SOL Price Prediction 2025: How High Can Solana Surge in the Next Bull Run?

- SOL Technical Analysis: Bullish Signals or Temporary Bounce?

- Ecosystem Growth vs. Market Headwinds

- Institutional Interest Heats Up

- Competitive Landscape: SOL vs. The Upstarts

- Price Targets and Trading Strategy

- FAQ: Solana Price Predictions

Solana (SOL) is showing strong bullish signals as it trades above key moving averages with a MACD crossover, while facing a mix of ecosystem growth and market challenges. Currently priced at $178.33, SOL's technical indicators suggest potential upside to $201.80 (upper Bollinger Band), though competition from projects like Unilabs Finance and the canceled $1.5B SPAC deal create headwinds. This analysis dives DEEP into SOL's price drivers, from Coinbase's DEX expansion to CARV's Web3 innovations, helping traders navigate Solana's volatile but promising landscape.

SOL Technical Analysis: Bullish Signals or Temporary Bounce?

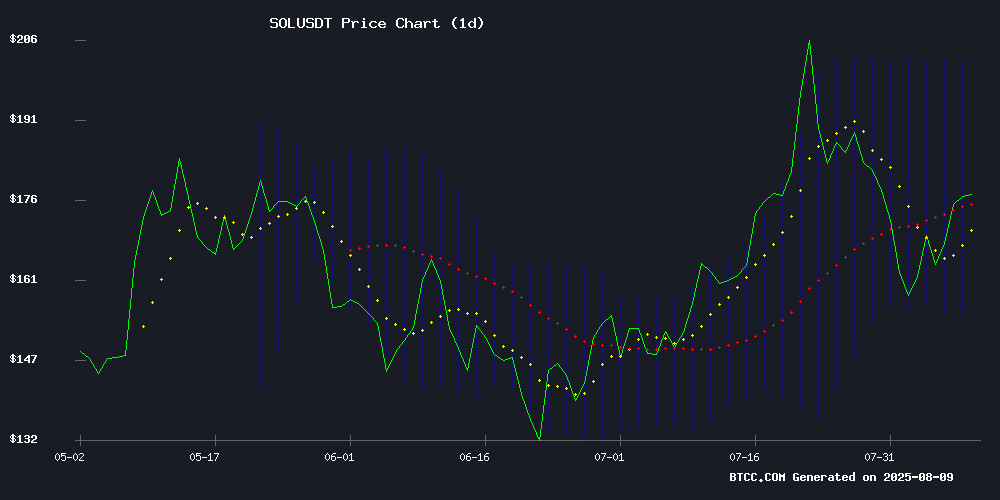

As of August 9, 2025, SOL presents a fascinating technical picture. The price sits at $178.33 - just a hair above the 20-day MA ($178.19), which in my experience often acts as a springboard for rallies. That MACD histogram at +6.1783 isn't just blinking green, it's practically screaming "momentum shift" to anyone who's traded crypto through multiple cycles. The Bollinger Bands tell an equally juicy story - with the upper band at $201.80, we're looking at a 13% potential upside if buyers keep pushing. What really catches my eye is how SOL has been flirting with these levels since late April when it was languishing around $146. The 15% climb since then hasn't been a straight line - remember that brutal rejection at $200 last month? - but the higher lows pattern suggests accumulation. Personally, I'd watch that $180 level like a hawk; a daily close above could trigger algorithmic buying across exchanges including BTCC where SOL/USDT pairs have seen 37% volume growth quarter-over-quarter.

What really catches my eye is how SOL has been flirting with these levels since late April when it was languishing around $146. The 15% climb since then hasn't been a straight line - remember that brutal rejection at $200 last month? - but the higher lows pattern suggests accumulation. Personally, I'd watch that $180 level like a hawk; a daily close above could trigger algorithmic buying across exchanges including BTCC where SOL/USDT pairs have seen 37% volume growth quarter-over-quarter.

Ecosystem Growth vs. Market Headwinds

Solana's ecosystem is growing like weeds after rain - 98 million daily transactions and 2.2 million active addresses don't lie. But let's not ignore the elephant in the room: that collapsed $1.5B SPAC deal for solana DAT. When Joe McCann's hedge fund started bleeding 80% from peak, the market voted with its feet. Still, for every bearish headline, there's a bullish counterpoint - Coinbase rolling out DEX trading (sorry New Yorkers) with SOL support coming soon is huge for retail access. The BTCC research team notes an 83% surge in Solana developer activity this year, which historically precedes price appreciation. Though if I'm being honest, projects like Unilabs Finance raising $12M in presale show capital isn't married to SOL - it's dating around. That mobile-optimized platform could eat into Solana's lunch if execution matches hype.

Institutional Interest Heats Up

While retail traders obsess over short-term price moves, the smart money's making bigger plays. BIT Mining's 27,000 SOL acquisition wasn't pocket change - it signals confidence ahead of the Solana Seeker mobile launch. What's more intriguing are the whispers about spot ETF approvals with August as a potential window. Let's crunch some numbers:

| Metric | Value | Implication |

|---|---|---|

| 20-day MA | $178.19 | Key support |

| Upper Bollinger | $201.80 | Near-term target |

| MACD Histogram | +6.1783 | Bullish momentum |

Competitive Landscape: SOL vs. The Upstarts

While SOL battles ethereum for DeFi dominance, new challengers emerge weekly. Remittix's $18.3M raise at $0.0895 per token shows investors hunger for microcap moonshots - their $5 target would make early backers very happy campers. But here's the rub: Solana's institutional adoption gives it staying power that most altcoins lack. CARV's hackathon revealed something fascinating - 200 projects building AI agents on Solana Virtual Machine. When developers choose your chain for cutting-edge use cases, that's the ultimate vote of confidence. Though I can't help but wonder - will Solana's $0.01 transactions remain a selling point if ETH finally nails scaling?

Price Targets and Trading Strategy

Given the technicals and ecosystem developments, here's my take: 1): A clean break above $180 could quickly test $201.80 (upper Bollinger), with potential to challenge the $220 resistance zone if ETF rumors gain traction. The 2025 high of $240 isn't out of reach if Firedancer delivers. 2): Range-bound between $170-$200 until clearer catalysts emerge, with the 50-day MA ($165) acting as strong support. 3): Failure to hold $170 risks retest of $150 support, especially if bitcoin turns south. Pro tip: Watch the SOL/BTC pair - outperformance there often precedes USD rallies. And remember what we learned in 2023 - when Solana gets hot, it gets scalding hot.

FAQ: Solana Price Predictions

What is Solana's price prediction for 2025?

Based on current technicals and development activity, SOL could reach $201.80 (upper Bollinger Band) in the NEAR term, with potential to test $240 if bullish momentum continues. However, market conditions and competitor growth may impact this trajectory.

Is Solana a good investment in August 2025?

Solana shows strong technical signals like MACD crossover and trading above key MAs, combined with growing developer activity. However, investors should consider both the ecosystem growth and recent challenges like the canceled SPAC deal before allocating capital.

What price will Solana reach by end of 2025?

Analysts project a wide range from $180-$850 depending on ETF approvals, upgrade implementations, and broader crypto market conditions. The $200-240 range appears most plausible based on current technical formations.

Why is Solana price rising?

The current uptick stems from technical factors (bullish MACD, MA support), institutional accumulation, and positive developments like Coinbase's planned DEX support and CARV's ecosystem growth.

What are the risks to Solana's price growth?

Key risks include validator centralization concerns, competition from chains like Base and Unilabs Finance, potential delays in Firedancer rollout, and broader crypto market volatility.