Brace for Impact: $4.3B BTC and ETH Options Expiry Set to Unleash Market Volatility

Massive crypto derivatives event triggers trader anxiety—and opportunity.

The Setup

Nearly $4.3 billion in Bitcoin and Ethereum options hit expiration today, creating one of the largest potential volatility catalysts this quarter. Market makers scramble to hedge positions while speculators place bets on direction.

Market Mechanics

Options expiries force traders to either exercise contracts or let them expire worthless—creating concentrated buying or selling pressure. This volume dwarfs typical daily flows, often acting as a catalyst for short-term price dislocation.

Trading Implications

Expect exaggerated moves around key strike prices as market makers delta-hedge their exposure. Liquidity typically thins around these events, amplifying price swings—perfect conditions for breakout traders and nightmare fuel for risk managers.

Because nothing says 'efficient markets' like scheduled, predictable chaos that somehow still catches everyone by surprise every single time.

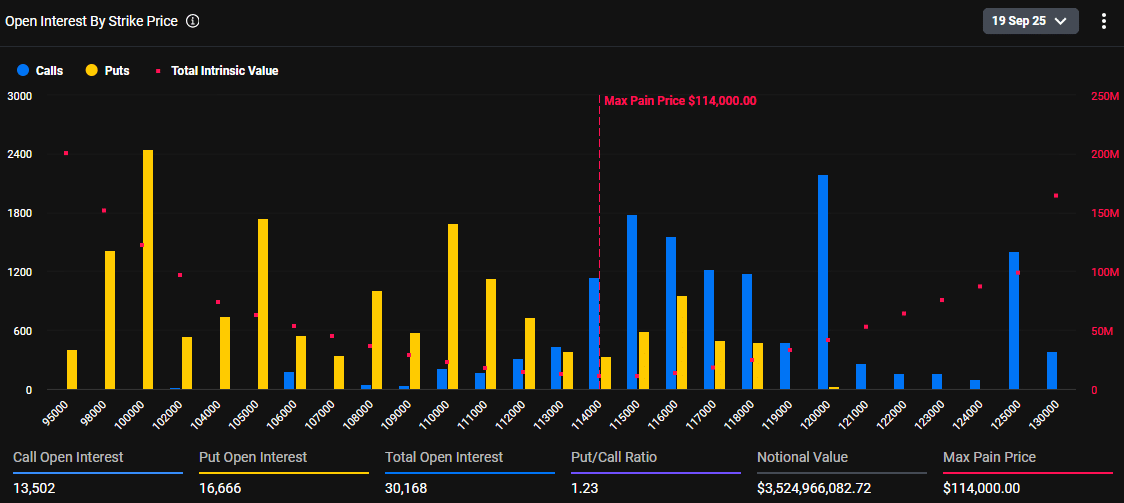

Bitcoin Options – Source: Deribit

Bitcoin Options – Source: Deribit

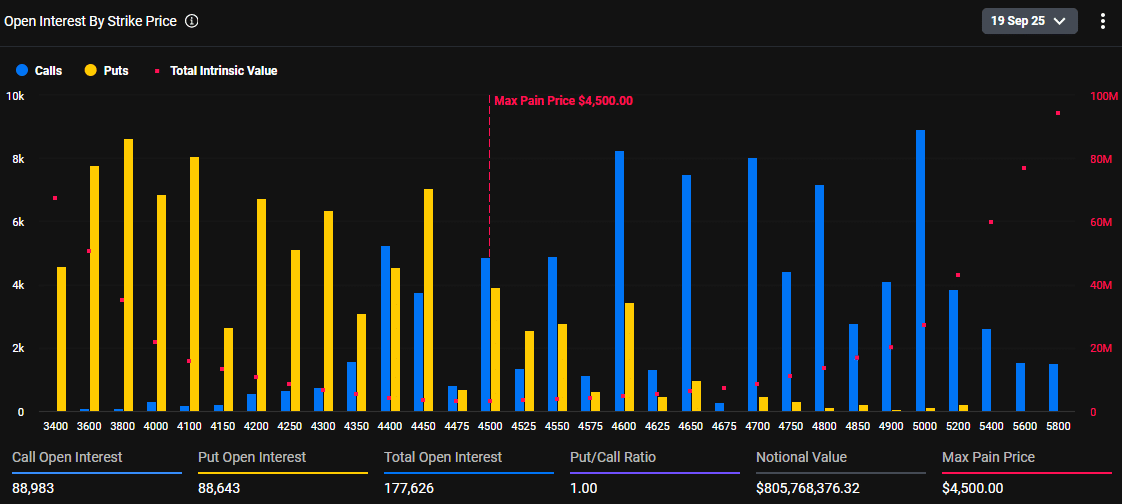

Ethereum has $806.75 million options of expiry in 177,398 contracts. Its PCR is slightly below 1 at 0.99, indicating a slightly bullish feeling since more Call (buy) options are in place. Ethereum has a maximum pain point at $4500, and since Ethereum is trading at 4,527, it might fall to this strike as options expire.

This week’s expiries are little higher than it was last week, and the markets have more balanced bullish and bearish bets. Analysts observe that the close balance between the Calls and Puts shows that traders are hedging portfolios or are not sure of the direction in the market.

Options Expiry Signals Caution

After the recent reduction in the Federal Reserve rate, implied volatility in crypto options increased, and actual volume decreased. According to Glassnode, the Bitcoin trades are above 115,200 and 95% of the supply is in profit, which is a sign of a hesitant yet positive market.

Post-Cut Patience

Bitcoin trades above 115.2k with 95% of supply in profit after the FOMC rally. Futures show short squeezes and options open interest hit a record 500k BTC ahead of the September 26 expiry. Holding above 115.2k is key while a drop risks a MOVE back toward… pic.twitter.com/MnDJxFPLcF

According to the max pain theory, Bitcoin might go to $114,000 and Ethereum to $4,500 as the options approach expiration at 8:00 UTC on Deribit. Markets usually stabilize soon after the expiry, but traders should expect some short-term swings before the weekend.

With next week’s massive $18 billion Bitcoin options expiry approaching, today’s $4.3 billion event is a reminder of how options can influence short-term crypto price action.

Also Read: NBA Star Kevin Durant Forgot Password To His Bitcoin Account