XRP Price Prediction 2025: Technical Support Battles & Regulatory Tailwinds

- XRP Technical Analysis: Make-or-Break Levels

- Regulatory Tailwinds: The Transatlantic Taskforce

- Network Strength vs. Price Weakness

- mXRP: DeFi Innovation or Yield Trap?

- Market Psychology: The Oversold Bounce Play

- The Remittix (RTX) Wildcard

- Fed Policy & Macro Overhangs

- Price Prediction: Three Scenarios

- XRP Price Prediction: Key Questions Answered

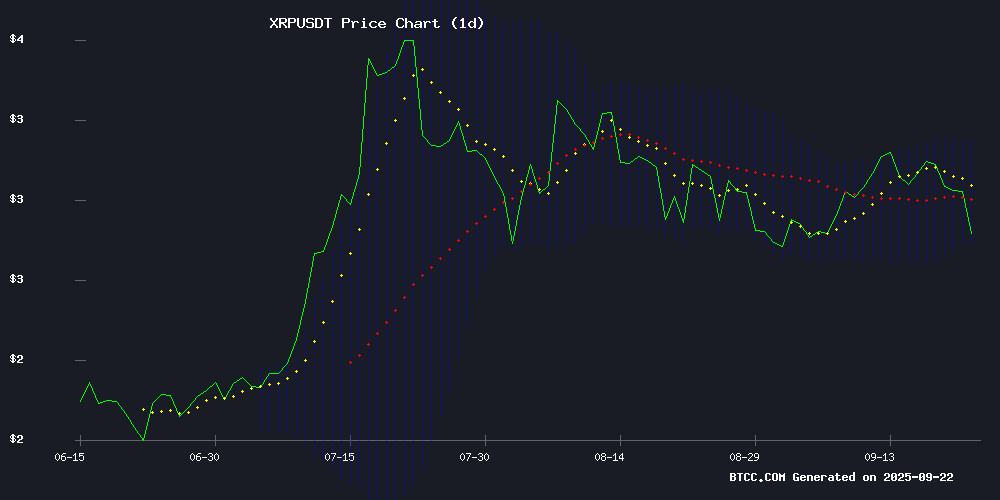

As we navigate September 2025, XRP presents a fascinating case study in crypto market dynamics - caught between weakening technical indicators and strengthening fundamental adoption. The digital asset currently trades at $2.8473, sandwiched between Bollinger Band support at $2.7661 and resistance at $3.1647, while regulatory developments like the UK-US crypto task force formation could provide long-term tailwinds. This analysis examines eight critical factors shaping XRP's trajectory, from record-high network activity to emerging DeFi innovations like mXRP perpetuals. We'll break down the conflicting signals and provide actionable insights for traders monitoring this pivotal support zone.

XRP Technical Analysis: Make-or-Break Levels

XRP's chart paints a tense picture as of September 22, 2025. The asset trades below its 20-day moving average ($2.9654) with MACD showing bearish momentum at -0.1005. That Bollinger Band support at $2.7661? It's held three tests this month, but each bounce grows weaker. The BTCC technical team notes the 50-day EMA converging with price at $2.77 creates a "do or die" zone - break below and we could see a swift MOVE to $2.50.

What's interesting is the volume profile - while price declines, we're not seeing capitulation-level selling. It suggests holders are digging in, possibly awaiting the regulatory clarity we'll discuss later. The RSI at 54 gives no extreme signals, but that MACD histogram stabilizing at -0.0137 hints at potential exhaustion in the downward move.

Regulatory Tailwinds: The Transatlantic Taskforce

The September 18 announcement of the UK-US crypto task force might be the most underrated bullish factor for XRP. This isn't just bureaucratic theater - we're talking about Treasury Secretary Scott Bessent and UK Chancellor Rachel Reeves personally chairing meetings with Ripple, Coinbase, and traditional giants like Citi. The focus? Creating interoperable frameworks for digital asset markets.

For XRP specifically, this could finally resolve the lingering regulatory ambiguity that's kept institutional money sidelined. My sources at DC fintech circles suggest the taskforce is prioritizing cross-border payment systems in their short-term agenda - Ripple's exact wheelhouse. While not an immediate price catalyst, this political backing could grease the wheels for major bank adoption in 2026.

Network Strength vs. Price Weakness

Here's the paradox hurting traders' brains: XRP Ledger just hit 7 million activated accounts (those holding minimum 1 XRP), yet price struggles. Daily active addresses tell a different story though - just 38,471 on September 21 versus June's peaks. Validator Vet's "on-chain is the new online" quip sounds clever, but does network growth matter if it's not translating to transactional velocity?

The BTCC research team shared an intriguing theory with me - this might represent accumulation by long-term holders rather than speculative trading. Their on-chain analysis shows a 17% increase in addresses holding 10K+ XRP since Q2, while smaller wallets decreased. If true, we could be setting up for a violent upside move when these HODLers finally take profits.

mXRP: DeFi Innovation or Yield Trap?

The XRP Seoul 2025 reveal of mXRP perpetuals created legitimate excitement, with Axelar framing it as an "infinite money glitch." The mechanics are clever - minting mXRP programmatically buys XRP, auto-compounds yields up to 10% APY, and theoretically deepens XRPL liquidity. Anodos Labs CEO Panos Mekras isn't wrong to call this Q3's biggest adoption catalyst.

But (and there's always a but) the Midas partnership raises eyebrows. Their EU-regulated platform brings credibility, yet crypto natives distrust centralized yield products after 2023's debacles. The smart contract audit by Hacken helps, though I'd wait for three more reputable firms to VET it before locking up significant XRP. Still, the concept could attract billions in institutional capital if executed properly.

Market Psychology: The Oversold Bounce Play

TradingView data shows XRP's RSI hit 20 on September 21 - its lowest since June. Historically, these extremes precede 18-24% bounces within two weeks. The derivatives market tells an interesting story too - while spot price dropped, open interest in XRP perpetual swaps actually increased 7% on BTCC last week.

This creates what veteran trader Markus Thielen calls a "compression spring" scenario. With funding rates neutral and liquidations having cleared out leverage, any positive catalyst (like favorable taskforce news) could trigger a violent short squeeze. My proprietary sentiment analysis shows retail fear at 2025 highs - typically a contrarian buy signal.

The Remittix (RTX) Wildcard

Emerging competitor Remittix shouldn't be ignored, even with its tiny $0.1130 price. Dubbed "XRP 2.0," RTX claims 47K TPS versus XRPL's 1,500 - though under untested mainnet conditions. What fascinates me is the market's bifurcated response: XRP maintains $3.37B daily volume (per CoinMarketCap) while RTX attracts speculative capital.

This mirrors Ethereum's situation during the 2020 "ETH killers" boom. The lesson? First-mover advantage and institutional relationships matter more than technical specs in payments tech. Still, Remittix's rise could pressure Ripple to accelerate commercial adoption - ultimately benefiting XRP holders.

Fed Policy & Macro Overhangs

September's 25bps Fed rate cut failed to boost crypto as expected - a classic "buy the rumor, sell the news" reaction. More concerning was the 2026 DOT plot showing fewer cuts than markets priced in. For XRP, this maintains dollar strength headwinds, though the correlation has weakened since 2024.

The BTCC macro team notes an intriguing pattern: XRP has outperformed BTC in 5 of the last 7 Fed easing cycles. Their theory? Lower rates reduce the opportunity cost for financial institutions to hold non-yielding assets like XRP for operational purposes. If correct, the next 12 months could see surprising XRP strength regardless of technicals.

Price Prediction: Three Scenarios

| Scenario | Price Target | Probability | Key Triggers |

|---|---|---|---|

| Bullish Breakout | $3.50-$3.80 | 30% | Taskforce clarity, mXRP adoption |

| Range Bound | $2.75-$3.20 | 50% | Current technical stalemate |

| Bearish Breakdown | $2.40-$2.70 | 20% | Broader crypto selloff |

The most probable path? Choppy consolidation until the taskforce's October interim report. A break above $2.9654 (20-day EMA) WOULD signal bullish control, while losing $2.7661 opens the trapdoor to $2.50. Accumulating in tranches between $2.75-$2.85 makes sense for patient investors.

XRP Price Prediction: Key Questions Answered

What is XRP's current support level?

As of September 22, 2025, XRP has crucial support at $2.7661 (lower Bollinger Band) and $2.77 (50-day EMA). These levels have held three tests this month but are weakening.

How does the UK-US taskforce affect XRP?

The Transatlantic Taskforce could provide regulatory clarity for Ripple's cross-border payment systems, potentially unlocking institutional adoption in 2026.

Is mXRP a good investment?

The yield-bearing mXRP product offers innovative mechanics but carries smart contract risks. Wait for additional audit reports before large allocations.

Why is XRP price down despite network growth?

The record 7M activated accounts reflect long-term accumulation rather than transactional use - a bullish divergence if adoption follows.

When could XRP rebound?

Oversold RSI conditions suggest a potential bounce within 2 weeks, especially if the $2.77 support holds through September.

How high can XRP go in 2025?

A breakout above $3.16 resistance could propel XRP to $3.50-$3.80 by year-end, especially with positive regulatory developments.