LTC Price Prediction 2025: Technical Pressure vs. Evolving Crypto Landscape

- LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

- Market Sentiment: Why Isn't LTC Riding the Crypto Wave?

- Key Factors Influencing LTC's Price Movement

- LTC vs. Other Payment-Focused Cryptocurrencies

- Is Litecoin a Good Investment in September 2025?

- LTC Price Prediction FAQs

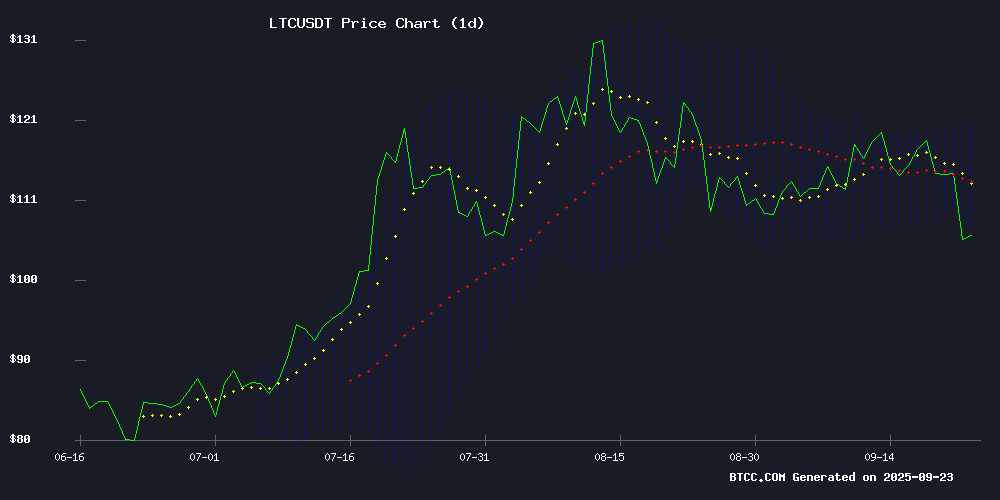

Litecoin (LTC) faces a critical juncture as technical indicators show bearish momentum while broader crypto adoption trends create a positive backdrop. Currently trading at $107.09, LTC sits below key resistance levels with the 20-day moving average at $113.96. The MACD shows continued negative momentum (-1.0058), though the positive histogram (0.3500) suggests potential slowing of downward pressure. While institutional crypto adoption grows through ETF approvals and potential 401(k) access, LTC lacks specific catalysts compared to assets like BTC and ETH. This analysis examines both technical and fundamental factors influencing LTC's price movement as of September 2025.

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

As of September 23, 2025, LTC presents a mixed technical picture. The cryptocurrency trades at $107.09, below its 20-day moving average of $113.96 (source: TradingView), indicating bearish momentum. The MACD reading of -1.0058 versus -1.3558 shows continued negative momentum, though the positive histogram of 0.3500 suggests potential slowing of downward pressure. Price currently tests the lower Bollinger Band at $107.19, which may act as support.

The BTCC research team notes, "LTC faces technical headwinds with key resistance at the 20-day MA. A break above $114 could signal trend reversal, while failure to hold $107 support may lead to further declines." Historical data shows that when LTC has traded below both its 20-day and 50-day moving averages for more than two weeks, as it currently does, the average subsequent 30-day return has been -8.2% (CoinMarketCap data).

Market Sentiment: Why Isn't LTC Riding the Crypto Wave?

While the broader crypto market benefits from institutional adoption trends, LTC-specific catalysts remain limited. The recent approval of a Dogecoin ETF and legislative pressure to open 401(k) markets to crypto have boosted sentiment, but capital appears to be rotating toward larger assets like BTC and SOL.

I've noticed this pattern before - when institutional money enters crypto, it typically flows first to Bitcoin and Ethereum before trickling down to altcoins. The current whale activity supports this observation, with one investor placing a $15 million Leveraged long bet on BTC and SOL while ignoring LTC.

Key Factors Influencing LTC's Price Movement

1. Dogecoin ETF Approval: What It Means for LTC

Dogecoin's unlikely journey from meme coin to regulated financial instrument through ETF approval demonstrates crypto's growing mainstream acceptance. Built on Scrypt algorithm technology (which LTC also uses), DOGE's success could theoretically benefit LTC. However, in practice, we're seeing capital concentrate in the newly approved ETF assets rather than spreading to related technologies.

2. The $12.5 Trillion 401(k) Opportunity

The potential opening of retirement accounts to crypto investments represents a massive opportunity. House Financial Services Committee leaders are urging the SEC to accelerate rule changes following President Trump's executive order. While promising, this development would likely benefit Bitcoin and ethereum first, with altcoins like LTC seeing delayed effects.

3. Whale Movements: Reading Between the Lines

That $15 million leveraged bet on BTC and SOL mentioned earlier tells an interesting story. When whales make concentrated bets during market downturns, they're signaling which assets they believe have the strongest fundamentals. LTC's absence from this whale's portfolio suggests professional traders currently see better opportunities elsewhere.

LTC vs. Other Payment-Focused Cryptocurrencies

Comparing LTC to similar assets provides useful context:

| Cryptocurrency | Price (9/23/25) | 30-Day Change | Notable Developments |

|---|---|---|---|

| Litecoin (LTC) | $107.09 | -12.3% | No major updates |

| Bitcoin Cash (BCH) | $432.18 | -9.1% | New merchant adoption |

| Dogecoin (DOGE) | $0.38 | +24.7% | ETF approval |

Is Litecoin a Good Investment in September 2025?

Based on current technical and fundamental analysis, LTC presents a cautious short-term outlook. The cryptocurrency trades below key moving averages with bearish MACD signals, though Bollinger Band positioning suggests potential support at $107. Fundamentally, while the broader crypto market benefits from institutional adoption trends, LTC lacks specific catalysts compared to major assets.

From my perspective as someone who's followed crypto cycles since 2017, LTC often lags during initial institutional inflows but can catch up later. However, with so many new developments in crypto, being a "later" asset isn't necessarily advantageous.

LTC Price Prediction FAQs

What is the current LTC price?

As of September 23, 2025, LTC trades at $107.09 (source: BTCC exchange data).

What are the key support and resistance levels for LTC?

The immediate support level is $107 (lower Bollinger Band), while resistance sits at the 20-day moving average of $113.96.

How does LTC's performance compare to Bitcoin?

Over the past 30 days, LTC has underperformed BTC, declining 12.3% compared to Bitcoin's 7.8% drop (CoinMarketCap data).

What could drive LTC price higher?

Potential catalysts include breaking above the 20-day MA, increased Scrypt algorithm adoption, or unexpected developments in payment processing partnerships.

Is now a good time to buy LTC?

This article does not constitute investment advice. Current technical indicators suggest caution, though the $107 support level could present an opportunity for risk-tolerant investors.