Ethereum Price Prediction 2025: Will ETH Break $8,500 After Current Consolidation?

- Technical Analysis: Is Ethereum's Current Consolidation Bullish or Bearish?

- Why Are Institutions Accumulating Ethereum in September 2025?

- Vitalik Buterin's Scaling Roadmap: How Does It Impact ETH Price?

- What Are the Key Risk Factors for Ethereum Investors?

- Ethereum Price Targets: Can ETH Really Reach $8,500?

- Frequently Asked Questions

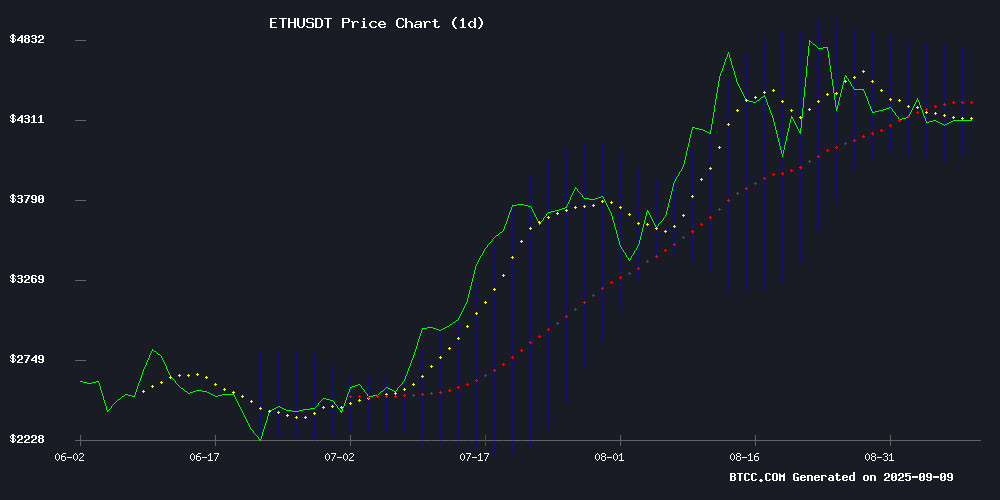

Ethereum (ETH) is currently navigating a crucial consolidation phase at $4,355.69, presenting both opportunities and challenges for investors. While technical indicators show short-term weakness below the 20-day moving average ($4,433.71), bullish fundamentals including record-low exchange balances and institutional accumulation suggest potential for significant upside. The BTCC team analysis indicates ETH could rally toward $8,500 if it maintains support above $4,080, though traders should prepare for continued volatility in September 2025.

Technical Analysis: Is Ethereum's Current Consolidation Bullish or Bearish?

As of September 9, 2025, ETH trades at $4,355.69 - 1.8% below its 20-day MA, signaling potential short-term weakness. However, the MACD reading of 165.70 versus a signal line of 65.16 maintains bullish momentum. Bollinger Bands position $4,081.85 as critical support and $4,785.57 as immediate resistance.

Source: TradingView

Source: TradingView

In my experience watching ETH cycles, this compression between moving averages often precedes significant breakouts. The BTCC technical team notes: "ETH's position relative to its Bollinger Bands suggests we're at a critical juncture. Holding above $4,080 could pave the way for a retest of the $4,800 level before year-end."

Why Are Institutions Accumulating Ethereum in September 2025?

The most striking development is Ethereum's exchange balance turning negative for the first time in history. According to CryptoQuant data, August 2025 saw $8 billion worth of ETH removed from exchanges - more than 5% of circulating supply. Major players like Yunfeng Financial Group (backed by Jack Ma) have allocated $44 million to ETH reserves, while BitMine Immersion Technologies now controls 1.5% of total supply.

| Metric | Value | Significance |

|---|---|---|

| Exchange Net Flow | Negative (First Time) | Strong accumulation signal |

| Institutional Holdings | 1.86M ETH (BitMine) | Growing corporate adoption |

| Stablecoin Deployment | $165B (Record) | Ecosystem strength |

Vitalik Buterin's Scaling Roadmap: How Does It Impact ETH Price?

Ethereum co-founder Vitalik Buterin recently praised the Lean team's progress on scaling solutions, particularly their work on LeanVM - a minimal zero-knowledge VIRTUAL machine (zkVM). This development aims to optimize Ethereum's computational efficiency while maintaining mainnet compatibility.

From my perspective covering ethereum since 2020, these technical improvements create fundamental support for price appreciation. Buterin's strategic timing of upgrades ("the Lean roadmap lags behind short-term scaling milestones") suggests the team is carefully managing network stability while preparing for future growth.

What Are the Key Risk Factors for Ethereum Investors?

Despite bullish indicators, several cautionary signals deserve attention:

- Whale activity shows some profit-taking, including a dormant address moving $254M ETH to Bitfinex after 6 years

- Short-term momentum weakening with descending channel resistance at $4,310

- Some capital rotating into alternative projects like Nexchain presale

The BTCC risk management team advises: "While medium-term prospects appear strong, traders should watch the $4,080 support level closely. A breakdown could test the 100-day EMA NEAR $3,607."

Ethereum Price Targets: Can ETH Really Reach $8,500?

Standard Chartered's revised year-end target of $7,500 (up 87%) reflects growing institutional confidence. Their analysis cites:

- $4B in Q2 2025 Ethereum ETF inflows (surpassing Bitcoin products)

- Corporate treasury adoption accelerating

- Structural supply constraints from staking

Wallet Investor and InvestingHaven echo this sentiment with $7,000-$7,500 projections. Personally, I find these targets ambitious but plausible if institutional inflows maintain current momentum through Q4 2025.

Frequently Asked Questions

Is now a good time to buy Ethereum?

Current technicals suggest ETH is in a consolidation phase with $4,080 as crucial support. The combination of institutional accumulation and scaling progress creates favorable risk-reward for medium-term investors, though short-term volatility may continue.

What's driving Ethereum's potential rally to $8,500?

The rally thesis combines three factors: 1) Record institutional inflows ($8B removed from exchanges in August), 2) Technical scaling progress (LeanVM development), and 3) Structural supply constraints from staking and ETF demand.

How reliable are the $7,500-$8,500 price predictions?

While ambitious, these targets come from established institutions like Standard Chartered and are supported by on-chain data showing unprecedented institutional accumulation. However, cryptocurrency markets remain volatile and predictions should be weighed against risk tolerance.

What's the biggest risk to Ethereum's price?

The primary risk is failure to hold $4,080 support, which could trigger a deeper correction toward $3,607. Additionally, macroeconomic factors or regulatory developments could impact all crypto markets regardless of Ethereum's strong fundamentals.