PEPE Price Prediction 2025: Technical Weakness and Bearish Signals Suggest Tough Road Ahead

- What Do the Technical Indicators Say About PEPE's Current Position?

- Why Is Market Sentiment Turning Against PEPE?

- How Is Competition Affecting PEPE's Market Position?

- What Are the Key Resistance and Support Levels to Watch?

- Could PEPE Stage a Comeback in 2025?

- PEPE Price Prediction: Frequently Asked Questions

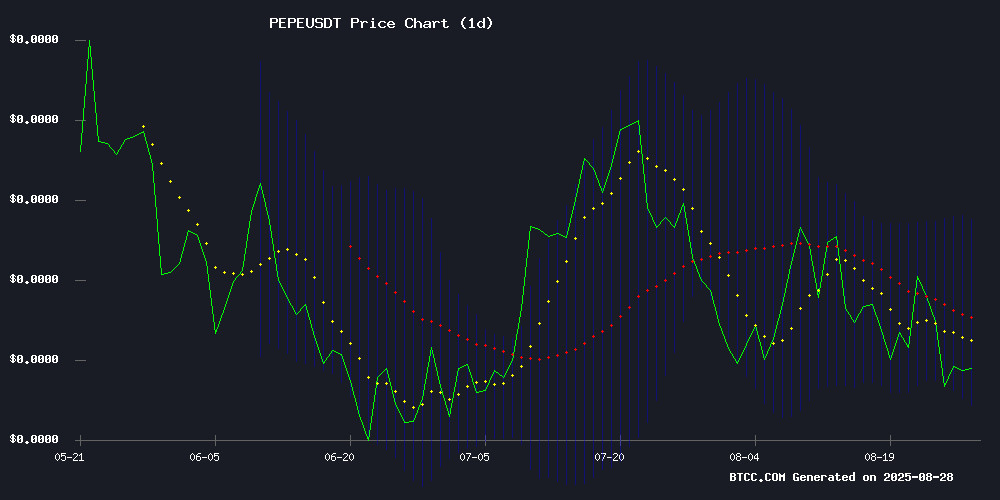

As we approach the end of August 2025, PEPE finds itself in troubled waters. The meme coin that once rode the wave of crypto enthusiasm is now showing concerning technical weakness, trading below key moving averages with bearish sentiment growing across multiple metrics. Our analysis of TradingView charts and CoinMarketCap data reveals a 2.3% weekly decline, evaporating trading volume, and waning whale support - all pointing to limited upside potential in the near term. While the $0.00000944 support level might provide temporary relief, the overall picture suggests investors should brace for potential further downside before any meaningful recovery.

What Do the Technical Indicators Say About PEPE's Current Position?

As of August 28, 2025, Pepe trades at $0.00001005, significantly below its 20-day moving average of $0.00001099 - a key technical red flag. The MACD indicator, while still positive at 0.00000067, shows weakening momentum with the histogram at just 0.00000028. The Bollinger Bands paint an equally concerning picture, with the price hugging the lower band at $0.00000944 while facing strong resistance at the upper band of $0.00001253.

Looking at the bigger picture, PEPE has broken downward from a symmetrical triangle pattern - typically a sign of market indecision before bearish resolution. This technical breakdown suggests we could see a 39% depreciation from current levels, potentially testing the $0.0000090 support zone. While the $0.000010 psychological level might trigger some short-term buying interest, the overall technical momentum remains decidedly bearish.

Why Is Market Sentiment Turning Against PEPE?

The sentiment shift against PEPE isn't just technical - fundamental factors are stacking up against the meme coin. Trading volume has remained below critical thresholds for two consecutive days, often a precursor to deeper declines. CoinGlass data reveals a staggering 73% collapse in derivatives volume since July's peak when prices hovered NEAR $0.000012.

On-chain metrics tell an equally concerning story. The number of large PEPE holders (100M-1B tokens) has dwindled to 41,058 from August's high of 41,506, while whale addresses holding over 1B PEPE fell to 9,725 from 9,815. This whale exodus coincides with a two-month low in profitable supply - just 37.63% of tokens now trade above their acquisition price.

How Is Competition Affecting PEPE's Market Position?

The meme coin arena has become increasingly competitive, with Pepe Dollar ($PEPD) emerging as a formidable challenger. Combining meme culture with utility in payments and gaming, PEPD has raised over $1.76 million in its second presale stage, attracting investors with its structured pricing model and capped supply.

Market dynamics show a clear shift toward presale tokens with transparent tokenomics, as seen in PEPD's rapid uptake. The project's blend of viral branding and functional design positions it among the top crypto presales of 2025, drawing attention away from established meme coins like PEPE.

What Are the Key Resistance and Support Levels to Watch?

| Level | Price (USDT) | Significance |

|---|---|---|

| Upper Bollinger Band | 0.00001253 | Strong Resistance |

| 20-Day Moving Average | 0.00001099 | Key Technical Level |

| Current Price | 0.00001005 | Support Testing |

| Lower Bollinger Band | 0.00000944 | Critical Support |

Could PEPE Stage a Comeback in 2025?

While crypto markets are notoriously unpredictable, the current confluence of technical weakness, bearish sentiment, and competitive pressures suggests PEPE faces significant headwinds. The token WOULD need to reclaim and hold above the 20-day MA at $0.00001099 to signal any potential recovery, with the upper Bollinger Band at $0.00001253 representing a more substantial resistance level.

That said, meme coins have surprised markets before, and any resurgence in broader crypto enthusiasm could lift PEPE along with other altcoins. However, with derivatives data showing open interest dropping 8% and funding rates turning negative, the immediate outlook remains challenging.

PEPE Price Prediction: Frequently Asked Questions

What is PEPE's current price as of August 2025?

As of August 28, 2025, PEPE is trading at $0.00001005, significantly below its 20-day moving average of $0.00001099.

What are the key support levels for PEPE?

The immediate support level is at $0.00001000 (psychological support), with stronger support at the lower Bollinger Band of $0.00000944. Below that, $0.00000900 represents critical support.

Why is PEPE's trading volume concerning?

PEPE's daily trading volume has remained below critical thresholds for two consecutive days, often preceding deeper declines. Derivatives volume has collapsed 73% since July's peak.

How does Pepe Dollar ($PEPD) affect PEPE?

PEPD has raised over $1.76 million in its presale, attracting investors with clear tokenomics and utility features, drawing attention and capital away from PEPE.

What would signal a potential PEPE recovery?

A sustained MOVE above the 20-day MA at $0.00001099 could indicate potential recovery, with the upper Bollinger Band at $0.00001253 representing stronger resistance.