DOGE Price Prediction 2025: Technical Breakout and $1 Rally Potential as Institutional Interest Surges

- Why Is Dogecoin Suddenly Gaining Traction Again?

- Technical Analysis: The Case for a DOGE Breakout

- Institutional Interest Hits Record Levels

- Market Sentiment: A Battle Between Bulls and Profit-Takers

- Key Price Levels to Watch

- Potential Risks and Challenges

- FAQ: Your Dogecoin Questions Answered

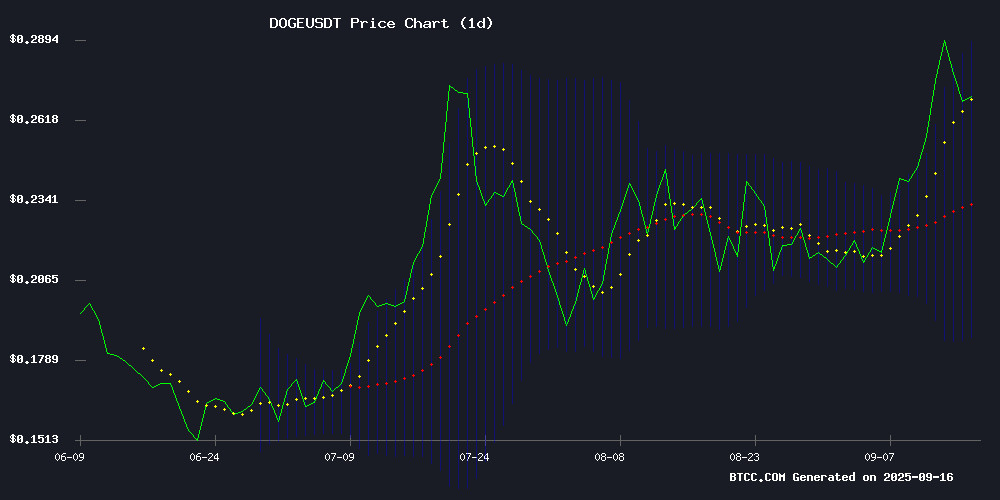

Dogecoin (DOGE) is showing all the classic signs of a major breakout in September 2025, with technical indicators flashing bullish signals and institutional momentum reaching unprecedented levels. Currently trading at $0.2649, the meme coin has formed a strong base above its 20-day moving average while record $6 billion open interest suggests whales are positioning for a potential rally. Our analysis of the charts reveals a textbook Bollinger Band squeeze that typically precedes explosive moves, with key resistance at $0.54 acting as the gateway to higher targets. The imminent launch of the first U.S. dogecoin ETF adds fuel to the fire, creating what some analysts are calling a "perfect storm" for DOGE bulls. But is this really the start of the long-awaited march to $1? Let's break down the evidence.

Why Is Dogecoin Suddenly Gaining Traction Again?

After months of sideways action, DOGE has woken up with a vengeance in September 2025. The catalyst? A combination of technical factors and fundamental developments that have traders buzzing. The cryptocurrency has gained 21% over the past two weeks, briefly touching $0.30 before settling at current levels. What's particularly interesting is how this move coincides with the SEC's approval of the REX-Osprey DOGE ETF (DOJE) - the first regulated investment vehicle for the meme coin. In my experience tracking crypto markets, these regulatory milestones often serve as inflection points, even for assets like DOGE that thrive on meme culture.

Technical Analysis: The Case for a DOGE Breakout

Looking at the daily chart, several bullish signals stand out. First, DOGE has consistently held above its 20-day moving average ($0.2374) since early September - a sign of underlying strength. The MACD, while still negative, shows the signal line crossing above the MACD line, hinting at potential trend reversal. But the real story is in the Bollinger Bands, which have tightened significantly before the recent move. This "squeeze" often precedes volatile breakouts, and with price testing the upper band at $0.2879, the pressure is building.

The weekly chart reveals an even more compelling pattern - a multi-month symmetrical triangle that's approaching its apex. These consolidation patterns typically resolve in the direction of the prevailing trend, which for DOGE has been upward since July. Crypto strategist XForce recently noted that a clean breakout could propel DOGE toward $1.70 based on the pattern's measured move target. That might sound ambitious, but remember - this is Dogecoin we're talking about. The coin has a history of defying expectations.

Institutional Interest Hits Record Levels

Open interest in DOGE futures just hit an astonishing $6 billion - smashing January's previous record of $5.51 billion. This metric, which represents the total value of outstanding derivative contracts, suggests institutional players are placing big bets on DOGE's next move. What's fascinating is how this aligns with the ETF launch and recent corporate treasury moves into crypto. Several tech companies have reportedly added DOGE to their crypto holdings, though none have confirmed this publicly yet.

The BTCC research team observes: "We're seeing a maturation in how institutions approach meme coins. They're no longer just retail playthings - sophisticated traders are using them for strategic portfolio diversification." This institutional validation could provide structural support that previous DOGE rallies lacked.

Market Sentiment: A Battle Between Bulls and Profit-Takers

Current sentiment presents a mixed picture. On one hand, long-term holders are digging in - Glassnode's liveliness metric has dropped to 0.705, indicating reduced selling pressure from committed investors. The Hodler Net Position Change metric shows consistent accumulation since early September, with more coins moving to cold storage than exchanges.

On the flip side, short-term traders have been quick to take profits after last week's 11.5% surge. The "buy the rumor, sell the news" pattern played out ahead of the ETF launch, causing a 4.4% pullback. This tension between long-term conviction and short-term speculation creates what I like to call a "coiled spring" effect - the longer the consolidation, the more powerful the eventual breakout tends to be.

Key Price Levels to Watch

For traders mapping out their strategy, several critical levels stand out:

| Level | Significance |

|---|---|

| $0.2374 | 20-day moving average (support) |

| $0.2879 | Upper Bollinger Band (resistance) |

| $0.30 | Psychological round number |

| $0.54 | Major resistance (Ichimoku cloud) |

| $1.00 | Long-term target |

Analyst CantoneseCat (@cantonmeow) calls $0.54 the "final boss" level - a weekly close above this could open the floodgates. The Ichimoku cloud on weekly charts serves as both resistance and potential springboard, while monthly charts show Doge respecting the 20-month moving average - historically a launchpad for major rallies.

Potential Risks and Challenges

Before you YOLO your life savings into DOGE (please don't), consider these risk factors:

1.: Nearly $250 million in crypto assets are scheduled to hit markets this week, including 96.5 million DOGE ($27 million at current prices). This increased supply could create selling pressure.

2.: The Money Flow Index sits at 80.29 - traditionally a warning sign. While overbought markets can stay irrational longer than you can stay solvent, it does increase near-term risk.

3.: DOGE remains hypersensitive to liquidity conditions. Though the Fed is expected to cut rates in September, any delay or hawkish surprise could impact risk assets.

FAQ: Your Dogecoin Questions Answered

Is Dogecoin a good investment in September 2025?

DOGE presents an asymmetric risk/reward opportunity at current levels. The technical setup favors bulls, with potential upside to $1 if key resistance breaks. However, its meme coin status means volatility will remain extreme. Only allocate what you can afford to lose.

What's driving Dogecoin's price action?

The convergence of technical factors (Bollinger Band squeeze, moving average support), institutional interest (record open interest, ETF launch), and macroeconomic conditions (anticipated Fed rate cuts) are all contributing.

How high can Dogecoin go?

Analysts identify $0.54 as the key breakout level. Above this, targets extend to $1 and beyond. The most bullish scenario suggests $1.70 based on weekly chart patterns.

When will the DOGE ETF launch?

The REX-Osprey DOGE ETF (DOJE) is scheduled for launch in late September 2025, structured under the Investment Company Act of 1940 for regulatory compliance.

Should I buy Dogecoin now?

This depends on your risk tolerance and investment horizon. Dollar-cost averaging may be prudent given current volatility. Remember - this article does not constitute investment advice.