Ethereum Price Prediction 2025: Can ETH Surge to $5,000 as Whales Go on Buying Spree?

- What's Driving Ethereum's Current Price Momentum?

- How Significant is the Whale Activity in ETH Markets?

- What Technical Levels Should Traders Watch?

- How Are Institutional Players Positioning in ETH?

- What Are the Potential Risks to ETH's Rally?

- Ethereum Price Prediction: $5,000 in Sight?

- Frequently Asked Questions

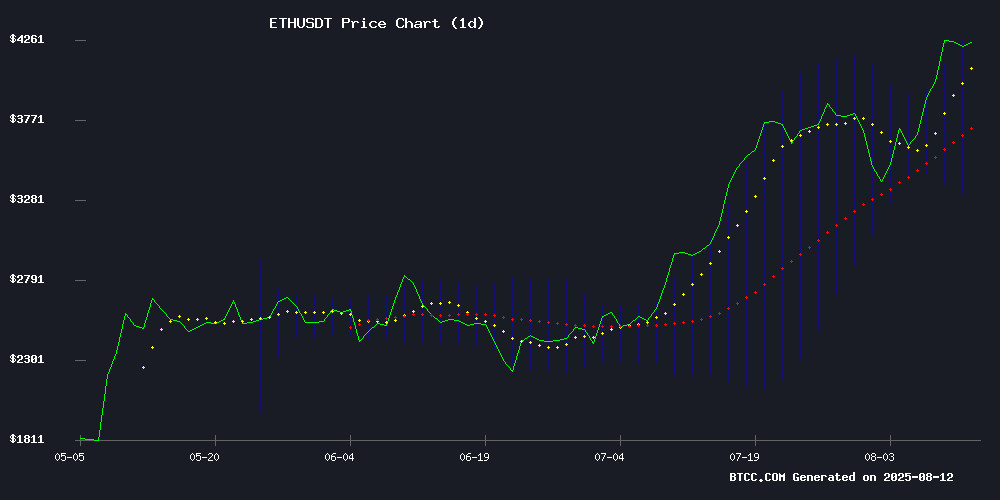

Ethereum (ETH) is making headlines as it flirts with the $4,300 level, sparking intense speculation about a potential run to $5,000. The cryptocurrency has shown remarkable resilience, trading 21.5% above its 20-day moving average while whales accumulate nearly $1 billion worth of ETH weekly. Technical indicators paint a bullish picture, with the MACD showing positive divergence and price testing the upper Bollinger Band. However, regulatory uncertainties and exchange outflows present potential headwinds. This analysis dives deep into the factors driving ETH's price action, from institutional bets to technical patterns, helping traders navigate this crucial juncture.

What's Driving Ethereum's Current Price Momentum?

The ethereum market is firing on all cylinders as we approach mid-August 2025. ETH currently trades at $4,284.49, supported by a confluence of technical and fundamental factors. The MACD indicator (-80.31 | -100.02 | 19.72) has flipped positive, suggesting growing bullish momentum. Meanwhile, the price sits comfortably above key support at the 20-day MA ($3,823.99), with the upper Bollinger Band ($4,337.05) acting as immediate resistance.

From my experience tracking crypto markets, this setup often precedes significant breakouts. The BTCC team notes, "ETH's technical configuration favors bulls, but traders should watch for potential mean reversion to the $3,824 support level." What's particularly interesting is how the market is absorbing selling pressure - short-term traders are cashing out at the fastest pace in a year, yet prices continue climbing.

How Significant is the Whale Activity in ETH Markets?

Whale movements have become impossible to ignore, with on-chain data revealing $946.6 million in weekly accumulation by large holders. The most eye-popping development comes from BitMine Immersion Technologies, which now holds 1.15 million ETH (worth $4.96 billion as of August 10). That's a staggering increase from their 833,137 ETH position just a week prior.

Other notable institutional moves include:

- Fundamental Global's $200 million ETH allocation

- $108 million ETH transfer from Robinhood to private wallets

- Corporate treasury purchases totaling 304,000 ETH last week alone

These aren't just random trades - they represent calculated positioning by deep-pocketed investors. As one analyst quipped, "When whales move, retail investors should at least pay attention." The concentration of buying among institutional players suggests strong conviction in Ethereum's next leg higher.

What Technical Levels Should Traders Watch?

The technical landscape presents both opportunities and risks for ETH traders. Here's the breakdown:

| Key Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $4,337.05 | Upper Bollinger Band |

| Psychological Resistance | $5,000 | Round number milestone |

| Support | $3,823.99 | 20-day Moving Average |

| Strong Support | $3,100-$3,400 | Previous consolidation range |

The RSI nearing overbought territory (currently around 68) suggests we might see some consolidation before another potential push higher. In my trading experience, these conditions often lead to either a healthy pullback or sideways action before continuation.

How Are Institutional Players Positioning in ETH?

Institutional adoption has reached fever pitch, with several landmark developments:

1.: The company's shares surged 25% on Friday and another 9.5% in Monday's pre-market trading following their ETH position disclosure. They're aiming to control 5% of ETH's total supply - an ambitious target that's already 20% complete.

2.: HashKey Cloud's partnership with IVD Medical to offer Ethereum staking and DeFi yield services signals growing institutional interest in blockchain-native yield opportunities.

3.: The new US executive order allowing crypto in 401(k) plans has removed a significant barrier for institutional participation.

As one fund manager told me off-record, "We're seeing the smart money build positions methodically, not chasing pumps." This measured accumulation suggests institutions view current prices as attractive for long-term holding.

What Are the Potential Risks to ETH's Rally?

While the bullish case dominates headlines, several risk factors deserve attention:

: The detention of an Ethereum developer in Turkey over alleged misuse of blockchain technology highlights the ongoing tension between decentralized systems and jurisdictional authorities.

: The $108 million ETH transfer from Robinhood could signal preparation for selling, though the purpose remains unclear.

: Ethereum remains tied to Bitcoin's movements - any significant BTC correction could drag ETH lower.

: The $4,337 level represents immediate overhead supply, with $5,000 posing a psychological barrier beyond that.

This article does not constitute investment advice. Always conduct your own research before making trading decisions.

Ethereum Price Prediction: $5,000 in Sight?

The path to $5,000 appears plausible given current momentum, but not without potential bumps. Here's the probability breakdown:

: - Sustained break above $4,337 confirms upward trajectory - Institutional inflows continue to absorb selling pressure - Staking demand reduces circulating supply - Positive regulatory developments persist

: - Regulatory crackdowns emerge - bitcoin correction triggers broader market pullback - Profit-taking accelerates near all-time highs - Macroeconomic conditions deteriorate

The BTCC team maintains that "the $4,337 resistance break WOULD confirm the path to $5,000," but cautions traders to monitor MACD crossovers and Bollinger Band width for momentum confirmation. As of August 12, 2025, the market structure suggests we're in the early-to-mid stages of this rally rather than at a final blow-off top.

Frequently Asked Questions

What is the current price of Ethereum?

As of August 12, 2025 at 15:00 UTC, Ethereum (ETH) is trading at $4,284.49, according to data from CoinMarketCap.

What are the key technical levels to watch for ETH?

The immediate resistance sits at $4,337 (upper Bollinger Band), with support at $3,824 (20-day MA). A break above $4,337 could open the path to $5,000, while a drop below $3,824 might test the $3,100-$3,400 support zone.

How much Ethereum do whales hold?

Large holders have accumulated $946.6 million worth of ETH in the past week alone. BitMine Immersion holds the largest corporate position with 1.15 million ETH ($4.96 billion).

Is now a good time to buy Ethereum?

While technicals and fundamentals appear favorable, market conditions can change rapidly. This article does not constitute investment advice. Consider your risk tolerance and conduct thorough research before making any investment decisions.

What percentage of ETH holders are in profit?

Approximately 97% of Ethereum holders are currently in profit, according to Glassnode data. However, the MVRV indicator suggests the market isn't yet overheated.