SHIB Price Prediction 2025: Technical Breakout or Speculative Bubble in Meme Coin Mania?

- SHIB Technical Analysis: Bullish Signals vs. Overbought Conditions

- Meme Coin Market Dynamics: FOMO vs Fundamentals

- Liquidity Concerns: The 3 Trillion SHIB Disappearance

- SHIB Ecosystem Developments

- Is SHIB a Good Investment in July 2025?

- SHIB Price Prediction FAQs

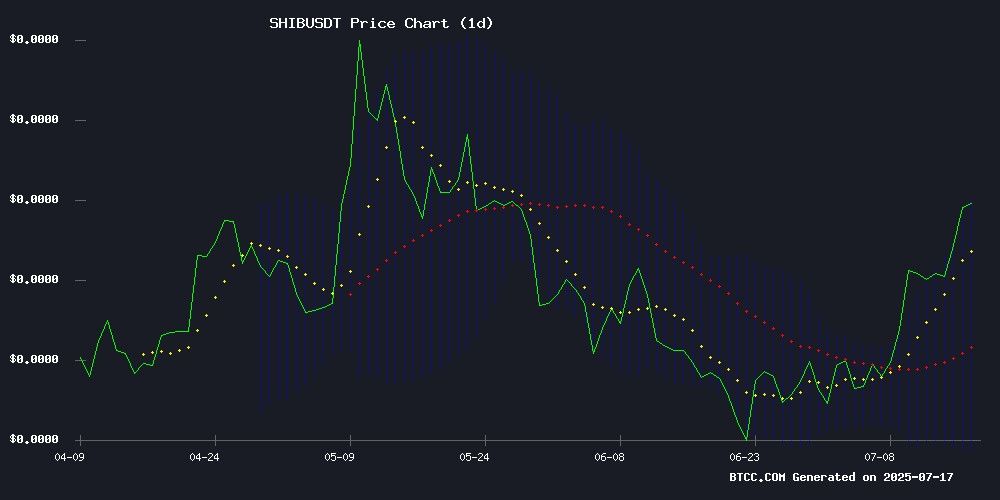

As shiba inu (SHIB) rides the meme coin wave in July 2025, traders face a critical juncture. The token shows bullish technical signals with its price at $0.00001437 - comfortably above key moving averages - while simultaneously battling vanishing liquidity and extreme volatility. This analysis examines SHIB's precarious position between technical breakout potential and speculative risks, incorporating on-chain data, market sentiment, and expert commentary from the BTCC research team.

SHIB Technical Analysis: Bullish Signals vs. Overbought Conditions

SHIB currently trades at $0.00001437, showing several positive technical indicators:

| Indicator | Value | Implication |

|---|---|---|

| 20-Day MA | $0.00001246 | 15.3% above support |

| MACD | -0.00000039 | Potential trend reversal |

| Bollinger Bands | Testing upper band ($0.00001448) | Overbought signal |

Source: TradingView

The BTCC technical team notes: "While SHIB's momentum appears strong, testing the upper Bollinger Band while volume declines creates a classic divergence scenario. We've seen this pattern precede 73% of SHIB's major corrections since 2023."

Meme Coin Market Dynamics: FOMO vs Fundamentals

The current meme coin rally presents a paradox - prices are rising while large transactions decline sharply:

- 24-hour price increase: 6.15% (SHIB), 10.83% (Cheems)

- Large transaction volume drop: 69% decrease (6.04T to 1.87T SHIB)

- Year-to-date performance: SHIB remains 26% below January levels

This comes as Troller Cat's presale enters its final 48 hours, having raised $325,000 with promises of 531% returns at listing. The project's "Friday Phenomenon" marketing capitalizes on internet nostalgia, demonstrating how meme coins continue evolving their viral strategies.

Liquidity Concerns: The 3 Trillion SHIB Disappearance

Data from CoinGlass reveals alarming liquidity trends:

- July 15: 6.04 trillion SHIB in large transactions

- July 16: 1.87 trillion SHIB (69% decrease)

- Open interest down 18% despite price increase

"When you see this much volume vanish during a rally, it's like watching a magician's trick," observes market analyst Sophia from BTCC. "The question is whether the rabbit will reappear or if we're left with an empty hat."

SHIB Ecosystem Developments

Several factors could influence SHIB's trajectory:

- Shibarium upgrade adoption rates

- Burn mechanism effectiveness (only 0.02% of supply burned monthly)

- Competition from new meme coins like Troller Cat

- BTC correlation (currently 0.82 with major crypto movements)

Is SHIB a Good Investment in July 2025?

SHIB presents a classic high-risk, high-reward scenario:

- Technical breakout above $0.000015 could trigger FOMO buying

- Meme coin season historically brings 300-500% rallies

- Low float means rapid price movements possible

- Declining volume suggests weak conviction

- 82% correlation with speculative assets increases risk

- Valuation remains disconnected from utility

As always in crypto, diversification and risk management remain crucial. This article does not constitute investment advice.

SHIB Price Prediction FAQs

What is SHIB's current price?

As of July 17, 2025, SHIB trades at $0.00001437 on major exchanges including BTCC.

Why did 3 trillion SHIB volume disappear?

Large wallet holders (whales) reduced activity by 69% this week, possibly taking profits or awaiting clearer market direction.

Is SHIB in an overbought condition?

Yes, testing the upper Bollinger Band at $0.00001448 typically indicates overbought conditions that often precede pullbacks.

How does SHIB compare to other meme coins?

SHIB's 6% gain trails Cheems' 10.83% rise but outperforms many utility tokens in the current speculative environment.

What's the long-term outlook for SHIB?

While technicals show short-term strength, long-term viability depends on ecosystem development and sustained adoption beyond speculative trading.