ETH Price Prediction 2025: Can Ethereum Shatter the $5,000 Barrier and Reach $8,500?

- Current ETH Market Overview

- Technical Analysis: Bullish Signals Emerge

- Institutional Demand Fuels Optimism

- Ethereum Foundation's AI Push

- Market Consolidation and Future Outlook

- ETH Price Prediction FAQs

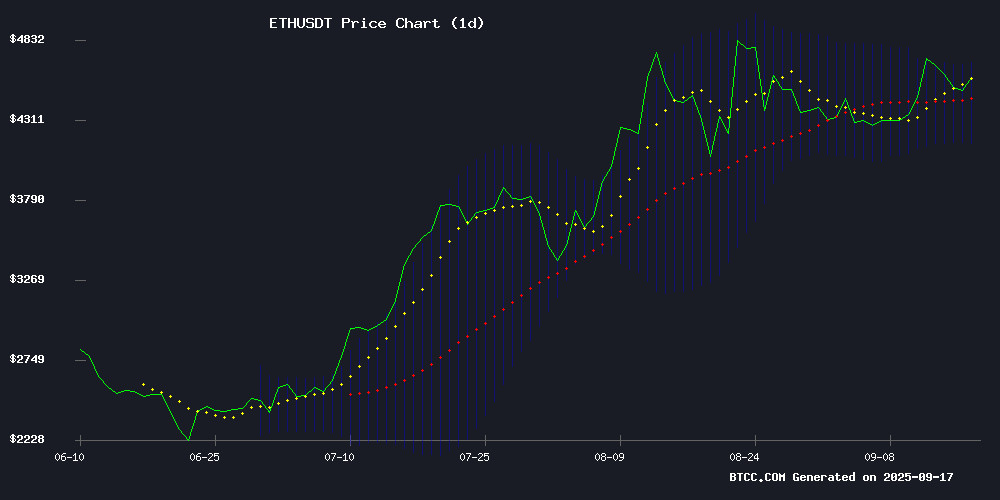

Ethereum (ETH) is showing strong bullish signals as we approach Q4 2025, currently trading at $4,507.09 and maintaining position above its critical 20-day moving average. With institutional ETF inflows hitting record levels and major corporations adopting Ethereum-based solutions, analysts are predicting potential targets ranging from $5,000 to $8,500 by year-end. This comprehensive analysis examines the technical indicators, market sentiment, and fundamental developments driving ETH's price action.

Current ETH Market Overview

As of September 17, 2025, Ethereum is demonstrating remarkable resilience in the crypto markets. The second-largest cryptocurrency by market cap has been consolidating between $4,400 and $4,600, building what technical analysts describe as a "launchpad" for its next major move. The 20-day moving average at $4,417.07 continues to provide strong support, while the $4,880 resistance level looms as the final barrier before potential price discovery.

Source: BTCC Market Data

Technical Analysis: Bullish Signals Emerge

ETH's technical setup paints an encouraging picture for bulls. The MACD indicator shows slight consolidation at -2.35, while Bollinger Bands indicate normal trading ranges with upper resistance at $4,672.39. What's particularly interesting is how ETH has maintained its position above the psychologically important $4,500 level despite recent market fluctuations.

"The $4,880 resistance zone is absolutely critical," notes a BTCC market analyst. "We've seen multiple tests of this level throughout September, and each rejection has actually strengthened the case for an eventual breakout."

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,507.09 | Above 20-day MA support |

| Immediate Resistance | $4,880 | Critical breakout level |

| Upper Target | $5,000 | Psychological barrier |

| Bullish Target | $8,500 | Long-term institutional forecast |

Institutional Demand Fuels Optimism

The institutional narrative around ethereum has never been stronger. Single-day ETF inflows recently hit $730 million, showcasing growing appetite from traditional finance players. Standard Chartered has been particularly bullish with their $7,500 year-end target, while crypto-native analysts see potential for even higher numbers.

What's fascinating is how corporate adoption is accelerating. American Express recently launched NFT passport stamps on Ethereum's Base L2 network, while SharpLink Gaming now holds 838,152 ETH (worth approximately $3.86 billion) as part of its corporate treasury strategy. These developments suggest Ethereum is becoming deeply embedded in traditional business operations.

Ethereum Foundation's AI Push

The Ethereum Foundation made waves in September 2025 with the launch of its dAI Team, focused on positioning Ethereum as the premier settlement LAYER for AI-driven economies. Developer Davide Crapis explained the vision: "Ethereum can serve both current AI developers and future sci-fi scenarios." This initiative challenges the dominance of tech giants in AI infrastructure while expanding Ethereum's use cases.

Market Consolidation and Future Outlook

ETH has been trading in a relatively tight range between $4,400-$4,600 throughout early September, which many analysts view as healthy consolidation after its strong August performance. The cryptocurrency briefly dipped below $4,500 on September 15 before quickly recovering, demonstrating strong support at this level.

Looking ahead, all eyes remain on the $4,880 resistance. A decisive break above this level could trigger the much-anticipated MOVE toward $5,000 and beyond. However, traders should remain cautious - the market has seen several false breakouts already this quarter.

ETH Price Prediction FAQs

What is the current price prediction for Ethereum (ETH)?

As of September 2025, analysts predict Ethereum could reach between $5,000 to $8,500 by year-end, with Standard Chartered notably forecasting $7,500. The immediate technical target is $4,880, which if broken could trigger significant upward momentum.

What are the key resistance levels for ETH?

The most critical resistance level to watch is $4,880, which has rejected multiple breakout attempts in September 2025. Beyond that, psychological resistance sits at $5,000, with longer-term targets at $7,500 and $8,500 according to institutional forecasts.

How has institutional adoption affected ETH's price?

Institutional demand has been a major driver, with single-day ETF inflows reaching $730 million recently. Corporate adoption by companies like American Express and SharpLink Gaming has also provided fundamental support, with SharpLink now holding over 838,000 ETH in its treasury.

What technical indicators suggest ETH is bullish?

ETH remains above its 20-day moving average ($4,417), a key support level. While the MACD shows some near-term consolidation, the overall technical structure appears strong, with Bollinger Bands indicating normal trading ranges and potential upside to $4,672.

Could ETH reach $10,000 in 2025?

While some optimistic analysts speculate about $10,000 ETH, most institutional forecasts remain in the $7,500-$8,500 range for 2025. Reaching $10,000 WOULD likely require significantly increased institutional adoption or major protocol developments.