Bitcoin Price Prediction 2025: Can BTC Really Hit $200K? Key Technical and Sentimental Signals to Watch

- BTC Technical Analysis: Bullish Indicators Amid Consolidation

- Market Sentiment: Institutional Demand vs. Whale Selling Pressure

- Critical Price Levels to Watch

- Institutional Accumulation Reshaping Bitcoin's Supply Dynamics

- Potential Catalysts on the Horizon

- Historical Patterns Suggest $200K Possible

- Trading Volume and Liquidity Insights

- Will Bitcoin Reach $200,000 in 2025?

- Bitcoin Price Prediction 2025: Your Questions Answered

As bitcoin hovers around $116,938, the crypto community is buzzing about whether we're on the verge of a historic rally to $200,000. This analysis dives deep into the technical indicators showing bullish momentum, the institutional accumulation reshaping market dynamics, and the critical resistance levels that could make or break this ambitious price target. From whale activity to Elon Musk's latest crypto endorsement, we'll examine all the factors that could propel Bitcoin to new heights or trigger a significant correction.

BTC Technical Analysis: Bullish Indicators Amid Consolidation

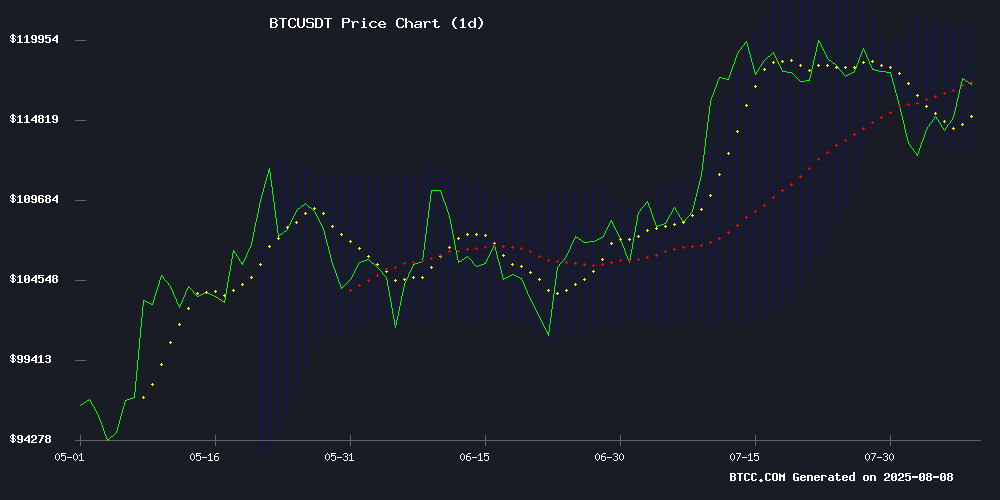

Bitcoin's current price action presents a fascinating technical picture. Trading slightly above its 20-day moving average at $116,745, BTC shows a neutral-to-bullish bias that has traders cautiously optimistic. The MACD indicator's bullish crossover, with the histogram sitting at 956.4042, suggests building upward momentum that could fuel the next leg up.

What's particularly interesting is how BTC is flirting with the upper Bollinger Band at $120,781. While this proximity might signal overbought conditions to some, veteran traders recognize it as a sign of strength in trending markets. The BTCC team notes, "The technical setup favors bulls if BTC can maintain support above $116K, with a retest of $120K looking increasingly probable."

Looking at historical patterns, we've seen similar consolidation phases precede major breakouts. The current setup reminds me of the 2020 accumulation period before Bitcoin's last major bull run. However, as always in crypto, past performance doesn't guarantee future results.

Market Sentiment: Institutional Demand vs. Whale Selling Pressure

The sentiment landscape presents a classic tug-of-war scenario. On one side, we have growing institutional interest through spot Bitcoin ETFs that have accumulated over 1.2 million BTC since January 2024. MicroStrategy continues leading the corporate charge with 628,791 BTC on its balance sheet, treating Bitcoin as both a growth asset and inflation hedge.

On the flip side, on-chain data reveals concerning whale activity. CryptoQuant analyst Arab Chain points to sustained inflows to Binance hovering between $4-5 billion as potential distribution signals. Unlike panic dumping, this appears to be methodical profit-taking by large holders - the kind of activity that often precedes 20-30% corrections during bull markets.

From my experience watching these cycles, it's the institutional demand that might prove more sustainable. As Matthew Hougan of Bitwise noted, "ETF demand has front-run the typical post-halving price discovery," fundamentally altering Bitcoin's market dynamics.

Critical Price Levels to Watch

| Key Level | Significance |

|---|---|

| $118,000 | Liquidation zone; breakout could accelerate upside |

| $120,781 (Upper Bollinger) | Immediate resistance; close above confirms strength |

| 20-day MA ($116,745) | Support level; breach may trigger correction |

Institutional Accumulation Reshaping Bitcoin's Supply Dynamics

The institutional embrace of Bitcoin represents perhaps the most significant structural change in 2025. What began as speculative ETF interest has matured into strategic allocation, with public companies now holding 709,420 BTC collectively. This institutionalization has two profound effects:

First, it's converting liquid supply into long-term holdings, effectively reducing circulating supply. Second, it may be dampening volatility - a double-edged sword that could mean fewer wild price swings but potentially slower moves during rallies.

The BTCC research team observes, "We're seeing a fundamental shift where Bitcoin is transitioning from a speculative asset to a legitimate store of value in institutional portfolios." This transition could provide the stability needed for a sustained MOVE toward $200K.

Potential Catalysts on the Horizon

Several developments could serve as accelerants for Bitcoin's next major move:

1.: The ongoing drama around CoreWeave's proposed acquisition of Bitcoin miner Core Scientific has implications for mining sector stability. Two Seas Capital's opposition highlights governance issues that could affect market confidence.

2.: The unexpected rally in AI-focused cryptocurrencies amid the Core Scientific uncertainty shows how interconnected crypto sectors can influence Bitcoin sentiment.

3.: Musk's recent cryptic Bitcoin support via emoji response to a Coinbase post demonstrates his ongoing influence. When the world's richest person calls fiat "hopeless" while affirming Bitcoin, people notice.

Historical Patterns Suggest $200K Possible

Analysts are drawing parallels between current price action and Bitcoin's 2017 bull run, where similar consolidation preceded explosive gains. The emergence of bitcoin Hyper, a new BTC-linked altcoin that's raised $7.7 million in its presale, echoes previous cycles where innovative LAYER 2 solutions gained traction during bull markets.

However, Hougan's observation about Bitcoin's traditional four-year cycle potentially ending adds complexity to these historical comparisons. The March 2024 surge to $73,000 before April's halving event already broke from historical patterns, thanks largely to ETF approvals.

Trading Volume and Liquidity Insights

While trading volumes have retreated from mid-July highs ($10.22 billion spot, $60.17 billion futures on July 16), current levels ($6.61 billion spot, $41.05 billion futures as of August 7) remain elevated compared to early-summer lulls. This suggests institutional interest persists beneath the surface volatility.

The BTCC team notes, "This cooldown looks more like a bullish pause than loss of conviction. The resilience in spot volumes particularly indicates foundational demand that could support the next leg up."

Will Bitcoin Reach $200,000 in 2025?

The path to $200K hinges on several factors aligning:

- Sustained institutional inflows overcoming whale selling pressure

- Successful breakout above $118K liquidation zone

- Continued development of Bitcoin ecosystem (like Layer 2 solutions)

- Maintenance of key support levels during corrections

While the technical and fundamental setups suggest $200K is plausible, crypto markets remain notoriously unpredictable. The BTCC team cautions, "Historic patterns only provide context, not certainty. Traders should watch the $116K support and $118K resistance as near-term indicators of which direction we're heading."

This article does not constitute investment advice.

Bitcoin Price Prediction 2025: Your Questions Answered

What are the key technical indicators suggesting about Bitcoin's price?

The MACD shows a bullish crossover with the histogram at 956.4042, indicating upward momentum. Bitcoin is also trading NEAR the upper Bollinger Band at $120,781, which can signal strength in trending markets.

How is institutional demand affecting Bitcoin's price?

Institutional accumulation through spot ETFs (over 1.2 million BTC since January 2024) is converting liquid supply into long-term holdings, potentially reducing volatility while supporting higher prices.

What's the significance of the $118,000 level?

The $118K zone represents a major liquidation area where a breakout could accelerate upside momentum, while failure to break through might lead to deeper correction risks.

Could Bitcoin really reach $200,000 in 2025?

While technicals and institutional demand support a bullish case, reaching $200K requires overcoming several hurdles including sustained inflows and reduced whale selling pressure.

How does Elon Musk influence Bitcoin's price?

Musk's recent endorsement and comments about fiat currency being "hopeless" have reignited positive sentiment, recalling Bitcoin's anti-establishment ethos and potentially attracting new investors.