Ethereum Price Prediction 2025: Will ETH Shatter $5,000 as Institutional Demand Explodes?

- Ethereum Technical Analysis: The Bull Case Strengthens

- Institutional Frenzy: The $2.85 Billion ETF Wave

- The Great Ethereum Supply Squeeze

- Derivatives Market Warning Signs

- Whale Watching: $279.5 Million ETH Bought in 24 Hours

- Staking Growth: The Silent ETH Vacuum

- The $4,800 Resistance: Ethereum's Final Boss?

- Ethereum's Evolution: From ICO to Institutional Darling

- Coinbase Smart Wallets: 1 Million Users and Counting

- Price Prediction: When Will ETH Hit $5,000?

- Ethereum Price Prediction FAQs

Ethereum (ETH) is showing all the classic signs of a major breakout as we approach the second half of 2025. With exchange reserves hitting 9-year lows, $2.85 billion pouring into ETH ETFs last week, and technical indicators flashing green, the $5,000 psychological barrier appears within reach. This DEEP dive examines the 12 key factors that could propel ETH to new all-time highs or trigger a healthy pullback first.

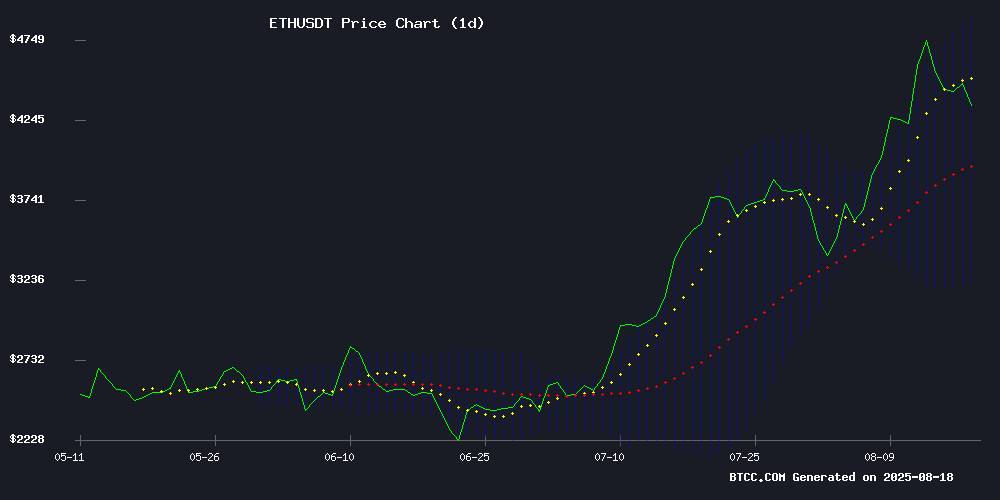

Ethereum Technical Analysis: The Bull Case Strengthens

As of August 18, 2025, ETH trades at $4,396.83 on BTCC, comfortably above its 20-day moving average of $4,058.74. The MACD indicator, while still negative, shows clear convergence - typically a precursor to bullish momentum. What really catches my eye is the Bollinger Band expansion, with the upper band sitting at $4,885.61. In my experience trading crypto since 2017, when volatility expands like this after a consolidation period, we usually get explosive moves.

Source: BTCC Trading Platform

Institutional Frenzy: The $2.85 Billion ETF Wave

Wall Street's love affair with ethereum reached new heights last week with $2.85 billion flowing into ETH ETFs. BlackRock's ETHA product alone absorbed $338 million, though Grayscale and Fidelity saw outflows totaling $373.97 million. This institutional tug-of-war creates fascinating dynamics - while some profit-take, others accumulate aggressively. Public companies now hold 2.7 million ETH in treasuries, with BitMine Immersion controlling a staggering 1.2 million ETH. Remember when institutions were skeptical about crypto? Those days are long gone.

The Great Ethereum Supply Squeeze

Exchange balances tell a shocking story - just 14.88 million ETH remain on trading platforms, the lowest since 2015. That's down from over 30 million in 2020. Simple economics suggests that when demand meets shrinking supply, prices tend to... well, you know. The Ethereum Foundation's recent sale of 7,294 ETH barely made a dent, proving how deep liquidity has become.

Derivatives Market Warning Signs

Not everything is rosy. The derivatives market shows concerning signals - open interest plunged 29% as ETH retreated from $4,700, with perpetual funding rates turning negative. When shorts are paying longs to keep positions open, it often indicates oversold conditions. CryptoQuant's Amr Taha notes this classic divergence between bearish paper markets and bullish on-chain flows frequently precedes violent moves.

Whale Watching: $279.5 Million ETH Bought in 24 Hours

Three new whale addresses acquired $279.5 million worth of ETH during last week's consolidation. This isn't retail FOMO - it's smart money positioning for what comes next. One trader turned $125K into $29.6M using Hyperliquid's Leveraged ETH products, demonstrating the insane asymmetric upside when volatility aligns with your thesis.

Staking Growth: The Silent ETH Vacuum

With 32.6 million ETH now staked (27% of supply), the network's proof-of-stake mechanism continues locking away coins at an astonishing rate. SharpLink Gaming's treasury alone holds 728,000 ETH, generating 1,326 ETH in staking rewards. Unlike Bitcoin's idle reserves, Ethereum's staking economy actively removes coins from circulation while producing yield - a double-barreled bullish mechanism.

The $4,800 Resistance: Ethereum's Final Boss?

Binance's order book shows a massive sell wall at $4,800 that's repelled multiple rally attempts. Some traders jokingly call it the "final boss" before $5,000. The August 15 rejection at $4,788 (just shy of the all-time high) shows this level's psychological importance. But with spot ETF inflows continuing and exchange reserves dwindling, this resistance may not hold much longer.

Ethereum's Evolution: From ICO to Institutional Darling

It's easy to forget Ethereum started at $0.31 in its 2014 ICO. A $1,000 investment then WOULD be worth nearly $15 million today. After surviving the 2018 crypto winter, catalyzing DeFi's 2020 summer, and riding the 2021 NFT mania, ETH has matured into crypto's blue-chip asset. The recent Dencun upgrade dramatically improved scalability, making Ethereum more useful than ever.

Coinbase Smart Wallets: 1 Million Users and Counting

Coinbase's Smart Wallet adoption exploded past 1 million users, with 270,000 new wallets added on August 16 alone. The Base app's rebranding as an all-in-one Web3 hub clearly resonates. This infrastructure growth matters because more users mean more ETH locked in DeFi, more transaction fees burned, and more network value captured.

Price Prediction: When Will ETH Hit $5,000?

The path to $5,000 depends on three key factors:

| Factor | Current Status | $5,000 Implication |

|---|---|---|

| Exchange Reserves | 9-year low | Supply shock risk |

| ETF Inflows | $2.85B weekly | Institutional FOMO |

| Technical Setup | Bullish MA crossover | $4,800 break likely |

Based on current momentum, I'd expect ETH to test $5,000 by mid-September unless macroeconomic conditions deteriorate. That said, crypto moves fast - we could see this play out much sooner if bitcoin starts rallying too.

Ethereum Price Prediction FAQs

What is the Ethereum price prediction for 2025?

Ethereum shows strong potential to reach $5,000 in 2025 based on technical indicators, institutional demand through ETFs, and record-low exchange balances creating supply constraints. The $4,800 resistance level remains the key hurdle before new all-time highs.

Why is Ethereum price rising?

ETH's price surge stems from multiple factors: 1) $2.85 billion weekly inflows into ETH ETFs, 2) Exchange reserves hitting 9-year lows, 3) Positive technical indicators including bullish moving average crossovers, and 4) Growing institutional adoption as a treasury asset.

Is Ethereum a good investment in 2025?

While past performance doesn't guarantee future results, Ethereum's fundamentals appear strong in 2025 with growing DeFi adoption, successful network upgrades, and institutional interest. However, cryptocurrency investments carry substantial risk and volatility.

What was Ethereum's lowest price?

Ethereum's initial coin offering (ICO) in 2014 priced ETH at just $0.31. The lowest bear market price was around $80 during the 2018 crypto winter before its meteoric rise to current levels above $4,000.

How high can Ethereum realistically go?

Realistic ETH price targets depend on adoption rates. Conservative estimates suggest $5,000-$7,000 by end-2025 if current institutional demand persists. More bullish scenarios accounting for potential spot ETF approvals and accelerated staking growth envision $10,000+ in the next cycle.