Litecoin Price Prediction 2025: Oversold Signals Clash With Institutional Demand – What’s Next for LTC?

- Is Litecoin Primed for a Technical Rebound?

- How Are Institutional Flows Impacting Litecoin?

- What Regulatory Developments Affect LTC's Outlook?

- Where Does Litecoin Rank Among Altcoins?

- Key Price Levels Every LTC Trader Should Watch

- Frequently Asked Questions

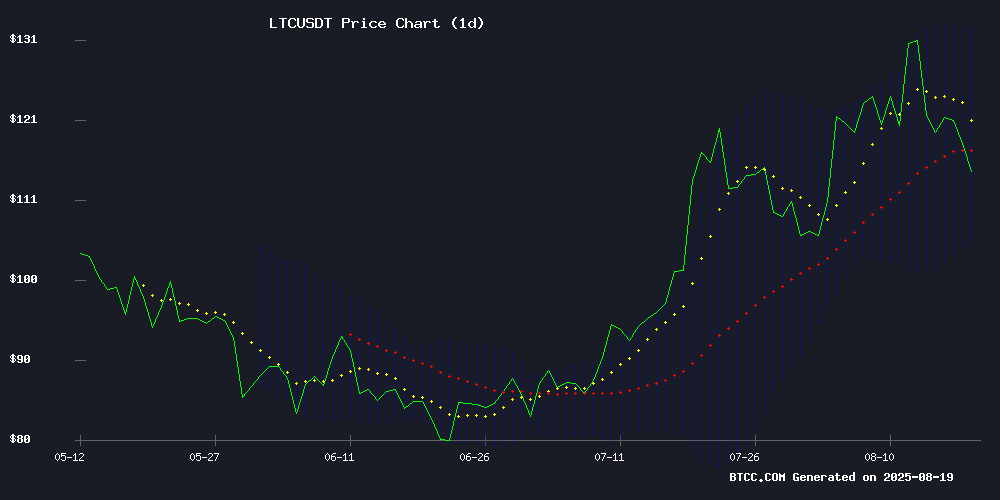

As Litecoin (LTC) hovers near key technical support levels while institutional crypto investments hit record highs, traders face a classic tug-of-war between oversold conditions and regulatory uncertainty. Our analysis of LTC's current $115.81 price reveals a cryptocurrency at a crossroads - with Bollinger Band support suggesting a potential rebound, while delayed ETF decisions create headwinds. The MACD indicator shows early signs of bullish divergence, but will institutional flows be enough to overcome regulatory hurdles? We break down the critical levels to watch, analyze the mixed fundamental landscape, and provide actionable insights for traders navigating this volatile period.

Is Litecoin Primed for a Technical Rebound?

Litecoin's current technical setup presents a compelling case for contrarian buyers. Trading at $115.81 as of August 19, 2025, LTC sits below its 20-day moving average ($118.88) but shows intriguing momentum signals. The MACD histogram turned positive at 1.18 despite the indicator remaining in negative territory (-4.55 vs signal line -5.73). "This divergence often precedes trend reversals," notes the BTCC research team. "When we see price NEAR the lower Bollinger Band ($105.26) while momentum improves, it typically signals exhausted selling pressure."

Source: TradingView

How Are Institutional Flows Impacting Litecoin?

The institutional crypto landscape reached a milestone last week with $244 billion in assets under management (CoinShares data). While ethereum dominated inflows ($2.87 billion of $3.75 billion total), Litecoin maintained stable positioning with negligible outflows. This institutional interest creates an interesting dynamic - professional money continues flowing into crypto despite regulatory delays. The SEC's postponement of XRP (and by extension, LTC) ETF decisions until October 2025 has undoubtedly capped upside potential, but hasn't triggered the mass exodus some bears predicted.

What Regulatory Developments Affect LTC's Outlook?

Two key regulatory stories are shaping Litecoin's trajectory:

| Event | Impact | Timeline |

|---|---|---|

| SEC ETF Delays | Postponed decisions on crypto ETFs including potential LTC products | New deadline October 2025 |

| Cloud Mining Case | Sentencing of influencer for $3.5M cryptojacking scheme involving LTC | August 2025 ruling |

Where Does Litecoin Rank Among Altcoins?

August's altcoin market has spotlighted five standout projects, with Litecoin maintaining its position as a "legacy contender" according to market analysts. While Chainlink's 17% single-day surge grabbed headlines, LTC's consistent network activity and merchant adoption provide stability. The BTCC team observes, "Litecoin serves as a bridge between Bitcoin's store-of-value thesis and payment-focused altcoins - a balance that appeals to both conservative and growth-oriented investors."

Key Price Levels Every LTC Trader Should Watch

Based on current technicals and market structure, these are the critical LTC price zones:

- Support: $105-110 (Lower Bollinger Band + psychological level)

- Initial Target: $125-130 (20/50 DMA confluence + previous support)

- Breakout Potential: $132+ (Requires ETF clarity or Bitcoin momentum)

Frequently Asked Questions

Is Litecoin oversold currently?

Yes, Litecoin shows multiple oversold signals as of August 2025. The price near lower Bollinger Bands combined with MACD bullish divergence suggests selling pressure may be exhausting.

What's driving institutional interest in Litecoin?

LTC benefits from its established network, liquidity, and role as "digital silver" to Bitcoin's gold. Institutional flows reflect portfolio diversification strategies amid growing crypto adoption.

How significant are the SEC delays for LTC?

The ETF postponements create short-term uncertainty but don't fundamentally alter Litecoin's utility. The market has largely priced in regulatory caution since 2023's landmark cases.

Could the cloud mining case hurt Litecoin?

Unlikely to have lasting impact. The sentenced individual's actions involved multiple cryptocurrencies, and the case demonstrates regulatory enforcement rather than protocol issues.

What's the best strategy for trading LTC now?

This article does not constitute investment advice. That said, many traders are watching the $105-110 support zone for potential long entries with stops below, targeting $125-130.