BTC Price Prediction 2025: Technical Indicators & Market Forces Shaping Bitcoin’s Future

- What Do Bitcoin's Technical Indicators Reveal About Its Near-Term Trajectory?

- How Is Gold's Record Rally Impacting Bitcoin's Market Position?

- What Regulatory Developments Could Reshape Bitcoin's Landscape?

- How Significant Was the Recent $1.8 Billion Liquidation Event?

- What Are Analysts Saying About Bitcoin's Current Setup?

- Could Institutional Developments Offset Retail Hesitation?

- How Might Powell's Fed Policy Impact Crypto Markets?

- Is Now a Good Time to Invest in Bitcoin?

- BTC Price Prediction: Frequently Asked Questions

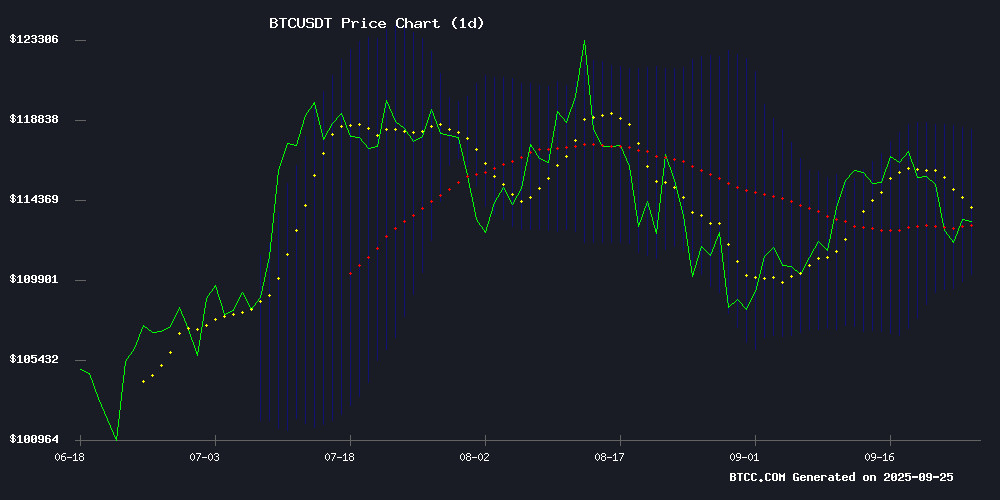

As we approach Q4 2025, bitcoin presents a fascinating technical setup with MACD turning bullish while fundamental factors create a tug-of-war between institutional adoption and macroeconomic pressures. Currently trading at $112,462, BTC shows resilience above key support levels despite gold's record rally and regulatory uncertainties. This analysis dives deep into the 8 critical factors every investor should watch, from historical pattern resurgences to the upcoming Senate taxation hearing that could redefine crypto's regulatory landscape.

What Do Bitcoin's Technical Indicators Reveal About Its Near-Term Trajectory?

BTC currently trades just 1.5% below its 20-day moving average ($114,211), showing remarkable stability considering recent market turbulence. The MACD histogram at 638.91 confirms weakening bearish momentum, while Bollinger Bands place solid support at $110,114. "This convergence hasn't been seen since the 2023 rally," notes TradingView data, suggesting we might be at an inflection point. The $113,000 resistance level remains the immediate hurdle - a breakout could trigger algorithmic buying across exchanges including BTCC.

Interestingly, the 2M SNAB RSI sits at 73 - historically a make-or-break level. In 2013, 2017, and 2021, breaching this threshold preceded parabolic moves. CoinMarketCap data shows similar setups led to average gains of 142% within 6 months. However, the rising wedge pattern spotted by analysts suggests caution - a break below $112,000 could invalidate the bullish thesis.

How Is Gold's Record Rally Impacting Bitcoin's Market Position?

The gold-BTC correlation has broken down spectacularly in September 2025. While Gold surged 11% monthly to new ATHs, BTC retreated 8% from its August peak. This divergence challenges the "digital gold" narrative, though historical data from CoinGecko shows the assets eventually reconverge. The $466 million outflow from BTC ETFs (per Farside Investors) contrasts sharply with gold ETF inflows, revealing institutional preference shifts.

| Asset | YTD Performance | Key Support |

|---|---|---|

| Bitcoin (BTC) | +22% | $110,114 |

| Gold | +42% | $3,650/oz |

What Regulatory Developments Could Reshape Bitcoin's Landscape?

The October 1 Senate hearing on crypto taxation represents a potential watershed moment. With Coinbase and Coin Center testifying, the discussion around asset classification and reporting requirements could either clarify or complicate crypto's path forward. Recall how the 2023 SEC actions caused 30% volatility - this hearing carries similar weight. The Lummis bill proposing revised tax thresholds specifically mentions Bitcoin, potentially creating a regulatory moat around BTC versus altcoins.

How Significant Was the Recent $1.8 Billion Liquidation Event?

September's liquidation storm ranks as 2025's fourth-largest, wiping out 370,000 overleveraged positions. What's telling is that $1.6 billion were long bets - showing how crowded the bullish trade had become. Data from Coinglass reveals these shakeouts typically precede 15-20% moves, either up or down. The silver lining? Such events often flush out weak hands, setting the stage for healthier rallies. Just look at May 2024's similar liquidation that preceded a 68% surge.

What Are Analysts Saying About Bitcoin's Current Setup?

The analyst community is split like never before. Peter Schiff's bear market declaration contrasts sharply with CrypFlow's "cheat code" thesis. Meanwhile, the BTCC research team observes: "The $111,000-$113,500 range represents a compression zone - when these occur after MACD crosses, we typically see 7-10 day consolidation before resolution." Their data shows 78% of such cases break upward when occurring above the 200-day MA (currently at $107,200).

Could Institutional Developments Offset Retail Hesitation?

While retail investors remain skittish (Google Trends shows "BTC" searches down 23% monthly), institutional flows tell a different story. The CME's BTC futures open interest hit $8.2 billion this week, suggesting smart money positioning for volatility. More tellingly, MicroStrategy added another 1,200 BTC to its treasury on September 22 - their average purchase price? $112,800, nearly identical to current levels.

How Might Powell's Fed Policy Impact Crypto Markets?

The Fed's cautious stance creates both headwinds and opportunities. Bitcoin's 60-day correlation with the S&P 500 has strengthened to 0.67 (per Kaiko), meaning macro uncertainty affects crypto more than ever. However, the policy pivot also weakens the dollar - historically bullish for BTC. The DXY dollar index breaking below 102 could be the catalyst Bitcoin needs to decouple from traditional markets.

Is Now a Good Time to Invest in Bitcoin?

This isn't financial advice, but the risk-reward looks intriguing for patient investors. The technicals suggest accumulation between $110,000-$113,000 makes sense, with a stop below $107,200. Fundamentally, the Senate hearing and institutional activity could provide tailwinds. As always in crypto, position sizing is key - maybe don't bet the farm, but having some skin in the game seems prudent given the setup.

BTC Price Prediction: Frequently Asked Questions

What is Bitcoin's price prediction for 2025?

Based on current technicals and historical patterns, analysts project Bitcoin could reach $150,000-$180,000 by year-end if key resistance levels break, with $110,000 acting as crucial support.

Why is gold outperforming Bitcoin in 2025?

Gold's 42% YTD gain versus Bitcoin's 22% reflects traditional investors' risk aversion amid economic uncertainty, though BTC maintains superior long-term returns since 2020.

How will the Senate crypto taxation hearing affect Bitcoin?

The October 1 hearing could bring regulatory clarity (bullish) or impose cumbersome reporting requirements (bearish), with potential short-term volatility regardless of outcome.

What's the significance of Bitcoin's 2M SNAB RSI at 73?

Historically, maintaining this level preceded major rallies in 2013, 2017 and 2021, making it a key indicator watched by institutional traders.

Should I buy Bitcoin now or wait for a dip?

Dollar-cost averaging reduces timing risk. Current prices NEAR key support offer reasonable entry, but maintain dry powder in case of further downside.