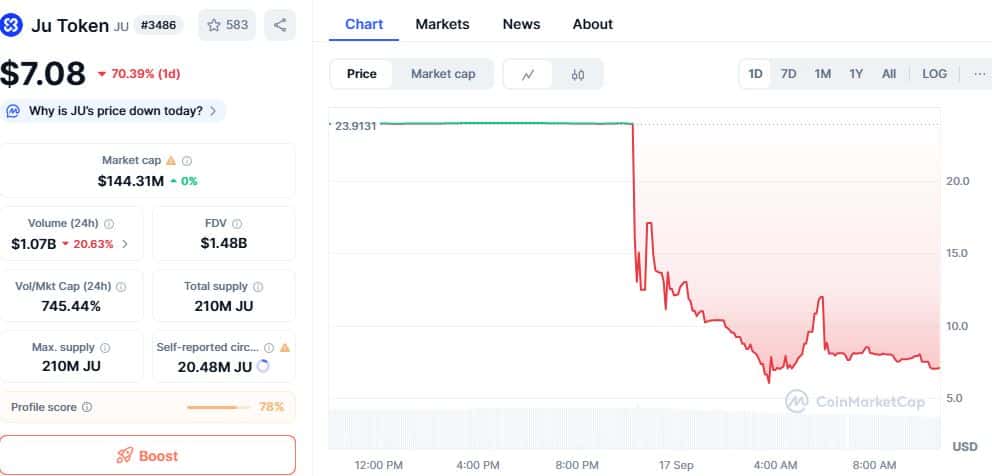

JuCoin’s JU Token Plummets 70% After $1 Billion Mass Exodus—Here’s What Triggered the Crash

Massive sell-off rocks JuCoin exchange as institutional investors flee—$1 billion wiped out in hours.

Behind the Panic

Traders scrambled to offload JU tokens after liquidity concerns surfaced. The exchange’s native token nosedived 70% from its recent high—no safety nets, no bailouts. Just pure, unfiltered crypto volatility.

Market Domino Effect

Other exchange tokens felt the tremor. When one stumbles, the whole sector holds its breath. JU’s collapse echoes past exchange failures—remember when 'too big to fail' meant nothing in crypto? Traders always forget.

Finance’s Ironic Twist

Wall Street veterans smirk—again. They’ve seen this script before: hype, explosion, collapse. But in crypto, the cycle spins faster. One day you’re riding the bull; the next, you’re explaining a 70% loss to your followers. Classic decentralized finance—where your gains are yours alone, and your losses are everyone’s entertainment.

Source: CoinMarketCap

Source: CoinMarketCap

Ju is currently priced at $7.08, crashing down 71%, with a market cap of $144.31 million and 24-hour trading volume valued at $1.07 billion, down by 20.63%.

Regulatory Scrutiny Adds Pressure

The sharp decline came just days after blockchain investigator ZachXBT flagged JuCoin as a “sketchy” sponsor of the upcoming Token2049 conference. He pointed to the exchange’s history of shifting regulatory compliance and anonymous trading practices. Earlier this year, JU also faced questions after allegations involving its trading partner.

The warnings have fueled fears of stricter oversight, with some drawing parallels to scandals like JPEX, where regulatory troubles sent its token’s value crashing.

Investor Confidence Shaken

Even JuCoin’s announcement in July of a $100 million expansion program for its blockchain has done little to restore faith.

Investors are still uneasy about JuCoin’s lack of transparency. The project hasn’t released proper audits, its team is mostly anonymous, and a significant portion of its trading occurs on smaller exchanges that lack strong oversight.

As these concerns grew, many investors decided to pull out. JU saw more than $1 billion worth of trades in a single day, showing just how quickly panic set in and how uncertain the outlook has become.

Volatility Adds to the Worry

Experts have also flagged JU’s unusually high trading activity compared to well-established coins like Bitcoin. Such erratic movement has fueled talk of possible manipulation and added to the belief that JU’s market is far from stable.

The Road Ahead

Attention now turns to whether JU can hold above its yearly low of $6.03. Some traders may look for a short-term bounce after the steep fall, but overall sentiment remains weak. Any MOVE from regulators in Singapore or South Korea could decide the token’s fate.

For JuCoin, the immediate task is to rebuild trust. With more than 70% of its value erased in a single day, investors are left wondering whether JU can stage a recovery — or if this is the start of a deeper crisis.

Also Read: KindlyMD Stock Crashes 55% After CEO Warns of Volatility