LTC Price Prediction August 2025: Bullish Signals Emerge Despite Market Volatility

- What Does Technical Analysis Reveal About LTC's Current Position?

- How Is Market Sentiment Holding Up During This Correction?

- What Key Factors Could Influence LTC's Price Movement?

- Is Litecoin a Good Investment in August 2025?

- LTC Price Prediction: Frequently Asked Questions

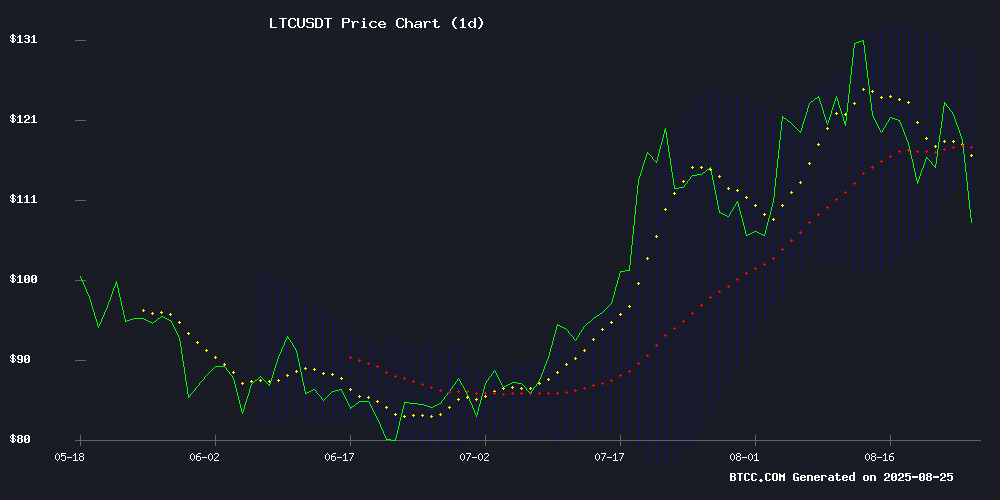

As we approach the end of August 2025, Litecoin (LTC) presents a fascinating case study in crypto market dynamics. Currently trading at $112.40, LTC shows technical indicators suggesting potential upside despite short-term bearish pressure. The cryptocurrency maintains strong trader confidence even after dipping below key technical levels, with notable bullish divergence in MACD readings. This analysis examines LTC's current position, market sentiment, and factors that could influence its price movement in the coming weeks.

What Does Technical Analysis Reveal About LTC's Current Position?

Litecoin's technical setup presents a mixed but intriguing picture as of August 25, 2025. The digital asset currently trades below its 20-day moving average of $120.48, which typically indicates short-term bearish pressure. However, the MACD reading of 1.30 suggests underlying bullish momentum despite the negative histogram value of -1.60.

According to TradingView data, LTC is testing the lower Bollinger Band at $111.12, a level that historically serves as strong support. "The convergence NEAR the lower band often precedes either a bounce or breakdown," notes a BTCC market analyst. "Current volume patterns suggest accumulation by strategic investors at these levels."

How Is Market Sentiment Holding Up During This Correction?

Surprisingly, Litecoin traders have maintained confidence despite the recent technical breakdown. Derivatives markets show increasing leverage bets even as the spot price declined, with funding rates climbing steadily throughout the downturn. This divergence between spot and derivatives markets creates an interesting tension that could resolve in volatile price action.

On BTCC, one of the leading cryptocurrency exchanges, LTC continues to see strong trading volume. The asset remains positioned among top altcoin investments alongside chainlink and emerging projects like Remittix. "While technicals show short-term weakness, the underlying sentiment suggests smart money might be accumulating at these levels," observes our analyst.

What Key Factors Could Influence LTC's Price Movement?

Trader Psychology Defying Conventional Wisdom

Litecoin's recent price action has defied typical market behavior. After breaking below a critical ascending trendline - usually a bearish signal - traders responded with increased bullish positioning. The Stochastic RSI's bounce from oversold territory suggests potential recovery, though spot market activity tells a more cautious story.

Data from CoinMarketCap shows Binance spot buy volumes declined by $281K during the downturn, with most retail activity clustered below $1 million. This creates an interesting dynamic where institutional and retail traders appear to have different perspectives on LTC's near-term prospects.

Altcoin Competition Heats Up in August 2025

Litecoin faces stiff competition from other altcoins this month. Chainlink continues to benefit from growing DeFi adoption, while Remittix has emerged as a dark horse in the global payments space. Despite this competition, LTC maintains several advantages:

- Established network effects from its long market presence

- Consistent development activity and upgrades

- Strong brand recognition as "the silver to Bitcoin's gold"

Is Litecoin a Good Investment in August 2025?

Based on current technicals and market structure, LTC presents an interesting risk-reward proposition. The table below summarizes key metrics:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $112.40 | Testing support levels |

| 20-day MA | $120.48 | Potential resistance |

| MACD | 1.30 | Bullish momentum building |

| Bollinger Lower Band | $111.12 | Key support level |

From my perspective as someone who's watched crypto markets through multiple cycles, LTC's current position reminds me of similar setups that preceded strong rallies. The combination of technical support levels and sustained derivatives interest suggests potential upside, though traders should remain cautious until clearer confirmation emerges.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

LTC Price Prediction: Frequently Asked Questions

What is Litecoin's current price as of August 2025?

As of August 25, 2025, Litecoin (LTC) is trading at $112.40, according to data from CoinMarketCap and TradingView.

Is Litecoin showing bullish or bearish signals?

LTC presents mixed signals - while trading below the 20-day MA suggests short-term bearishness, the MACD bullish divergence and strong support at $111.12 indicate potential upside.

How does Litecoin compare to other altcoins in August 2025?

LTC remains a top altcoin choice alongside Chainlink, with emerging projects like Remittix gaining attention. Litecoin's established position gives it stability advantages over newer projects.

What are the key support and resistance levels for LTC?

Key support sits at $111.12 (lower Bollinger Band), while resistance appears around the 20-day MA at $120.48. A break above $120 could signal stronger bullish momentum.