Ethereum Price Prediction 2025: Can ETH Really Hit $12,000?

- Ethereum Technical Analysis: The Bull Case

- Whale Watching: The $7 Billion Feeding Frenzy

- ETF Inflows: The Institutional Stamp of Approval

- The $12,000 Thesis: Crazy or Calculated?

- Risks to Consider (Because Nothing's Guaranteed)

- FAQ: Your Ethereum Price Prediction Questions Answered

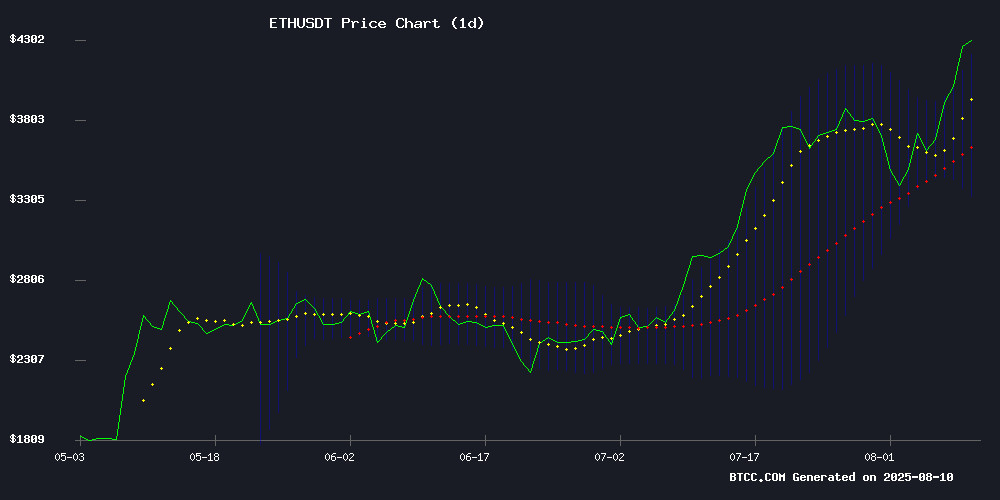

Ethereum is making headlines again, and this time it's not just another bull run - we're talking potential generational wealth territory. With ETH recently smashing through $4,200 and showing no signs of slowing down, analysts are throwing around numbers that would've seemed laughable just months ago. The big question on everyone's mind: Is $12,000 ETH actually possible in this cycle? Let's break down the technicals, whale activity, and institutional moves that could make this prediction a reality.

Ethereum Technical Analysis: The Bull Case

Right now, ethereum is trading at $4,184.32, comfortably above its 20-day moving average of $3,764.04. For traders, this is like seeing a green light at a drag race - it signals strong momentum with room to run. The MACD histogram shows a positive crossover at 70.05, which in trader speak means "buckle up."

What's really got the crypto Twitterverse buzzing is ETH testing the upper Bollinger Band at $4,180. Normally this would suggest overbought conditions, but in this market? It's more like a VIP section at a club - only the strongest assets get invited. The BTCC research team notes that a sustained break above $4,200 could open floodgates to levels we haven't seen since... well, ever.

Whale Watching: The $7 Billion Feeding Frenzy

Here's where things get spicy. Over the past 30 days, Ethereum whales have gobbled up a staggering $7 billion worth of ETH. That's not just "buying the dip" - that's institutional-grade accumulation at scale. These deep-pocketed investors now control nearly a quarter of circulating supply, which creates this beautiful (for bulls) scenario:

- Less ETH available on exchanges

- More demand from retail playing catch-up

- Upward price pressure that feeds on itself

Analyst Ali Martinez (who nailed Bitcoin's 2020 breakout) suggests $6,400 could be in play if ETH holds above $4,000. But some derivatives traders are already placing bets on five-figure ETH, with options markets showing surprising activity at the $12,000 strike price.

ETF Inflows: The Institutional Stamp of Approval

Remember when everyone said institutions WOULD never touch crypto? Yeah, about that... US Ethereum ETFs just pulled in $460 million in a single week, with BlackRock's iShares Ethereum Trust leading the charge at $254 million on Friday alone. These aren't your cousin's meme coin investments - this is serious capital flowing into ETH as an asset class.

| ETF | Weekly Inflow | Total AUM |

|---|---|---|

| BlackRock iShares | $254.73M | $12.35B |

| Fidelity | $132.36M | $8.12B |

| Grayscale | $38.25M | $5.87B |

The $12,000 Thesis: Crazy or Calculated?

Let's address the elephant in the room - $12,000 ETH sounds insane until you run the numbers:

- Previous cycle multiples: ETH's 2021 run saw ~10x from cycle low to high

- Current institutional adoption: Far exceeds 2021 levels

- Supply dynamics: More ETH locked in staking than ever before

- Derivatives market: Open interest suggests big players are positioning for upside

Pseudonymous analyst Tracer made waves recently suggesting we could see a "MONSTER rally" if ETH clears $4,400 cleanly. The logic? Every major resistance break in crypto tends to trigger algorithmic buying and FOMO that far exceeds rational targets.

Risks to Consider (Because Nothing's Guaranteed)

Before you mortgage your house for ETH, let's keep it real:

- RSI is flirting with overbought territory (above 70)

- $207 million in shorts got liquidated recently - that kind of volatility cuts both ways

- Regulatory uncertainty still looms, despite SEC's warmer tone

- Macroeconomic factors could throw cold water on risk assets

This isn't financial advice (seriously, talk to a professional), but dollar-cost averaging into ETH might be smarter than going all-in at these levels. The BTCC team recommends keeping an eye on the $4,150 support level - if that breaks, we could see a healthy pullback before the next leg up.

FAQ: Your Ethereum Price Prediction Questions Answered

What's driving Ethereum's current price surge?

Three main factors: 1) Whale accumulation totaling $7 billion in 30 days, 2) $460M inflows into ETH ETFs last week, and 3) technical breakout above key resistance levels. It's the perfect storm of institutional and retail demand.

How realistic is the $12,000 ETH prediction?

While aggressive, it's not without precedent. ETH has historically shown 10x moves in bull cycles. With current institutional adoption exceeding previous cycles and supply constraints from staking, some analysts see a path to five figures.

What are the key support levels to watch?

$4,210 is critical short-term support, with $4,150 acting as major psychological support. On the upside, $4,400 is the next resistance level to watch for confirmation of continued upside.

Are Ethereum ETFs a game-changer?

Absolutely. The $12.35B in BlackRock's ETH ETF alone represents more institutional exposure than ETH has ever had. These products create constant buy pressure as they accumulate assets.

What's the biggest risk to Ethereum's price?

Regulatory uncertainty remains the wildcard. While the SEC appears to be warming to crypto, any hostile action could spook markets. Macro factors like interest rate hikes could also impact risk assets.