. Still, as BitMEX co-founder Arthur Hayes recently warned, "Buying Bitcoin today and demanding a Lamborghini tomorrow isn't how this works."

Key Factors Influencing BTC's Price Movement

1. Institutional Adoption: Game Changer or Overhyped?

The institutional narrative has evolved dramatically since MicroStrategy's early moves. Now with over 1 million BTC ($110 billion) held across 213 corporate entities, the game's changing. "We're past the easy money phase," says a Coinbase Research report, noting how NAV multiples have compressed from 1.75x to 1.24x since June.

Alex Thorn's prediction about a potential U.S. Strategic Bitcoin Reserve by year-end could be the next institutional catalyst. If it materializes, we might see the mother of all FOMO rallies. But until then, corporate BTC accumulation has slowed to a trickle - down 97% from November 2024's peaks.

2. Miner Struggles: A Canary in the Coal Mine?

Bitcoin miners are feeling the squeeze like never before. With network difficulty hitting 136 trillion (yes, with a 't') and hashprice down to $51, profitability looks uglier than a bear market portfolio. Companies like CleanSpark and Bitdeer are getting creative with energy partnerships, but the math keeps getting tougher.

This miner stress could impact BTC's price in two ways: either forcing sell pressure as operations liquidate holdings, or potentially reducing new supply if hash rate drops significantly. Neither scenario looks particularly bullish in the short term.

3. The Macro Picture: Fed, Gold, and Crypto

The anticipated 2025 Fed rate cut has created some strange bedfellows. While Gold and stocks rallied on the news, Bitcoin's reaction has been... well, Bitcoin-like - volatile and unpredictable. This divergence highlights crypto's identity crisis: is it digital gold, risk asset, or something entirely new?

One thing's clear - with U.S. debt levels and monetary expansion continuing unabated, Bitcoin's fixed supply narrative grows more compelling by the day. As one Wall Street analyst quipped, "When your hedge against the system becomes the system, you know we're in uncharted territory."

BTC Price Prediction: Where Next for Bitcoin?

Looking at the technicals and fundamentals together paints a nuanced picture:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $115,385.77 | Bullish above 20-day MA |

| 20-Day MA | $111,524.91 | Key support level |

| Upper Bollinger Band | $115,925.62 | Near-term resistance |

| Projected 2030 Price | $333,000 | 25% annualized return |

The conservative $333,000 by 2030 prediction (a mere 3x from current levels) actually seems modest compared to Bitcoin's historical 61% annual returns. But in today's market environment, even that projection requires several stars to align:

- Sustained institutional adoption

- No catastrophic regulatory changes

- Continued fiat currency debasement

- Successful scaling solutions

Frequently Asked Questions

Is Bitcoin a good investment in 2025?

For investors with higher risk tolerance and long-term perspective, BTC remains compelling. The technical setup shows strength above key moving averages, while institutional adoption continues growing. However, short-term volatility from regulatory uncertainty and miner struggles could test investors' resolve.

What's the most realistic Bitcoin price prediction for 2030?

Conservative models suggest $333,000 by 2030 (25% annual returns), while more bullish scenarios envision $500,000+. The actual outcome will depend on adoption rates, macroeconomic conditions, and Bitcoin's evolving role in global finance.

How does the Federal Reserve impact Bitcoin's price?

Fed policy indirectly affects BTC through its influence on risk assets and the dollar. Rate cuts typically weaken the dollar, potentially benefiting Bitcoin as an alternative store of value. However, the relationship remains inconsistent compared to traditional assets.

Why are Bitcoin miners struggling in 2025?

Record-high network difficulty (136 trillion) combined with depressed hashprice ($51) has squeezed miner margins. Many operations are restructuring through energy partnerships and cost-cutting measures to survive the current downturn.

What would a U.S. Bitcoin reserve mean for prices?

A Strategic Bitcoin Reserve could validate BTC as a legitimate reserve asset, potentially triggering massive institutional inflows. However, the actual price impact WOULD depend on the reserve's size and implementation details.