ETH Price Prediction 2025: Navigating Volatility with Key Technical and Fundamental Insights

- ETH Technical Analysis: Key Levels to Watch in September 2025

- Market Sentiment: Institutional Progress vs. Whale Movements

- Critical Factors Influencing ETH's Price Trajectory

- ETH Price Prediction: Potential Scenarios

- Market Liquidation Events and Their Impact

- Ethereum's Macroeconomic Sensitivity

- Historical RSI Signal Sparks Debate

- Frequently Asked Questions

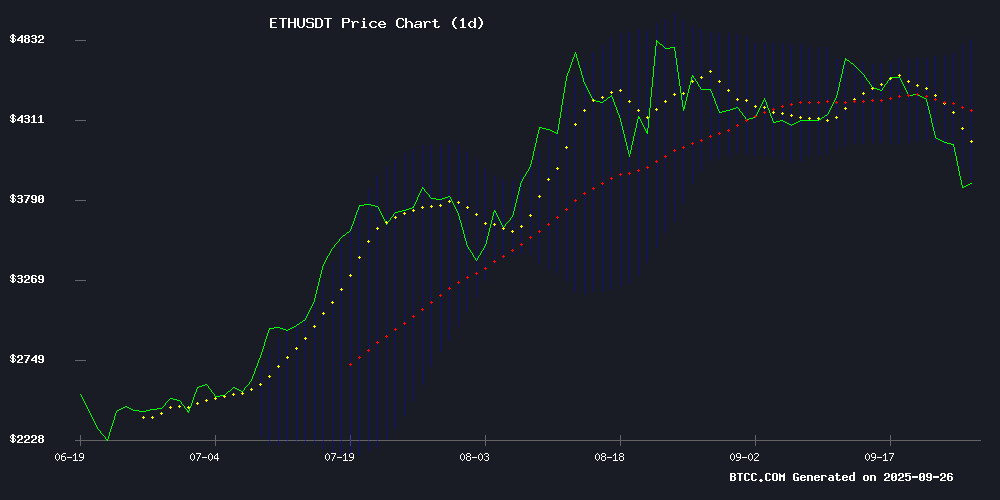

Ethereum (ETH) finds itself at a critical juncture in late September 2025, with technical indicators showing potential for both rebound and further decline. Currently trading at $4,032.55, ETH faces immediate resistance at its 20-day moving average of $4,386.71 while testing crucial support near $3,950. The market presents a fascinating dichotomy - institutional adoption continues through developments like SWIFT's pilot with Consensys' ethereum Layer-2 Linea, while whale movements and macroeconomic pressures create short-term uncertainty. This comprehensive analysis examines the competing forces shaping ETH's price trajectory through technical indicators, fundamental developments, and market sentiment.

ETH Technical Analysis: Key Levels to Watch in September 2025

As of September 26, 2025, Ethereum's technical setup presents a mixed picture that traders should watch closely. The price currently sits below the 20-day moving average ($4,386.71), typically a bearish signal, yet the MACD shows a positive histogram of 95.16 suggesting underlying strength. The Bollinger Bands position ETH NEAR the lower band at $3,958.44, which could serve as a springboard for recovery if support holds.

Source: BTCC TradingView

According to TradingView data, ETH has been range-bound between $3,829 and $4,020 in recent days, with the $3,950 level emerging as critical short-term support. A break below this could see ETH test the $3,600 zone, while reclaiming $4,060 as support might open the path toward the upper Bollinger Band at $4,814.99. The Relative Strength Index (RSI) at 34 sits near oversold territory, potentially signaling a buying opportunity for contrarian investors.

Market Sentiment: Institutional Progress vs. Whale Movements

The fundamental backdrop for Ethereum presents what analysts are calling a "tug-of-war" scenario. On the bullish side, SWIFT's collaboration with Consensys' Ethereum Layer-2 Linea represents significant institutional validation, with major banks like BNP Paribas and BNY Mellon participating in the pilot program. This could modernize cross-border payments using Ethereum's technology.

However, concerning signals emerged as Ethereum co-founder Jeffrey Wilcke moved $5.99 million worth of ETH to Kraken, sparking fears of impending sales. This occurred alongside reports of dormant wallets awakening after eight years to transfer 200,000 ETH ($785 million). While these whale movements create short-term uncertainty, institutional players like Galaxy Digital and FalconX reportedly accumulated 406,117 ETH ($1.6 billion) during the dip, suggesting long-term confidence in Ethereum's prospects.

Critical Factors Influencing ETH's Price Trajectory

Several key developments are currently shaping Ethereum's market dynamics:

1. SWIFT's Blockchain Experiment with Ethereum Technology

The global payments network SWIFT has begun testing a blockchain-based upgrade to its Core messaging system using Consensys' Ethereum Layer-2 solution Linea. This multi-month pilot involves over a dozen major financial institutions and could potentially redefine interbank communications. Linea's appeal lies in its regulatory-compliant privacy features and Ethereum compatibility, positioning it as a bridge between traditional finance and decentralized technology.

2. Exchange Supply Dynamics

Ethereum reserves on major exchanges have hit multi-year lows, with Binance and Coinbase Advanced recording significant outflows. The 50-day SMA netflow has sunk below -40,000 ETH per day - levels not seen since February 2023. This supply contraction historically precedes upward price movements, as reduced available supply can lead to buying pressure when demand returns.

3. Regulatory Developments

Coinbase's chief legal officer Paul Grewal has publicly defended the company's Ethereum Layer-2 network Base against potential SEC exchange classification. This regulatory scrutiny highlights the evolving landscape for Ethereum-based technologies and could impact developer activity and institutional adoption depending on outcomes.

ETH Price Prediction: Potential Scenarios

Based on current technical and fundamental factors, here are the most likely scenarios for ETH in the coming weeks:

| Price Level | Significance | Probability |

|---|---|---|

| $3,600 | Major Support | 30% |

| $4,400 | 20-day MA Resistance | 50% |

| $4,815 | Upper Bollinger Target | 20% |

The BTCC research team notes, "The $4,800 level represents a realistic medium-term target if institutional adoption continues and technical support holds. However, traders should remain cautious of macroeconomic factors that could extend the current volatility."

Market Liquidation Events and Their Impact

September 26, 2025, saw significant market turbulence with over $1.24 billion in crypto positions liquidated within 24 hours. Ethereum positions accounted for $312 million of this total, with long positions suffering disproportionately across major exchanges:

- Bybit: $257.71 million liquidated (90.36% longs)

- Hyperliquid: $219.72 million (95.79% longs)

- Binance: $206.13 million (predominantly long positions)

This liquidation storm followed ETH's failure to hold resistance at $4,500 and a hotter-than-expected August inflation report that rattled risk assets. The events underscore the risks of excessive leverage during periods of heightened volatility.

Ethereum's Macroeconomic Sensitivity

ETH's 11.3% weekly decline in late September 2025 reflects its growing correlation with traditional risk assets. The selloff was exacerbated by macroeconomic headwinds threatening to delay anticipated Federal Reserve rate cuts. Ethereum's price action now demonstrates sensitivity to interest rate expectations similar to tech stocks, with ETF products and tokenized wrappers propagating its price signals across financial markets.

This maturation brings both benefits and challenges - while it may lead to greater institutional adoption, it also makes ETH more vulnerable to macroeconomic shocks that traditionally affected only conventional markets.

Historical RSI Signal Sparks Debate

A rare oversold signal on Ethereum's Relative Strength Index (RSI) has divided analyst opinions. With the daily RSI hovering around 34, some strategists see this as one of the largest oversold signals in ETH's history, potentially signaling a buying opportunity. Others caution that broader market confirmation is needed before assuming a rebound is imminent.

Crypto strategist Quinten François noted, "The current RSI reading matches levels that preceded significant rallies in ETH's history." However, trading firms like AvaTrade advise clients to wait for additional confirmation signals before making substantial position changes.

Frequently Asked Questions

What is Ethereum's current price and key technical levels?

As of September 27, 2025, Ethereum trades at $4,032.55. Key levels to watch include support at $3,950 and resistance at the 20-day moving average of $4,386.71. The Bollinger Bands suggest potential rebound zones between $3,958.44 (lower band) and $4,814.99 (upper band).

What are the main factors influencing ETH's price?

ETH's price is being shaped by: 1) Institutional adoption through projects like SWIFT's Linea pilot, 2) Whale movements including co-founder transactions and dormant wallet activations, 3) Exchange supply dynamics showing decreasing available ETH, and 4) Macroeconomic factors affecting all risk assets.

Is now a good time to buy Ethereum?

The answer depends on your investment horizon and risk tolerance. Technical indicators show ETH is near potential support levels with oversold conditions, but macroeconomic uncertainty persists. Dollar-cost averaging may be prudent for long-term investors, while traders should watch key support/resistance levels.

How might SWIFT's Ethereum integration affect ETH's price?

Successful implementation could significantly boost institutional adoption and utility demand for ETH. However, the pilot program will take months, meaning any price impact WOULD likely be gradual rather than immediate.

What's the significance of ETH exchange reserves hitting multi-year lows?

Declining exchange reserves typically indicate investors are moving ETH to long-term storage, reducing available supply. This can create upward price pressure when demand increases, as fewer coins are readily available for purchase on exchanges.