Ethereum Price Prediction 2025: Can ETH Reach $5,000 With Bullish Technicals and Strong Fundamentals?

- What Do the Technical Indicators Say About ETH's Price Potential?

- How Is Institutional Activity Supporting ETH's Price?

- What Fundamental Catalysts Could Drive ETH Higher?

- What Are the Key Levels to Watch for ETH?

- How Does ETH Compare to Emerging Alternatives Like Ozak AI?

- What Are the Risks to ETH's $5,000 Target?

- Ethereum Price Prediction: The Path Forward

- Frequently Asked Questions

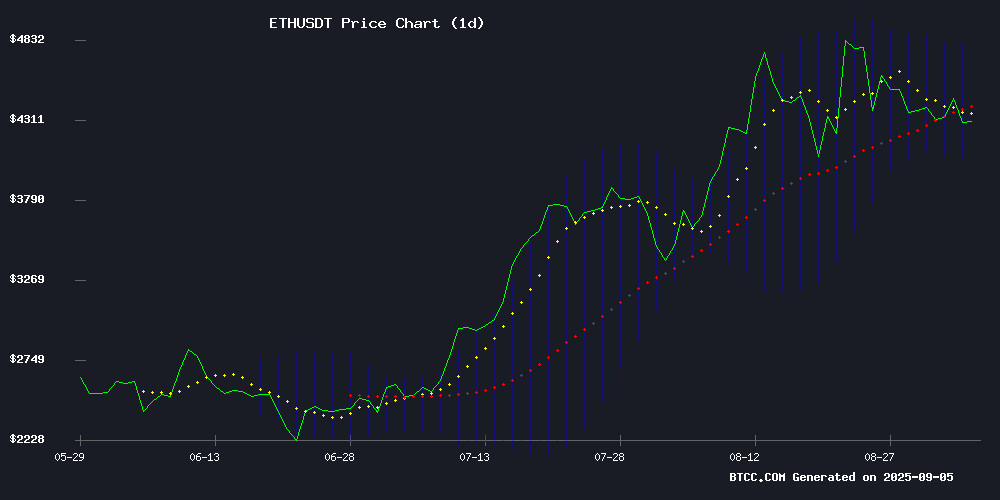

Ethereum (ETH) is showing all the right signs for a potential surge to $5,000 as we enter September 2025. With bullish technical indicators, accelerating institutional accumulation, and fundamental catalysts like the Pectra upgrade, ETH appears poised for significant upside. Currently trading at $4,325.36, ethereum faces some near-term resistance but has strong support from both technical and fundamental factors that could propel it toward new all-time highs.

What Do the Technical Indicators Say About ETH's Price Potential?

Looking at the charts as of September 5, 2025, ETH presents an interesting technical picture. While currently trading below its 20-day moving average of $4,432.39, the MACD reading of 36.49 suggests building bullish momentum. The Bollinger Bands position shows ETH trading closer to the middle band than the lower band, indicating room for upward movement toward the $4,807 upper resistance level.

According to TradingView data, ETH has established strong support around $4,200, with multiple tests holding firm throughout August. The recent price action formed a swing low at $4,269, and Ethereum is now testing the 23.6% Fibonacci retracement level of its decline from $4,488. Market participants are watching the 50% retracement level near $4,370 as the next critical resistance point.

How Is Institutional Activity Supporting ETH's Price?

The institutional accumulation of Ethereum has been nothing short of remarkable in 2025. Major players including SharpLink Gaming and Bitmine have been significantly increasing their ETH holdings, creating substantial buying pressure. SharpLink Gaming alone now holds 837K ETH worth $3.6 billion after acquiring 39,008 ETH at ~$4,531 this week.

On-chain data from CoinMarketCap reveals that mid-sized whales holding 1,000-100,000 ETH have increased their positions by 14% over the past five months. Analysis from Altcoin Vector shows mega whales (10,000+ ETH) and large whales (1,000-10,000 ETH) particularly accelerated purchases between mid-July and August, coinciding with Ethereum's current upward momentum.

What Fundamental Catalysts Could Drive ETH Higher?

Several fundamental developments are creating a positive foundation for ETH price appreciation:

| Catalyst | Impact |

|---|---|

| Pectra Upgrade | Implemented on May 7, 2025, bringing temporary smart contract functionality and increased validator balance ceilings |

| Validator Queue | Flipped to net inflows for first time since July, with entry queue hitting two-year high of 860,300 ETH |

| Institutional Products | Grayscale's new Ethereum Covered Call ETF (ETCO) provides income generation options |

The Pectra upgrade's dual focus on user experience and validator economics appears to be driving renewed institutional interest. Meanwhile, the validator queue reversal alleviates concerns about potential sell pressure from mass unstaking events.

What Are the Key Levels to Watch for ETH?

For traders and investors eyeing ETH's path to $5,000, these are the critical levels to monitor:

- Immediate Resistance: 20-Day MA at $4,432.39

- Upper Resistance: Bollinger Band upper at $4,807.70

- Psychological Barrier: $5,000

- Support Levels: $4,200 (strong), $4,100 (next major)

The 100-hourly Simple Moving Average currently acts as dynamic resistance, with the market awaiting a decisive close above $4,450 to confirm bullish momentum. A bearish trend line has emerged on the hourly chart, capping gains NEAR $4,370.

How Does ETH Compare to Emerging Alternatives Like Ozak AI?

While Ethereum's projected surge to $10,000 by 2025 draws attention, projects like Ozak AI are creating competition for speculative capital. The AI-powered project has raised $2.6 million in presale and sold 840 million tokens at $0.01, with listings on CoinMarketCap and CoinGecko already secured.

However, Ethereum maintains significant advantages in institutional adoption and network effects. The launch of products like Grayscale's ETCO ETF demonstrates ETH's growing acceptance in traditional finance circles. As Krista Lynch, Grayscale's Senior VP of ETF Capital Markets noted, "This ETF complements existing Ethereum holdings by adding an income component through option premiums."

What Are the Risks to ETH's $5,000 Target?

While the outlook appears positive, several factors could derail ETH's ascent:

- Failure to hold $4,200 support could trigger deeper correction

- Macroeconomic factors affecting crypto markets broadly

- Regulatory developments impacting institutional participation

- Technical hurdles in Pectra upgrade implementation

The cryptocurrency market remains volatile, and ETH's path to $5,000 may not be linear. As always in crypto investing, risk management remains paramount.

Ethereum Price Prediction: The Path Forward

Considering all factors - technical setup, institutional accumulation, and fundamental developments - ETH has a reasonable chance of reaching $5,000 in the medium term. The combination of technical recovery potential and strong fundamental drivers makes this target achievable within the current market cycle, though timing remains uncertain given market volatility.

As the BTCC team notes, "While the $5,000 target is ambitious, the current alignment of positive factors suggests ETH could test this level before year-end if current momentum sustains."

This article does not constitute investment advice.

Frequently Asked Questions

What is the current price of Ethereum (ETH)?

As of September 5, 2025, Ethereum (ETH) is trading at $4,325.36 according to TradingView data.

What are the key resistance levels for ETH?

The immediate resistance is the 20-day MA at $4,432.39, followed by the Bollinger Band upper at $4,807.70. The psychological $5,000 level represents the next major resistance.

How has institutional activity impacted ETH's price?

Institutional players like SharpLink Gaming and Bitmine have been accumulating ETH aggressively, with mid-sized whales increasing holdings by 14% over five months, creating substantial buying pressure.

What fundamental factors support ETH's price growth?

The Pectra upgrade, validator queue flipping to net inflows, and growing institutional products like Grayscale's ETCO ETF are key fundamental catalysts supporting ETH's price.

What are the risks to ETH reaching $5,000?

Key risks include failure to hold $4,200 support, macroeconomic factors affecting crypto markets, regulatory developments, and technical hurdles in upgrade implementations.