NAKA CEO Breaks Silence on 96% Stock Plunge: Inside the Sell-Off Chaos

NAKA's stock just got crypto-style volatility—without the crypto. CEO steps into the storm after shares nosedive 96%, leaving traditional investors wondering if they accidentally bought a meme coin.

The Great Unraveling

Massive sell-off triggers catastrophic drop—wiping out nearly all equity value in brutal trading sessions. No fancy algorithms needed here; just old-fashioned panic selling doing what it does best.

Leadership in the Crosshairs

CEO addresses shareholders with classic corporate calm—acknowledges the plunge, outlines stabilization plans, and insists fundamentals remain strong. Because nothing says 'strong fundamentals' like a 96% haircut.

Market Realities

Traders dump positions faster than a hot Bitcoin in a bear market. Liquidity vanishes, spreads widen, and suddenly everyone’s a long-term holder—whether they like it or not.

Finance’s Ironic Twist

Traditional markets getting a taste of crypto-style volatility? How quaint—maybe they’ll finally understand why we HODL through 80% dips. Welcome to the party, Wall Street.

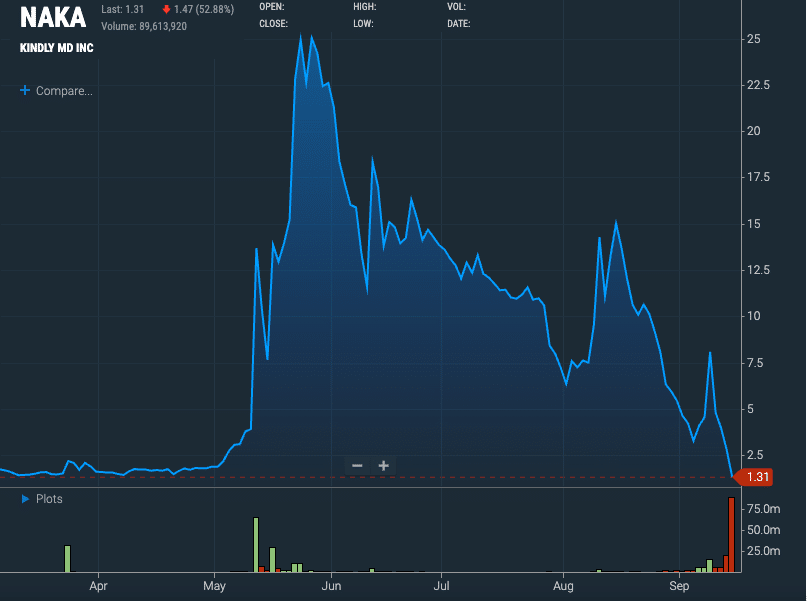

Naka Price Chart, Source: Nasdaq

Naka Price Chart, Source: Nasdaq

Selling Pressure and Investor Disparity

Sustained selling pressure, which was partly caused by news regarding the company’s private placement financing, seems to be the main reason for the drop. Early investors, such as Jameson Lopp and Adam Back, bought shares for as little as $1.12. This price stands in stark contrast to the stock’s public debut, where it opened at $28.51, creating significant concern among retail investors who bought in at much higher valuations.

Names that stood out to me:

Jameson Lopp: 1,340,000 shares of $NAKA

Balaji Srinivasan: 273,038 shares of $NAKA

David Bailey: 11,160,572 shares of $NAKA

Clark Moody: 100,000 shares of $NAKA

Adam Back: 8,928,572 shares of $NAKA

Danny Yang: 450,000 shares of $NAKA

Jeff Park: 89,286… https://t.co/ECNmmMJU9b

In response to the sell-off, Bailey characterized the situation as “upgrading our shareholder base” and urged those who believe in the company’s long-term vision to “brave the storm.” He also highlighted the intense negative market sentiment, noting the implied 2000% cost to borrow NAKA shares, which he claimed was the “highest in the nation,” indicating that a large portion of the market is betting against the company. This is a sharp reversal from the initial HYPE in May when he claimed, “I can feel the stampede building, the fomo is very real.”

Wow. Intense volume. Thankful for all the messages of support. Today is a day of transition. We are upgrading our shareholder base from short term traders to long term investors. Brave the storm.

To the ₿ullievers go the spoils.

Volatility Risks

Nakamoto’s quick rise and fall is a warning about how unstable new enterprises in the crypto sector might be, especially those that are linked to a bitcoin treasury model. The huge difference between private placement and public offering prices shows how risky it is for regular investors to get into the market when there is a lot of buzz. Bailey’s attempts to change the story will be very important in deciding if the company can win back investors’ trust or if it will just be another footnote in the history of crypto-related market crashes.

Also read: David Bailey’s Nakamoto Joins KindlyMD to Build Bitcoin Treasury