BTC Price Prediction November 2025: Why Experts Stay Bullish Despite Market Swings

- What Do the Charts Say About BTC's Current Position?

- Why Are Institutions Doubling Down on Bitcoin?

- How Are Regulatory Developments Impacting BTC?

- What's Driving Retail Interest in Bitcoin?

- Is Now a Good Time to Invest in Bitcoin?

- Frequently Asked Questions

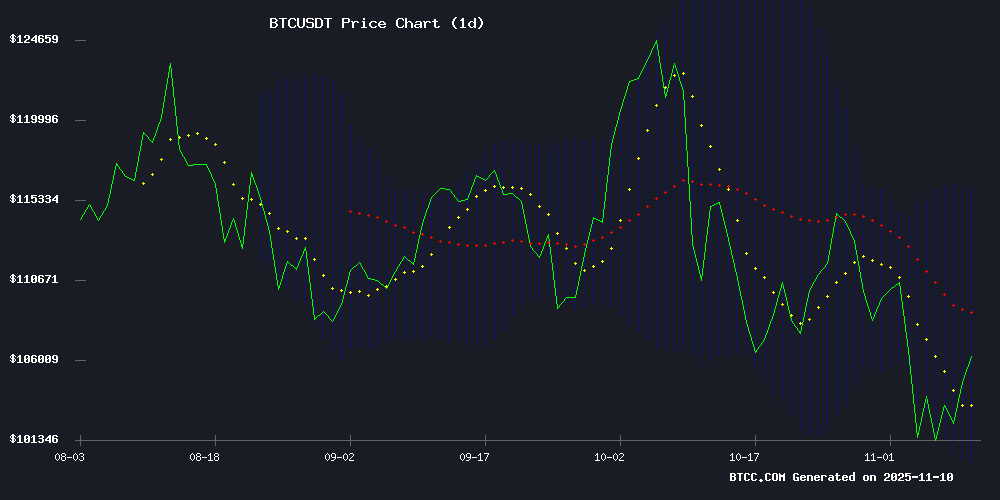

Bitcoin (BTC) continues to show resilience in November 2025, trading around $105,000 despite recent volatility. The BTCC research team analyzes why institutional investors remain confident even as short-term traders navigate choppy waters. From technical indicators flashing bullish signals to major corporate acquisitions, we break down the key factors driving Bitcoin's price action this month.

What Do the Charts Say About BTC's Current Position?

As of November 10, 2025, bitcoin sits just below its 20-day moving average at $105,317, presenting what many analysts call a "buy the dip" opportunity. The MACD histogram shows strong bullish momentum at +1,498.04, while Bollinger Bands indicate we're in a period of moderate volatility. "Whenever we see BTC trading near the middle Bollinger Band with MACD turning positive, it typically precedes upward movement," notes a BTCC market strategist. Immediate resistance appears at $108,000, with support holding firm at $102,500.

"Whenever we see BTC trading near the middle Bollinger Band with MACD turning positive, it typically precedes upward movement," notes a BTCC market strategist. Immediate resistance appears at $108,000, with support holding firm at $102,500.

Why Are Institutions Doubling Down on Bitcoin?

The past week saw remarkable corporate activity:

| Company | BTC Purchased | Amount (USD) | Average Price |

|---|---|---|---|

| MicroStrategy | 487 BTC | $49.9M | $102,557 |

| Strive Asset Management | 1,567 BTC | $162M | $103,315 |

Michael Saylor's rebranded "Strategy" corporation now holds 641,692 BTC worth over $47 billion. Meanwhile, Vivek Ramaswamy's Strive Asset Management has been quietly accumulating positions during dips. "This isn't speculative trading - these are long-term treasury strategies," explains a Wall Street analyst who requested anonymity.

How Are Regulatory Developments Impacting BTC?

The crypto world received two major policy boosts in early November:

- Treasury's Crypto Structure Bill: Secretary Scott Bessent's endorsement signals potential trillions in institutional capital flowing into digital assets

- New York Mining Agreement: Greenidge Generation's emissions deal sets precedent for sustainable Bitcoin operations

Interestingly, these developments come as stablecoin supplies contract - historically a warning sign for liquidity. "We're seeing unusual conditions where positive fundamentals clash with tightening market mechanics," observes a CoinMarketCap analyst.

What's Driving Retail Interest in Bitcoin?

Jack Dorsey's Block Inc. just activated Bitcoin payments for 4 million Square merchants, while Trump's proposed $2,000 stimulus checks have traders recalling 2020's post-stimulus rally. "When those CARES Act checks hit, we saw exact-$1,200 BTC purchases spike," remembers a veteran trader. "At today's prices, even fractional buying could move markets."

Meanwhile, Silver's surprising outperformance (up 58% YTD vs BTC's 30%) has some investors questioning asset rotations. "Precious metals are stealing headlines, but Bitcoin's infrastructure growth tells a different story," counters a Bloomberg Crypto reporter.

Is Now a Good Time to Invest in Bitcoin?

Current metrics present a complex picture:

- Technical Strength: Bullish MACD crossover suggests accumulation phase

- Institutional Demand: $212M in corporate purchases this week

- Macro Risks: Stablecoin liquidity contraction warrants caution

The BTCC research team maintains a cautiously optimistic outlook: "Bitcoin continues demonstrating its resilience as a macro asset, though November typically brings volatility. Dollar-cost averaging remains our recommended strategy."

Frequently Asked Questions

What's Bitcoin's price prediction for November 2025?

Analysts see Bitcoin potentially testing $108,000 resistance if current support holds, though stablecoin liquidity concerns may cap gains. The 20-day MA at $105,800 serves as key inflection point.

Why did MicroStrategy buy more BTC at $102,557?

The company's treasury strategy views prices below $110,000 as accumulation opportunities, maintaining their long-term "hodl" philosophy despite short-term volatility.

How does the Treasury bill affect Bitcoin?

The proposed crypto market Structure Bill could legitimize Bitcoin as a reserve asset for institutions, potentially unlocking trillions in capital over time.

Is silver outperforming Bitcoin?

Yes, silver has gained 58% YTD compared to Bitcoin's 30%, though BTC maintains much higher trading volume and institutional participation.

What's the significance of Square enabling BTC payments?

This brings Bitcoin commerce to mainstream retailers, reducing friction for everyday transactions and reinforcing BTC's utility beyond speculation.