XRP Price Prediction 2025: Can Bullish Technicals and Institutional Adoption Push It to $4?

- What Do the Technical Indicators Say About XRP's Current Position?

- How Is Institutional Adoption Impacting XRP's Valuation?

- What Are the Key Resistance and Support Levels to Watch?

- How Has Trading Volume and Market Sentiment Evolved?

- What Are Analysts Predicting for XRP's Price Trajectory?

- Frequently Asked Questions

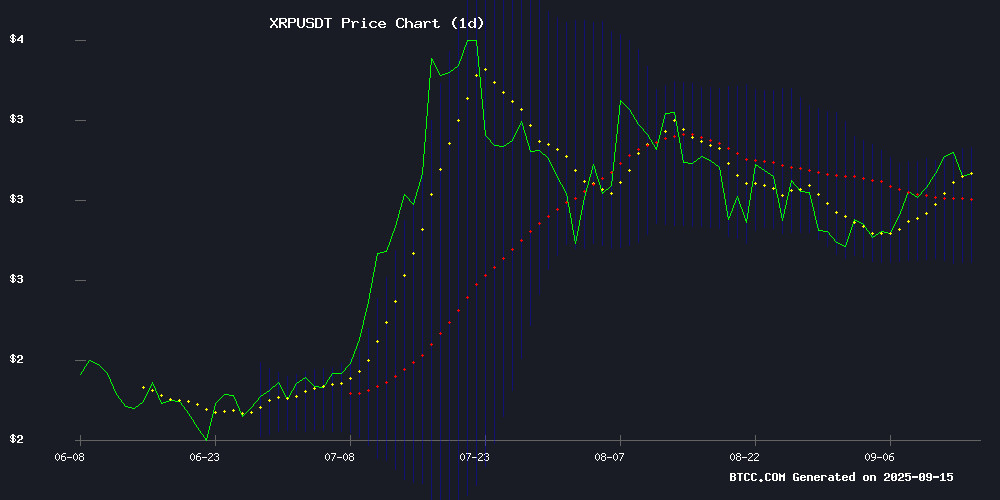

As of September 15, 2025, XRP shows strong bullish signals with its price at $2.9765, trading above key moving averages and demonstrating potential for further upside. Technical indicators suggest a possible move toward $3.40 in the near term, with $4 becoming plausible if current momentum continues. The cryptocurrency has recently surpassed Citigroup in market capitalization, signaling growing institutional adoption that could fuel its next rally. This analysis examines the technical setup, market sentiment, and fundamental drivers that could determine XRP's price trajectory in the coming weeks.

What Do the Technical Indicators Say About XRP's Current Position?

XRP's technical setup presents a mixed but generally bullish picture as of mid-September 2025. The price currently sits at $2.9765, comfortably above its 20-day moving average of $2.9140 - a key support level that traders are watching closely. The Bollinger Bands configuration shows upper, middle, and lower bands at $3.1291, $2.9140, and $2.6988 respectively, placing the current price in the upper range.

The MACD indicator shows readings of -0.0693 | 0.0189 | -0.0882, suggesting mixed signals. While the histogram remains negative, the signal line hints at potential momentum building beneath the surface. "The technical setup suggests consolidation with a bullish bias," notes an analyst from BTCC. "Holding above the 20-day MA is crucial for maintaining upward momentum toward the $3.13 resistance level."

Source: BTCC

How Is Institutional Adoption Impacting XRP's Valuation?

In a landmark development, XRP's market capitalization has surpassed that of banking giant Citigroup, reaching $184.20 billion compared to Citigroup's $183.62 billion. This milestone marks the first time a cryptocurrency has overtaken a major Wall Street institution by market value, signaling a significant shift in the financial landscape.

Ripple's projections about asset tokenization add fundamental support to XRP's valuation. The company forecasts that 10% of global assets will migrate to blockchain rails by 2030, representing a $16 trillion custody market. Real-world adoption is already visible, with Société Générale issuing its EURCV stablecoin on the XRP Ledger through Ripple Custody, and South Korea's BDACS utilizing the same infrastructure for Ripple USD (RLUSD) management.

What Are the Key Resistance and Support Levels to Watch?

| Price Level | Significance | Probability |

|---|---|---|

| $3.13 | Bollinger Upper Band Resistance | High |

| $3.40 | Technical Target | Medium-High |

| $4.00 | Psychological Resistance | Medium |

| $2.70 | Bollinger Lower Band Support | Low |

How Has Trading Volume and Market Sentiment Evolved?

XRP's trading volume has seen explosive growth recently, surging 200% to reach a weekly high of $3.03 billion. Daily volume even breached the $5 billion threshold at one point, according to data from CoinMarketCap. This surge comes as September call options approach expiration, with strike prices set at $3, $3.50, and $4.

Market sentiment remains overwhelmingly positive despite a recent 9% price correction, which analysts view as healthy consolidation rather than a bearish reversal. The cryptocurrency briefly touched $3.186 before encountering resistance, and while institutional selling has caused some pullback, the overall technical structure remains intact.

What Are Analysts Predicting for XRP's Price Trajectory?

Price predictions for XRP vary widely, reflecting both Optimism and caution. Some analysts project conservative targets in the $3.40-$3.60 range based on current technical patterns, while more bullish scenarios suggest $4 could come into play if trading volume sustains its growth.

Extreme bullish cases speculate about prices reaching $50-$100 if institutional adoption accelerates significantly. However, these projections remain highly speculative and WOULD require fundamental changes in XRP's adoption curve. For now, the $3.40 target appears most grounded in current technicals and market conditions.

Frequently Asked Questions

What is the current XRP price as of September 2025?

As of September 15, 2025, XRP is trading at $2.9765, according to data from TradingView and BTCC exchange.

What are the key support levels for XRP?

The immediate support levels to watch are $2.9140 (20-day MA) and $2.70 (Bollinger lower band). A break below $2.65 would invalidate the current bullish scenario.

Can XRP reach $4 in 2025?

While $4 remains possible, it would require sustained bullish momentum and continued institutional adoption. The more immediate technical target is $3.40.

Why did XRP surpass Citigroup in market cap?

XRP's market capitalization reached $184.20 billion compared to Citigroup's $183.62 billion, reflecting growing institutional adoption and the cryptocurrency's role in global payments.

What's driving XRP's recent volume surge?

The 200% volume increase appears driven by approaching options expirations, institutional interest, and technical breakout patterns attracting traders.