Bitcoin Price Forecast 2025: Why $200K BTC is Within Reach as Fundamentals Strengthen

- What's Driving Bitcoin's Current Price Action?

- Institutional Adoption Reaches Fever Pitch

- Mining Industry Gets Macro Boost

- Quantum Computing FUD Put to Rest

- Profit-Taking Patterns Reveal Market Maturity

- Technical Outlook: Road to $200K?

- Frequently Asked Questions

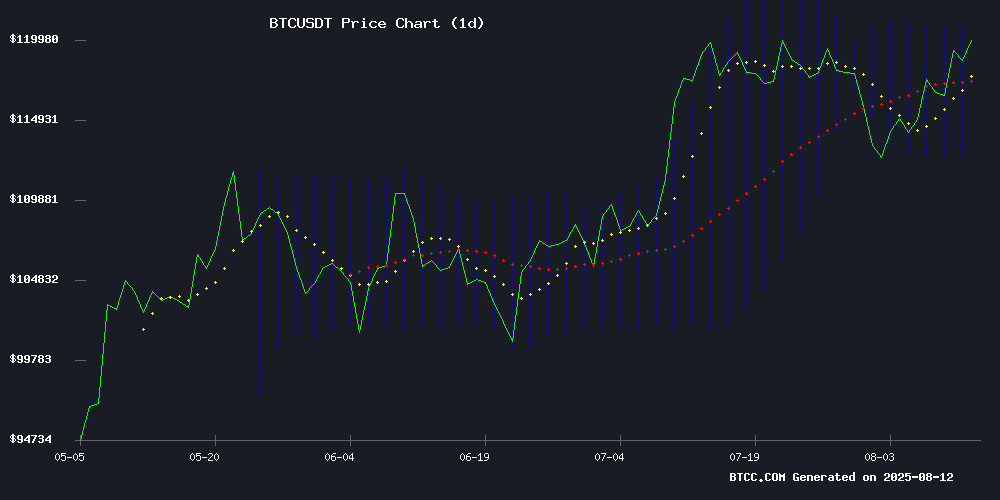

As bitcoin flirts with all-time highs in August 2025, a perfect storm of technical strength, institutional adoption, and favorable macro conditions suggests the path to $200,000 may be clearer than ever. The BTCC research team analyzes seven critical factors driving this bullish outlook, from Michael Saylor's latest $18M purchase to quantum computing security assurances that are calming investor nerves. With BTC currently trading at $118,809 and showing no signs of slowing down, we break down exactly why this rally could have staying power.

What's Driving Bitcoin's Current Price Action?

Bitcoin's price action in early August 2025 reflects a market consolidating after explosive gains, with the cryptocurrency finding strong support above $115,000. The BTCC technical analysis team notes several bullish indicators:

Source: BTCC TradingView

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $118,809.95 | Above key moving averages |

| 20-day MA | $116,726.87 | Bullish crossover pattern |

| MACD Histogram | +124.27 | Positive momentum building |

Institutional Adoption Reaches Fever Pitch

The institutional floodgates have well and truly opened in 2025. BlackRock's IBIT Bitcoin ETF now holds a staggering $80 billion in BTC - putting it within spitting distance of the largest gold ETF. Meanwhile, Michael Saylor's corporate vehicle just added another 155 BTC ($18M worth) to its treasury, bringing its total holdings to 628,946 BTC - about 3.16% of all Bitcoin that will ever exist.

Trump Media's amended Bitcoin ETF filing with Crypto.com as custodian shows even political figures want in on the action. Though honestly, I'm skeptical about how competitive another ETF can be in this crowded market - Bloomberg's Eric Balchunas makes a good point about their late entry lacking differentiation.

Mining Industry Gets Macro Boost

The US extension of China tariff suspensions came at the perfect time for miners preparing for the next halving. Keeping ASIC import tariffs at 10% instead of the threatened 145% gives breathing room as operations scale up. MARA Holdings' €148 million MOVE into AI infrastructure through its Exaion acquisition shows miners diversifying revenue streams - smart hedge if you ask me.

Quantum Computing FUD Put to Rest

Google veteran GC Cooke's takedown of quantum computing fears was one of the more satisfying reads this month. His math showing it WOULD take 10^40 years to crack a Bitcoin seed phrase even with absurd computing power should finally put this narrative to bed. Microsoft's fancy "knots in rubber band" quantum physics won't save them from Bitcoin's cryptographic fundamentals.

Profit-Taking Patterns Reveal Market Maturity

Glassnode's latest on-chain data shows an interesting shift - it's now the previous cycle's buyers (155+ day holders) driving most profit-taking. This contrasts sharply with 2021 patterns and suggests we're seeing more sophisticated, long-term oriented market participants. The BTCC research team views this as a healthy development, though it does create some resistance around all-time highs.

Technical Outlook: Road to $200K?

Looking at the charts, BTC has established $115,500 as strong support after testing it multiple times in July. The current consolidation between $118,000-$122,000 looks like a classic bull market pause. A decisive break above $121,250 could trigger algorithmic buying and retail FOMO that propels us toward $150,000 - and potentially $200,000 if institutional inflows maintain their current pace.

That said, nothing moves in a straight line. The WHITE House's pro-crypto pivot could unlock $9 trillion in retirement assets, but regulatory clarity remains a work in progress. And while the technicals look strong, we've seen before how quickly crypto markets can turn.

Frequently Asked Questions

What is Bitcoin's current price and key technical levels?

As of August 12, 2025, Bitcoin trades at $118,809.95 with immediate resistance at $119,250 and stronger resistance at $120,500. Support holds at $118,000 and $115,500.

How much Bitcoin does Michael Saylor's company hold?

628,946 BTC worth approximately $76.5 billion at current prices, representing about 3.16% of Bitcoin's total supply.

Are quantum computers a threat to Bitcoin's security?

Not according to detailed analysis by Google veteran GC Cooke, who demonstrated the mathematical impossibility of quantum computers cracking Bitcoin's cryptography with current or foreseeable technology.

What's driving institutional Bitcoin adoption in 2025?

Three main factors: 1) Spot Bitcoin ETF approvals, 2) Corporate treasury strategies, and 3) Regulatory clarity from the WHITE House potentially allowing retirement fund exposure.

When could Bitcoin reach $200,000?

While timing predictions are speculative, the convergence of technical, institutional, and macro factors suggests $200K could be achievable in this market cycle if current trends continue.