HYPE Whale Unstakes $107M, Sparking Market-Wide Sell-Off Fears

Whale just yanked $107M from staking—market holds its breath.

The Unstake Heard 'Round Crypto

One address. One massive unstaking event. The entire HYPE ecosystem just felt the tremor as a top holder pulled nine figures from staking contracts. Liquidity's about to get interesting.

Market Mechanics on Edge

That much capital hitting the open market doesn't just cause a dip—it rewrites momentum. Trading algos are already sniffing blood in the water. Exchange inflows spiked 300% in the hour following the move.

Timing Tells Everything

No whale moves this size without a plan. Either they're repositioning for a bigger play—or they know something the rest of us don't. Classic crypto: one person's exit strategy is everyone else's panic attack.

Just another day in decentralized finance—where your portfolio swings on the whims of anonymous wallets with more capital than some banks. Stay sharp.

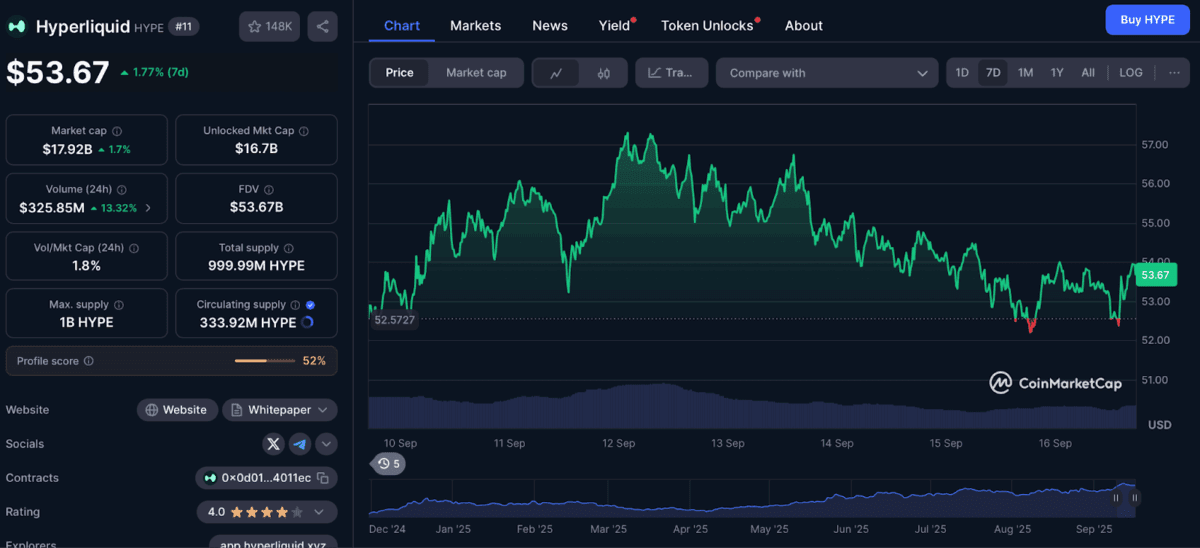

HYPE Price Chart | Source: CoinMarketCap

HYPE Price Chart | Source: CoinMarketCap

At the same time, another well-known whale is betting against HYPE. This trader, who previously pocketed $50 million from short positions, has opened a fresh $16 million short. The MOVE immediately shifted to an unrealized loss of over $348,000, yet it highlights the renewed bearish mood in the market.

According to Hyperliquid data, shorting remains the less popular strategy with 42% of trades, but rising funding fees are adding pressure on both sides. Meanwhile, predictions about HYPE’s future price mover remain divided. Some traders see prices dropping below $50 and potentially as low as $18 in a deeper correction.

Also Read: Bitcoin up 99% in yearly gains despite altcoin dominance