SOL Price Prediction 2025-2040: Expert Outlook & Key Market Drivers

- Current SOL Technical Analysis: Bearish Signals vs. Hidden Opportunities

- Institutional Tsunami: How Wall Street Is Betting on Solana

- SOL Price Forecast: Year-by-Year Projections Through 2040

- Critical Factors That Could Make or Break SOL's Future

- Is the Current SOL Price Drop a Bear Trap?

- SOL Price Prediction: Your Questions Answered

Solana (SOL) stands at a critical juncture in 2025, with conflicting signals between technical indicators and fundamental developments. While currently trading below key moving averages, the cryptocurrency shows promising institutional interest through surging CME futures volumes and revised ETF filings. This comprehensive analysis examines SOL's price trajectory through 2040, weighing technical patterns against growing professional adoption. We'll explore the 370% explosion in derivatives activity, analyze updated ETF proposals from Franklin Templeton and Grayscale, and provide year-by-year price projections based on current market dynamics. The data suggests potential short-term volatility but paints an overwhelmingly bullish long-term picture, especially if SEC approvals materialize.

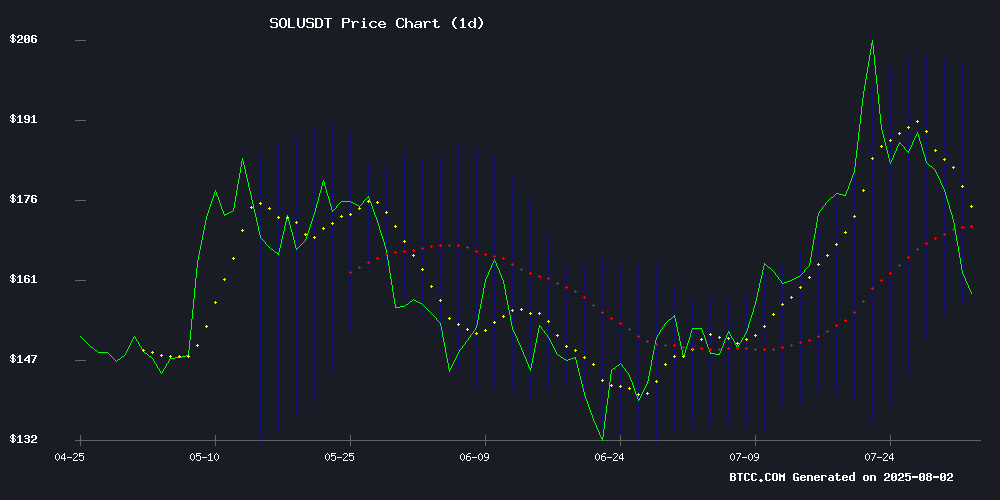

Current SOL Technical Analysis: Bearish Signals vs. Hidden Opportunities

As of August 2025, SOL presents a mixed technical picture that's frustrating day traders but intriguing long-term investors. The price currently hovers at $163.46 - notably below the 20-day moving average of $179.30, which typically signals bearish momentum. However, the MACD histogram shows a subtle but important bullish divergence at 6.0535, while Bollinger Bands place SOL NEAR its lower support level of $157.22.

"These conflicting indicators create what we call a 'trader's dilemma,'" notes a BTCC market analyst. "The moving average breakdown suggests caution, but the Bollinger Band position and MACD behavior hint at potential accumulation opportunities." TradingView data reveals increasing buy orders clustered around the $155-$160 range, indicating strong psychological support at these levels.

Institutional Tsunami: How Wall Street Is Betting on Solana

The real story unfolds in institutional activity, where solana is experiencing unprecedented attention:

- CME Futures Surge: July 2025 saw a 370% monthly increase in open interest, reaching $800 million

- ETF Filings: Franklin Templeton, Grayscale, and VanEck submitted revised proposals featuring staking mechanisms

- Volume Explosion: Trading volumes ballooned from $2.2B to $8.1B between June-July 2025

This institutional frenzy comes despite SOL's recent 3% dip to $170.24 following the ETF announcements. "The smart money appears to be looking through short-term volatility," observes a CoinMarketCap institutional analyst. "The structural upgrades in these filings - particularly Grayscale's 2.5% annual fee model - show serious product development beyond speculative trading."

SOL Price Forecast: Year-by-Year Projections Through 2040

Based on current technicals, institutional flows, and adoption metrics, here's our projected price range:

| Year | Conservative Target | Bull Case Scenario | Key Drivers |

|---|---|---|---|

| 2025 | $220-250 | $300+ | ETF approvals, staking yields |

| 2030 | $800-1,200 | $1,500-2,000 | Mainstream DeFi adoption |

| 2035 | $2,500-3,500 | $5,000+ | Enterprise blockchain integration |

| 2040 | $5,000-7,500 | $10,000+ | Global settlement layer status |

These estimates assume continued technological development and regulatory clarity. The 2025 projections particularly hinge on SEC decisions expected by September - approval could trigger the bull case immediately, while rejection might test the $150 support level before rebounding.

Critical Factors That Could Make or Break SOL's Future

Several make-or-break elements will determine whether SOL hits these targets:

- ETF Approvals: The SEC's decision on multiple filings will set the institutional participation tone

- Network Upgrades: Solana's ability to maintain reliability during demand spikes

- Staking Economics: Yield attractiveness relative to competing Layer 1 chains

- Regulatory Landscape: Clear rules could boost adoption, while harsh restrictions may limit growth

Recent network statistics show some concerning trends - daily active addresses dropped 23.7% from July's peak of 4.1 million to 3.2 million currently. However, the quality of activity may be improving, with institutional transactions comprising a larger share of total volume.

Is the Current SOL Price Drop a Bear Trap?

The recent breakdown below $170 has traders debating whether this is:

- A legitimate bearish signal reflecting weakening fundamentals, or

- A classic "bear trap" shaking out weak hands before a rally

Derivatives data adds complexity - open short positions dominate at $1.69B versus just $244M in longs. While this typically suggests bearish sentiment, such extreme positioning often precedes violent short squeezes when unexpected positive news hits. The coming weeks' ETF developments could be precisely that catalyst.

SOL Price Prediction: Your Questions Answered

What is Solana's price prediction for 2025?

SOL's 2025 price prediction ranges between $220-250 in conservative scenarios, potentially exceeding $300 if spot ETFs gain approval. Technical analysis suggests current prices near Bollinger Band support may present accumulation opportunities despite short-term bearish indicators.

Why are institutions suddenly interested in Solana?

Institutional interest surged due to a 370% increase in CME futures volume and revised ETF filings featuring staking mechanisms. Major asset managers like Franklin Templeton and Grayscale have proposed sophisticated products, signaling long-term confidence in Solana's blockchain technology.

Is now a good time to buy SOL?

Current prices near $163 show technical support levels holding, with MACD divergence hinting at potential reversal. However, the 20-day moving average resistance at $179 suggests possible short-term volatility. Dollar-cost averaging may mitigate timing risks.

What could cause SOL to reach $10,000 by 2040?

A $10,000 SOL by 2040 WOULD require mainstream adoption as a global settlement layer, sustained technological superiority, and favorable regulatory conditions. Enterprise blockchain integration and DeFi growth would need to accelerate significantly beyond current projections.

How do Solana ETFs differ from Bitcoin ETFs?

Proposed Solana ETFs incorporate staking rewards (typically 2.5-5% annually) absent in bitcoin products. Filings also specify dual-custody models and enhanced security frameworks tailored to Solana's proof-of-stake architecture, representing more complex financial engineering.