LTC Price Prediction 2025: Technical Strength Outweighs Market Noise as Litecoin Holds Key Support

- What Does Litecoin's Current Technical Setup Reveal?

- How Is Market Sentiment Impacting Litecoin?

- What Are the Key Factors Influencing LTC's Price?

- How Does Litecoin Compare to Emerging Alternatives?

- What's the Outlook for Litecoin Mining?

- Is Litecoin a Good Investment in September 2025?

- Litecoin (LTC) Investment FAQs

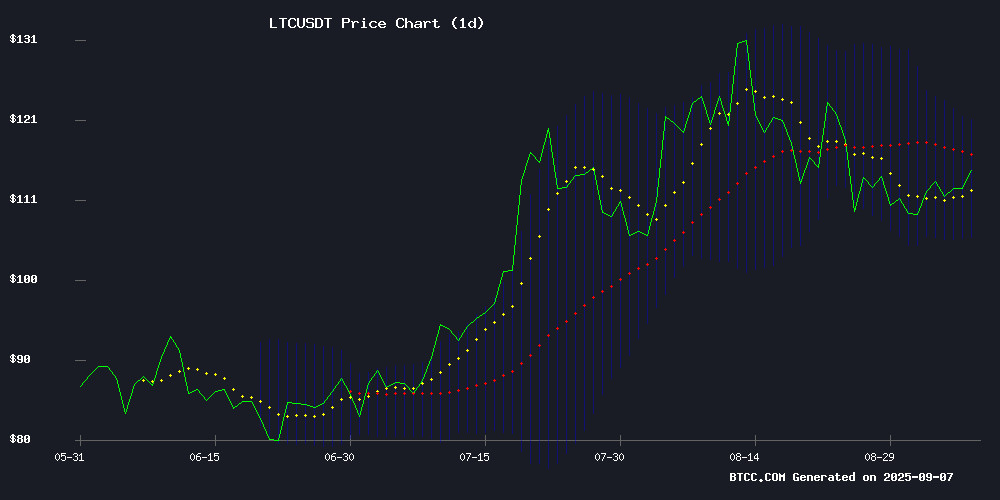

As we enter September 2025, Litecoin (LTC) presents a fascinating case study in cryptocurrency resilience. Currently trading at $114.04, LTC maintains its position above the crucial 20-day moving average ($113.35) while showing bullish MACD divergence. This technical strength comes despite mixed market sentiment and investor rotation toward newer projects. Our analysis suggests Litecoin's established market position and current chart patterns may offer better short-term opportunities than the social media hype surrounding newer tokens.

What Does Litecoin's Current Technical Setup Reveal?

Litecoin's price action tells an interesting story when we examine the technical indicators. The cryptocurrency has established $113.35 as immediate support, bouncing off this level multiple times in recent weeks. The MACD histogram shows positive momentum with a reading of 5.64 compared to its signal line at 5.13 - not a huge gap, but enough to suggest buyers are gaining control.

Looking at the Bollinger Bands, we see LTC comfortably positioned above the midline ($113.35) with upper resistance waiting at $120.85. "This configuration typically suggests continuation patterns," notes the BTCC research team. "The key will be whether LTC can maintain this foothold above the 20-day MA."

How Is Market Sentiment Impacting Litecoin?

Sentiment around Litecoin remains divided in early September 2025. On one hand, we're seeing capital rotation toward newer projects like Remittix and Layer Brett. On the other, Litecoin continues to benefit from its reputation as a reliable payment cryptocurrency with real-world adoption.

The recent social media feud involving Litecoin founders created unexpected volatility, proving that even established cryptocurrencies aren't immune to Twitter-fueled price swings. However, as one trader quipped on crypto Twitter, "LTC might be the boomer coin of crypto, but boomers have retirement money to spend."

What Are the Key Factors Influencing LTC's Price?

Several competing forces are shaping Litecoin's price action as we progress through Q3 2025:

| Factor | Impact |

|---|---|

| Technical Indicators | Bullish (MACD positive, above MA) |

| Investor Rotation | Moderate pressure from newer projects |

| Market Position | Strong as payment cryptocurrency |

| Social Media Activity | Increased short-term volatility |

How Does Litecoin Compare to Emerging Alternatives?

The crypto space in 2025 has become increasingly crowded, with projects like Layer BRETT gaining attention through presale hype. However, Litecoin offers something these newcomers can't match - a decade-long track record. While Layer Brett's presale has reportedly raised millions, Litecoin processes real transaction volume exceeding $500 million daily according to CoinMarketCap data.

That said, the market clearly has appetite for new narratives. The success of projects like Remittix in attracting former cardano and Litecoin investors suggests some traders are chasing higher-risk, higher-reward opportunities. "It's the eternal crypto dilemma," observes a BTCC market strategist. "Do you park funds in established assets or swing for the fences with newer projects?"

What's the Outlook for Litecoin Mining?

Mining dynamics continue evolving in 2025, with services like SAVVY MINING lowering barriers to entry. Their new mobile app offers $15 in free hashrate - a clever customer acquisition strategy in a competitive market. For Litecoin specifically, mining remains profitable at current prices, though margins have compressed compared to the 2021 bull market highs.

Interestingly, the shift toward renewable energy in mining (SAVVY claims 100% renewable usage) could benefit Litecoin's environmental narrative. As ESG concerns remain prominent in 2025, this could become an underappreciated bullish factor.

Is Litecoin a Good Investment in September 2025?

Based on current technicals and fundamentals, Litecoin presents a compelling case for investors seeking lower-risk crypto exposure. The $105-$120 range appears well-defined, offering clear risk/reward parameters. A break above $120.85 could signal a MOVE toward the $131-$155 zone some analysts project for October.

However, traders should watch the $105 support closely. A sustained break below could see LTC test the psychologically important $100 level. As always in crypto, position sizing and risk management remain crucial.

Litecoin (LTC) Investment FAQs

What is Litecoin's current price and key technical levels?

As of September 8, 2025, Litecoin trades at $114.04. Key levels include support at $113.35 (20-day MA) and $105, with resistance at $120.85 (Bollinger upper band).

How does Litecoin's technical outlook compare to its fundamentals?

Technicals appear stronger than fundamentals currently. While newer projects attract attention, LTC's chart shows bullish momentum above important moving averages.

What are the main risks to Litecoin's price in 2025?

Primary risks include loss of $105 support, continued investor rotation to newer projects, and potential regulatory developments affecting payment cryptocurrencies.

How does Litecoin's performance compare to Bitcoin in 2025?

LTC has shown slightly higher volatility but generally correlated movement with BTC. Its lower price point makes it more accessible to retail investors.

What makes Litecoin different from newer payment cryptocurrencies?

LTC offers proven security, wider merchant acceptance, and greater liquidity than most new payment-focused cryptocurrencies.