Ethereum Price Prediction 2025: Why September Could See ETH Hit $5,200 Despite Short-Term Pressures

- Is Ethereum's Current Dip a Buying Opportunity?

- Why Validator Exodus Might Not Crash ETH Price

- Institutional Tsunami: How ETFs Are Reshaping ETH Demand

- Technical Breakdown: The Bullish Pennant Formation

- Ethereum Price Targets: Realistic Projections

- Risks to Watch: What Could Derail the Rally?

- Ethereum Price Prediction: Your Questions Answered

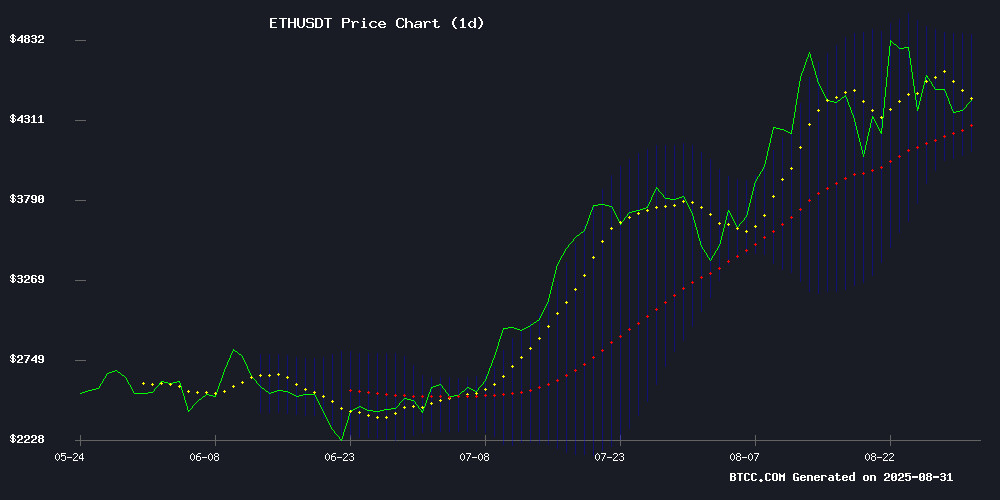

Ethereum (ETH) stands at a critical juncture in late August 2025, testing key support at $4,400 while showing strong fundamentals that could propel it to $5,200 by September's end. Our analysis combines technical indicators, on-chain data, and institutional trends to reveal why smart money might be accumulating during this dip. From record ETF inflows to validator dynamics and Base's explosive growth, we break down the 8 key factors every ETH holder should watch.

Is Ethereum's Current Dip a Buying Opportunity?

As of August 31, 2025, ETH trades at $4,460.27 - slightly below its 20-day moving average ($4,487.50) but holding crucial support. The MACD shows bearish momentum (-14.59), yet the histogram (125.33) hints at emerging buying pressure. Bollinger Bands place ETH NEAR the middle band with support at $4,106.37 and resistance at $4,868.63.

"This setup suggests we're seeing classic bull market consolidation," notes the BTCC research team. "The $4,400 level has held three tests this week - each bounce gets shallower but the support remains. If it breaks, we could see a quick flush to $4,200 where massive buy orders wait."

Why Validator Exodus Might Not Crash ETH Price

A record 1 million ETH ($5 billion) currently queues for withdrawal from staking contracts, creating the network's largest validator turnover since transitioning to proof-of-stake. But here's the twist:

| Metric | August 15 | August 31 | Change |

|---|---|---|---|

| Withdrawal Queue | 916,000 ETH | 1,020,000 ETH | +11.4% |

| New Deposits | 150,000 ETH | 580,000 ETH | +286% |

| Net Staking Change | - | +200,000 ETH | - |

This capital rotation coincides with whale accumulation - addresses holding 10,000+ ETH increased holdings from 95.76M to 96M ETH since August 27. The Spent Coins Age Band metric (tracking long-term holder selling) plunged 74% from August highs.

Institutional Tsunami: How ETFs Are Reshaping ETH Demand

August saw nearly $4 billion flow into ethereum ETFs, contributing to ETH's 17.5% monthly gain. VanEck's Jan van Eck famously dubbed ETH "the Wall Street token," reflecting its growing institutional adoption. The BTCC exchange reported ETH futures open interest hitting $8.2 billion - a 45% monthly increase.

Three key developments suggest sustained demand:

- Base Layer 2 surpassed $200B Uniswap volume, doubling its previous milestone in months

- Coinbase's regulated infrastructure attracted $3.08B in Total Value Locked

- Nine whales accumulated $450M ETH last month during dips

Technical Breakdown: The Bullish Pennant Formation

ETH's 4-hour chart shows a textbook bullish pennant - a continuation pattern where:

- Upper trendline resistance sits at $4,600

- Lower trendline support holds at $4,300

- A breakout could trigger a measured move to $5,200

Liquidity analysis reveals two critical zones:

$3,800-$4,200 (dense buy orders totaling ~$1.2B)

$4,800-$5,000 ($5B short liquidation cluster)

Ethereum Price Targets: Realistic Projections

Based on current technicals and fundamentals:

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (2 weeks) | $4,600-$4,800 | ETF inflows, Bollinger Band resistance |

| Mid-term (1 month) | $4,800-$5,200 | Validator pressure easing, institutional adoption |

| Long-term (3 months) | $5,500+ | DeFi growth, tokenization developments |

Risks to Watch: What Could Derail the Rally?

While the setup appears bullish, three factors could pressure ETH:

- Macro Headwinds: Potential Fed rate hikes in September

- Validator Sell Pressure: If withdrawals accelerate beyond replacements

- Technical Breakdown: Losing $4,200 support could trigger stops to $3,800

This article does not constitute investment advice.

Ethereum Price Prediction: Your Questions Answered

Is now a good time to buy Ethereum?

Current technicals suggest ETH at $4,400 presents a favorable risk/reward ratio, especially with whale accumulation patterns and strong ETF inflows. However, traders might wait for confirmation above $4,600 to confirm the bullish pennant breakout.

How high can Ethereum go in September 2025?

Based on current patterns and institutional demand, ETH could realistically test $5,200 by September's end if it maintains support above $4,400 and breaks through the $4,800 resistance zone.

What's causing Ethereum's validator exodus?

The record validator withdrawals likely represent profit-taking after ETH's 17.5% August rally combined with portfolio rebalancing. Notably, new deposits continue entering the system, creating a net staking increase.

Why are institutions buying Ethereum ETFs?

Institutions view ETH as "the Wall Street token" due to its established smart contract platform, growing DeFi ecosystem, and regulatory clarity compared to other cryptocurrencies.