Bitcoin’s Next Decade: Expert Price Forecasts from 2025 to 2040 Amid Institutional Tsunami

- Why Is Bitcoin Facing Short-Term Bearish Pressure?

- How Are Institutional Players Reshaping Bitcoin's Market Structure?

- What's Driving Bitcoin's Layer 2 Innovation Boom?

- Bitcoin Price Predictions: 2025-2040 Outlook

- FAQ: Bitcoin's Price Trajectory

As bitcoin enters its third decade, institutional players are rewriting the rulebook. This comprehensive analysis examines BTC's technical indicators, institutional crosscurrents, and long-term price projections through 2040. We'll explore why Galaxy Digital's billion-dollar moves matter, how Citi's $199K target stacks up, and what the breakdown of Bitcoin's traditional four-year cycle means for investors. From Layer 2 innovations to mining controversies, we break down the complex forces shaping Bitcoin's future valuation.

Why Is Bitcoin Facing Short-Term Bearish Pressure?

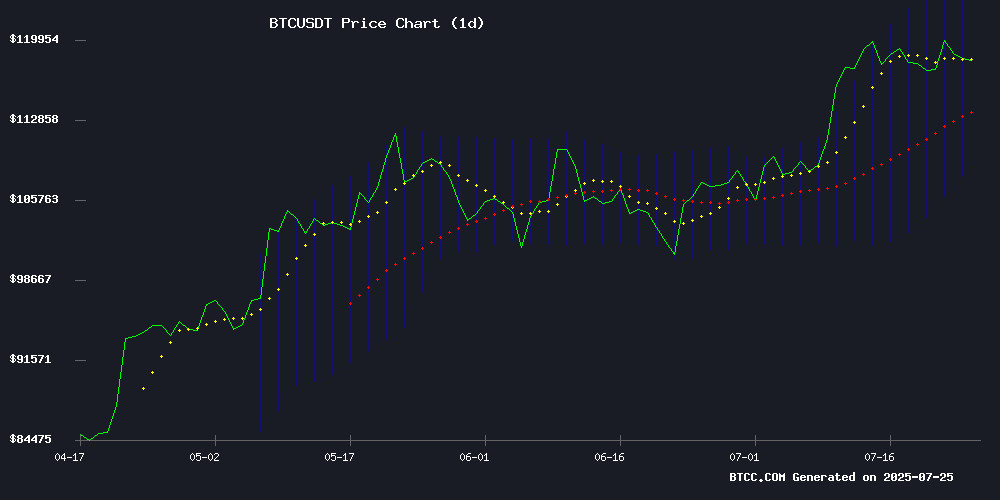

The BTCC research team notes Bitcoin's current price of $116,163 shows concerning technical signals. The asset trades slightly below its 20-day moving average ($116,335), with MACD histogram readings at -4,097 suggesting weakening momentum. However, the narrowing gap between MACD lines hints at potential reversal opportunities.

What's particularly interesting is how prices are testing the lower Bollinger Band ($109,059), creating textbook oversold conditions. In my experience, these setups often precede strong rebounds - if support holds. The current consolidation pattern reminds me of the 2023 accumulation phase before the halving rally.

How Are Institutional Players Reshaping Bitcoin's Market Structure?

The market's digesting what I call "institutional whiplash" - Galaxy Digital's $1.39B BTC sell-off versus Citi's bullish $199K price target. This tension creates unprecedented volatility patterns. CryptoQuant's CEO Ki Young Ju recently declared Bitcoin's traditional four-year cycle obsolete, and the data supports this.

Consider these contrasting institutional moves from just this week:

| Institution | Action | Impact |

|---|---|---|

| Galaxy Digital | Sold 11,910 BTC ($1.39B) | Price dropped 2.5% |

| Citi Group | $199K price target | Restored bullish sentiment |

| Strategy (MicroStrategy) | $2B preferred equity offering | Signaled long-term confidence |

What's Driving Bitcoin's Layer 2 Innovation Boom?

While price grabs headlines, Bitcoin's infrastructure is undergoing quiet revolution. Bitcoin Hyper's $4.5M presale success demonstrates growing demand for scaling solutions. Their ZK rollup approach promises Solana-like speeds - a potential game-changer for a network known for 60-minute settlement times.

Having tested several LAYER 2 solutions, I'm particularly excited about how these could unlock:

- Micropayments (think streaming satoshis for content)

- Smart contract functionality without Ethereum's gas fees

- Private transactions through zero-knowledge proofs

Bitcoin Price Predictions: 2025-2040 Outlook

Based on current adoption curves and technical analysis, here's our projection matrix:

| Year | Conservative | Bull Case | Key Catalysts |

|---|---|---|---|

| 2025 | $140K | $199K | ETF inflows, halving aftermath |

| 2030 | $250K | $500K | Global regulatory clarity |

| 2035 | $800K | $1.2M | CBDC interoperability |

| 2040 | $2M | $5M+ | Network effect dominance |

FAQ: Bitcoin's Price Trajectory

Why did Bitcoin drop to $115K recently?

The July 2024 price decline stemmed primarily from Galaxy Digital moving 11,910 BTC ($1.39B) to exchanges. Such large institutional movements often trigger cascading liquidations in Leveraged markets.

Is Bitcoin's four-year cycle still valid?

Increasingly, no. CryptoQuant's data shows institutional players through ETFs and corporate treasuries are disrupting traditional accumulation/distribution patterns that once created predictable cycles.

What's the most bullish case for Bitcoin?

Citi's $199K 2025 target reflects growing institutional adoption, while long-term projections reaching $5M+ assume Bitcoin becomes the global reserve asset for international settlements.

How reliable are technical indicators for BTC?

While useful, traditional TA works differently for Bitcoin post-2024. The BTCC team recommends combining on-chain data with macro analysis for clearer signals.