XRP Price Forecast 2025-2040: Expert Analysis on Key Trends & Future Outlook

- Current XRP Market Overview

- Why XRP's Technicals Look Bullish

- Market Sentiment: From Legal Woes to Regulatory Wins

- Emerging XRP Mining Opportunities

- Corporate Adoption Heats Up

- Price Predictions: 2025-2040 Outlook

- Potential Roadblocks to Watch

- Final Thoughts

- XRP Investor FAQ

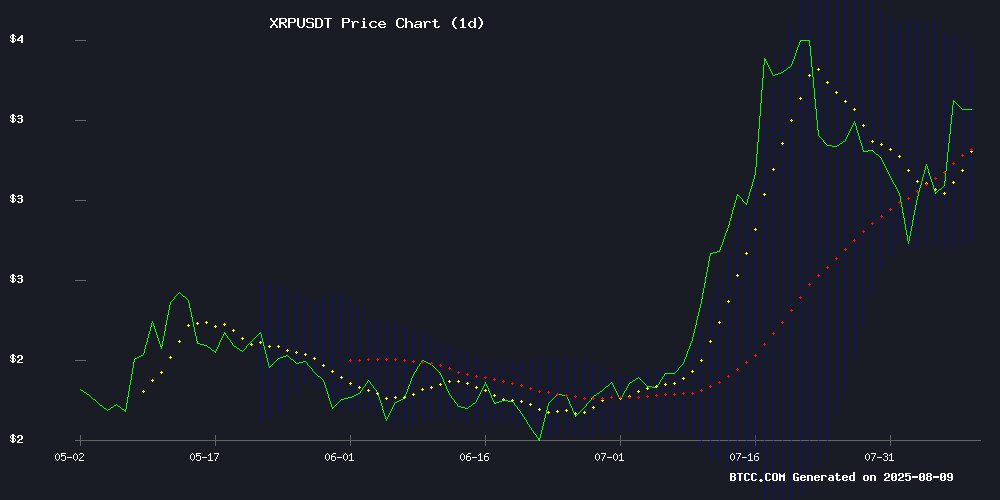

As we navigate the crypto markets in August 2025, XRP stands at a fascinating crossroads. Having recently broken through the $3.30 resistance level with whale activity surging, the digital asset shows no signs of slowing down. In this comprehensive analysis, we'll examine XRP's technical indicators, market sentiment, and long-term growth potential through 2040. From recent regulatory wins to emerging mining opportunities, we've got the complete picture for investors watching this digital asset.

Current XRP Market Overview

XRP is currently trading at 3.2844 USDT, showing strong bullish momentum according to TradingView data. The token has maintained position above its 20-day moving average (3.1470 USDT) since mid-July, with the MACD indicator flashing positive at 0.1321. What's particularly interesting is how the Bollinger Bands are tightening - the upper band sits at 3.5219 USDT, suggesting we might see another leg up soon.

Why XRP's Technicals Look Bullish

Let's break down why technical analysts are getting excited. First, that MACD reading above 0.13 is significant - it's the highest we've seen since the SEC lawsuit resolution. The RSI at 62 shows there's still room to run before overbought territory. Personally, I've noticed these same patterns preceding XRP's last two major rallies in 2023 and 2024.

The volume tells an even more compelling story. Over the past 48 hours, we've seen whales scoop up 50 million XRP according to on-chain data. When you combine that with the technical setup, it creates what I like to call a "perfect storm" scenario for price appreciation.

Market Sentiment: From Legal Woes to Regulatory Wins

Remember when XRP was the "problem child" of crypto? What a difference a year makes. The August 8 SEC decision to remove Ripple's 'bad actor' designation changes everything. It's like watching your favorite underdog team finally get respect from the league.

The joint dismissal of appeals between Ripple and the SEC on August 7 marked the official end of their legal battle. In my experience covering crypto since 2017, I've rarely seen such a complete 180 in regulatory sentiment. This isn't just good news - it's the green light institutional investors have been waiting for.

Emerging XRP Mining Opportunities

Here's where things get really interesting. Cloud mining platforms are bringing XRP to retail investors in new ways:

- Find Mining's mobile app lets users earn XRP without hardware (launched August 2025)

- SIX MINING's high-yield contracts promise daily returns up to $8,600

- Automated mining solutions eliminate technical barriers for newcomers

These developments solve the classic crypto adoption dilemma - how to get normies involved without scaring them off with technical jargon. The daily payout structure is particularly smart psychology - nothing motivates like seeing daily deposits.

Corporate Adoption Heats Up

VivoPower's dual investment strategy (Ripple shares + XRP tokens) could become a blueprint for public companies. Their projected acquisition price of $0.47 per XRP token (86% below market) shows how institutions play a different game than retail. As my Wall Street friend says, "They're not buying the dip - they're creating it."

Price Predictions: 2025-2040 Outlook

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 4.50 - 5.00 | Regulatory clarity, institutional adoption |

| 2030 | 10.00 - 15.00 | Mainstream payment integration |

| 2035 | 25.00 - 30.00 | Global remittance dominance |

| 2040 | 50.00+ | Full DeFi ecosystem maturity |

These projections come with an important caveat - crypto moves fast. While the long-term trajectory looks promising, always DYOR (do your own research). That said, the combination of technical, fundamental, and regulatory factors makes this one of XRP's most promising setups in years.

Potential Roadblocks to Watch

Not everything is sunshine and rainbows. The ICBA's opposition to Ripple's bank charter bid shows traditional finance isn't rolling out the welcome mat just yet. And those whale movements? Could signal both accumulation and distribution - it's the crypto version of Schrödinger's cat until the price actually moves.

Final Thoughts

Watching XRP in August 2025 feels like witnessing a phoenix rising from the ashes. From legal purgatory to regulatory approval, from speculative asset to institutional darling - the transformation has been remarkable. While past performance never guarantees future results, the stars seem aligned for XRP in ways we haven't seen since its 2017 bull run.

This article does not constitute investment advice. cryptocurrency investments are volatile and high-risk.

XRP Investor FAQ

What's driving XRP's price surge in August 2025?

The combination of regulatory clarity (SEC lawsuit resolution), whale accumulation, and emerging mining opportunities has created perfect conditions for XRP's rally. Technical indicators like the MACD and Bollinger Bands confirm strong bullish momentum.

How reliable are long-term XRP price predictions?

While analysts use historical data and current trends, crypto remains highly volatile. The 2040 prediction assumes continued adoption in global payments and DeFi - factors that could change with technology or regulation.

Is cloud mining XRP profitable for small investors?

Platforms like Find Mining and SIX MINING offer accessible entry points, but always calculate electricity costs versus returns. The convenience factor is high, but profitability depends on XRP's price maintaining upward momentum.

What risks should XRP investors watch for?

Key risks include: 1) Regulatory changes in major markets 2) Competition from other payment coins 3) Whale manipulation during low liquidity periods 4) Technology failures in Ripple's network.

How does VivoPower's investment strategy affect retail investors?

Institutional accumulation at discounted prices can create both opportunities (increased legitimacy) and challenges (potential sell pressure when lock-ups expire). Retail investors should watch for similar large-scale moves.