Massive 525 BTC Purchase Strategy Pushes Total Holdings to Record 638,985 BTC

Institutional whale just dropped another half-billion dollar bet on Bitcoin—because traditional finance wasn't volatile enough already.

The Numbers Don't Lie

Five hundred twenty-five fresh coins just entered cold storage, pushing the total stack to nearly six hundred thirty-nine thousand BTC. That's not just a position—it's a statement.

Strategy Over Speculation

This isn't some retail FOMO play. This move screams calculated accumulation from players who measure risk in percentages, not emotions. They're building digital fortresses while traditional banks still debate wire transfer fees.

Market Impact? Minimal—Until It's Not

Sure, five hundred coins might not move the needle immediately. But stack enough needles and you've got a porcupine that can puncture any bear market narrative.

Meanwhile in TradFi land: 'We're still evaluating blockchain technology's potential.' Good luck with that.

Small Buy, But Bigger Picture

Compared with its earlier purchase, the 525 BTC purchase is considered small. Just one week ago, the company added 1,955 BTC for $217 million, and earlier this year, the company made single purchases worth over $1 billion.

Since the summer of 2020, Strategy has kept up a tradition of buying Bitcoin almost every week, turning the company into a leader in corporate crypto investing.

Investors React as Market Holds Steady

Strategy said it funded this latest deal by selling shares through equity programs, including STRF, STRK, and STRD preferred stock sold at-the-market.

Data shows that Strategy currently has more than $20 billion raised from STRK preferred shares and $16.1 billion from MSTR common stock issuance. While STRK preferred shares are backed by Bitcoin claims, some shareholders have expressed concerns about dilution as new stock is regularly issued to fund the company’s strategy.

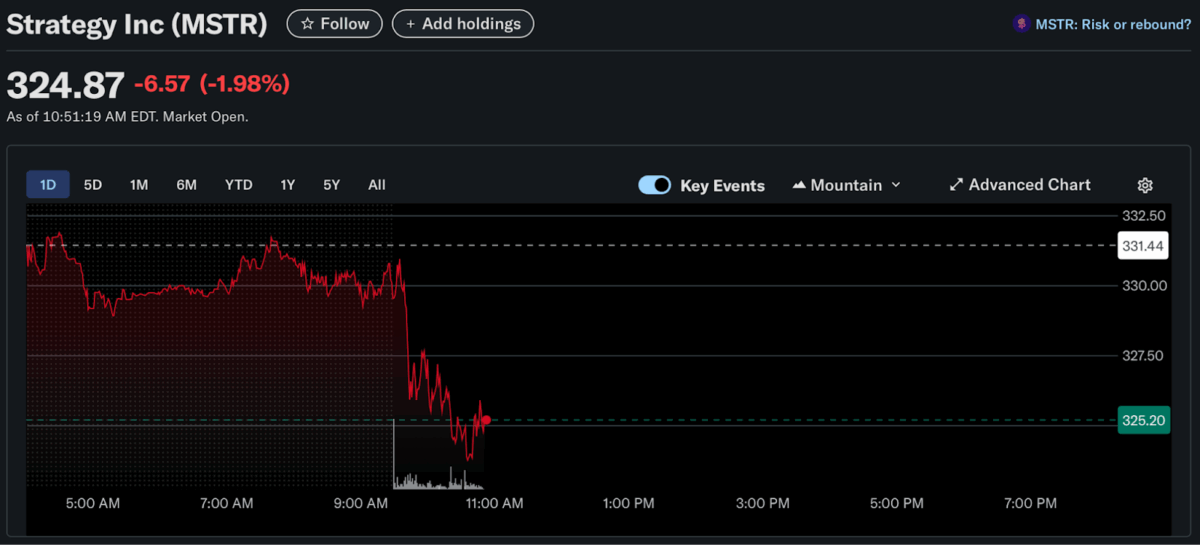

Despite the announcement, Strategy’s stock price remained flat. Currently, MSTR shares are trading sideways around $324, down 1.98% in pre-market activity. This muted reaction came even as Bitcoin itself traded NEAR $115,000 after a weekend rebound to $116,000.

Analysts remain split on the stock’s prospects. For instance, JPMorgan has flagged risks for crypto treasury firms, but TD Cowen maintained a buy rating with a $640 target, while Benchmark placed its forecast higher at $705.

Also Read: Peter Schiff Warns “Bitcoin Is Topping Out” Ahead of Fed Cut