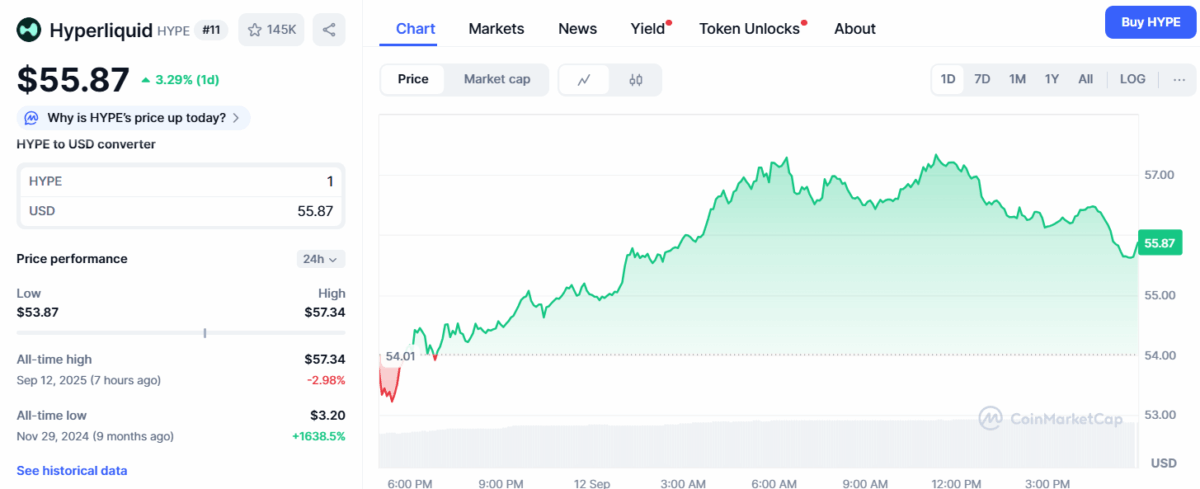

Hyperliquid’s HYPE Token Shatters Records as USDH Governance Vote Looms

Hyperliquid's native token HYPE just blasted past previous resistance levels, hitting unprecedented highs as the community prepares to vote on critical USDH stablecoin proposals.

Governance in Action

The protocol's decentralized voting mechanism kicks into high gear this week, with stakeholders weighing proposals that could reshape USDH's monetary policy and integration pathways. Market participants are positioning aggressively ahead of the decision—because nothing says 'decentralized finance' like coordinated speculation before major protocol changes.

Market Momentum Builds

Trading volumes surged alongside the price action, indicating strong institutional and retail interest in Hyperliquid's evolving ecosystem. The timing couldn't be more strategic—just as traditional finance grapples with another round of inflationary pressures, crypto natives are busy voting on stablecoin parameters that might actually protect purchasing power.

Another reminder that while Wall Street debates rate cuts, DeFi protocols are busy building the future of money—one governance proposal at a time.

Source: CoinMarketCap

Source: CoinMarketCap

The HYPE token is the native governance token of the decentralized exchange Hyperliquid, which was launched in 2024. The token was airdropped to early users and traders on the Hyperliquid platform as a way to decentralize ownership and reward people who participated naturally. This method was like how dYdX and Uniswap, two other decentralized exchanges, first gave out governance tokens.

According to an anonymous cryptocurrency analyst ALTF4, apart from USDH hype, whale accumulations and breakout above $50 followed by institutional interests have largely contributed to the surge in HYPE price.

“This isn’t just hype, it’s a structurally backed breakout across fundamentals, technicals, and institutional tails,” said the analyst.

Hyperliquid’s USDH Issuance Proposal

The surge comes at a time of anticipation around results of proposals that will decide who gets to handle the issuance of USDH, a dollar-pegged stablecoin that is native to Hyperliquid.

USDH Tracker says that several teams are competing to be the issuer, and Native Markets is currently in the lead because it has strong support from validators. The Nansen x HypurrCo validator, which holds a large amount of HYPE, is expected to show support for Native Markets.

Also Read: Radiant Hacker Moves $26.7 Million in Stolen Funds to Ethereum