Bitcoin Price Prediction 2025: Can BTC Really Hit $200,000? Technical and Fundamental Analysis

- What Does Bitcoin's Technical Setup Reveal About Its $200,000 Potential?

- How Could France's $48 Billion Bitcoin Proposal Impact Price?

- What Role Does Institutional Adoption Play in BTC's Price Trajectory?

- Can Mining Fundamentals Support a $200,000 Bitcoin Price?

- What Technical Indicators Suggest About BTC's Path to $200,000?

- What Are the Key Challenges to Bitcoin Reaching $200,000?

- Frequently Asked Questions

As bitcoin trades at $113,150 on October 29, 2025, the crypto community is buzzing about its potential to reach $200,000. This comprehensive analysis examines both technical indicators and fundamental developments that could propel BTC to this ambitious target. From France's groundbreaking $48 billion Bitcoin reserve proposal to Michael Saylor's aggressive accumulation strategy, we break down the key factors driving Bitcoin's price action. The technical setup shows bullish momentum with price trading above key moving averages, while institutional adoption reaches unprecedented levels. However, reaching $200,000 would require Bitcoin to overcome several resistance levels and maintain its current growth trajectory amid evolving macroeconomic conditions.

What Does Bitcoin's Technical Setup Reveal About Its $200,000 Potential?

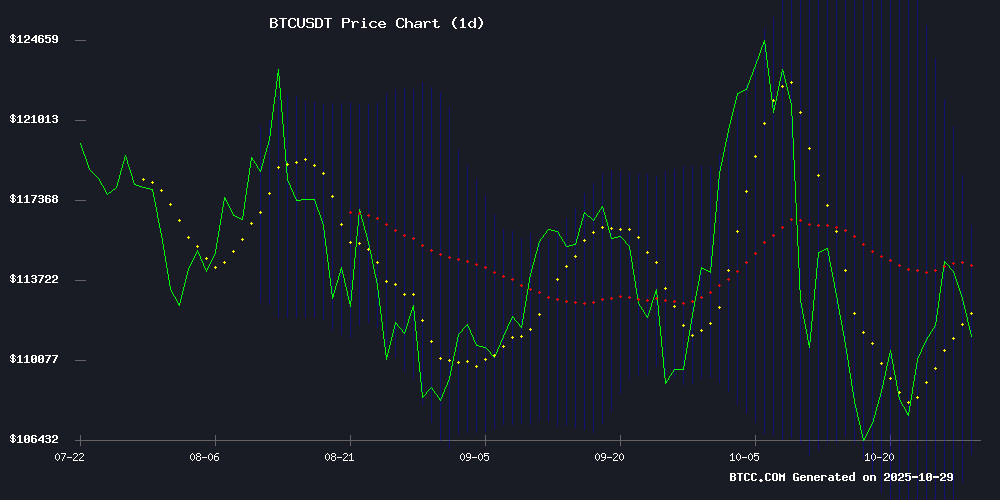

Bitcoin's current technical indicators paint an interesting picture for its path to $200,000. The cryptocurrency is trading comfortably above its 20-day moving average of $111,081, suggesting sustained bullish momentum. The MACD indicator, while positive at 2,853.83, remains below its signal line - a configuration that typically precedes consolidation before potential upward movement.

Source: BTCC TradingView Chart

Notably, Bitcoin currently sits between the Bollinger Band middle line ($111,081) and upper band ($116,379), with room to test resistance levels. "The technical setup supports continued upward pressure," notes a BTCC market analyst. "The key resistance at $116,379 serves as the next major test before we can realistically discuss $200,000 targets."

Historical patterns also suggest potential for significant movement. The Bull-Bear Structure Index has turned positive for the first time since October 2024, signaling building momentum for buyers. This on-chain metric combines price action and network data to gauge market sentiment, and its current reading aligns with improving sentiment across both retail and institutional indicators.

How Could France's $48 Billion Bitcoin Proposal Impact Price?

France has emerged as a surprising catalyst for Bitcoin's potential rally, with lawmakers proposing to allocate 2% of national reserves (approximately $48 billion) to Bitcoin. This bold legislative move, spearheaded by Union of the Right for the Republic leader Éric Ciotti, positions Bitcoin as a strategic reserve asset to bolster financial sovereignty.

| Proposal Element | Details |

|---|---|

| Reserve Allocation | 2% of French national reserves (~$48B) |

| BTC Holdings Target | 420,000 BTC (2% of total supply) |

| Implementation Timeline | 7-8 years |

| Management | Public Administrative Establishment (EPA) |

This proposal directly challenges the European Central Bank's digital euro initiative and could trigger similar moves by other nations if implemented. The psychological impact alone could be significant, as France WOULD become the first major European economy to formally adopt Bitcoin as part of its central bank reserves.

What Role Does Institutional Adoption Play in BTC's Price Trajectory?

Institutional adoption continues to accelerate, with Michael Saylor's Strategy (formerly MicroStrategy) holding 640,808 BTC as of October 2025. The company recently purchased an additional 390 BTC for $43.4 million, maintaining its aggressive accumulation strategy despite market fluctuations.

However, not all corporate Bitcoin strategies are succeeding. Sequans Communications, a Nasdaq-listed semiconductor firm, transferred 970 BTC worth $111 million to Coinbase - its first major outbound transaction since adopting Bitcoin as a treasury reserve in July. The company's stock has plummeted 60% year-to-date, raising questions about corporate Bitcoin strategies during market downturns.

BlackRock CEO Larry Fink recently labeled Bitcoin and gold as "assets of fear," reflecting growing institutional recognition of crypto as a hedge against traditional financial system risks. "People own these assets because they're scared," Fink stated at a Riyadh conference, highlighting concerns over currency devaluation and systemic instability.

Can Mining Fundamentals Support a $200,000 Bitcoin Price?

Bitcoin's network fundamentals remain robust, with mining difficulty set to increase by 6% to a new all-time high. This adjustment reflects continued miner commitment despite market pressures and serves as a key indicator of network security.

The mining sector is also evolving, with companies like CleanSpark demonstrating remarkable adaptability. The firm recently outbid Microsoft for a 100-megawatt site in Wyoming, planning to leverage its infrastructure for both cryptocurrency operations and AI data centers. "Access to power is the new battleground," noted CleanSpark CEO Matt Schultz, highlighting how miners' energy expertise positions them as unexpected contenders in the AI infrastructure race.

Mining difficulty increases typically precede price rallies, as they indicate network strength and miner confidence in Bitcoin's long-term value proposition. The current average block time of 9.42 minutes (below the target 10 minutes) triggers the upward difficulty adjustment, suggesting healthy network activity.

What Technical Indicators Suggest About BTC's Path to $200,000?

Reaching $200,000 from current levels would require a 76.7% increase - a significant but not unprecedented MOVE in Bitcoin's history. The technical setup shows several encouraging signs:

- Price trading above key moving averages (20-day MA at $111,081)

- Bollinger Band expansion suggesting increased volatility potential

- Positive Bull-Bear Structure Index crossover

- Long-term holder movement indicating veteran investor engagement

Analyst Sykodelic notes an interesting inverse correlation between Gold and Bitcoin, suggesting that as gold shows signs of peaking (currently correcting from its $4,300/oz high), capital may rotate into digital assets. "These transfer periods consistently precede Bitcoin's strongest upward movements," the analyst observed.

What Are the Key Challenges to Bitcoin Reaching $200,000?

While the path to $200,000 appears plausible, several challenges remain:

- Resistance Levels: Bitcoin must first break through $116,379 resistance before establishing higher price floors

- Macroeconomic Conditions: Federal Reserve interest rate decisions continue to impact risk assets

- Regulatory Uncertainty: While France's proposal is bullish, broader EU crypto regulation remains unclear

- Market Liquidity: Sustained institutional inflows are needed to support higher valuations

The Federal Reserve's upcoming interest rate decision looms large, with traders eyeing potential catalysts for crypto markets. A dovish pivot could ignite fresh optimism, while neutrality may prolong consolidation.

Frequently Asked Questions

What is the current Bitcoin price as of October 2025?

As of October 29, 2025, Bitcoin is trading at $113,150, comfortably above its 20-day moving average of $111,081 according to TradingView data.

How realistic is the $200,000 Bitcoin price target?

While ambitious, the $200,000 target (representing a 76.7% increase from current levels) is within historical precedent for Bitcoin bull runs. The combination of technical strength and accelerating institutional adoption makes it achievable, though dependent on several factors including macroeconomic conditions and regulatory developments.

What makes France's Bitcoin proposal significant?

France's proposal to allocate $48 billion to Bitcoin reserves represents unprecedented sovereign-level endorsement. If implemented, it would make France the first major European economy to formally adopt Bitcoin as part of its central bank reserves, potentially triggering similar moves by other nations.

How does mining difficulty affect Bitcoin's price?

Increasing mining difficulty (currently set to rise 6% to new all-time highs) indicates network security and miner confidence. Historically, difficulty increases have often preceded price rallies as they demonstrate commitment to the network despite market conditions.

What are the key resistance levels Bitcoin needs to break?

The immediate resistance level to watch is $116,379 (the current upper Bollinger Band). Beyond that, psychological levels at $150,000 and $175,000 would need to be conquered before testing $200,000.