Bitcoin ETF Boom Crashes Into Reality as TradFi Appetite Vanishes

TradFi's love affair with Bitcoin ETFs hits the skids—turns out even Wall Street gets cold feet when volatility bites.

The Gold Rush Fades

Institutions piled in during the hype cycle, but now the party's over. Flows dry up, applications stall, and suddenly everyone remembers why they hated crypto's wild swings in the first place.

Same game, different players—just another case of traditional finance chasing returns until they remember risk exists.

Shift in sentiment and waning appetite

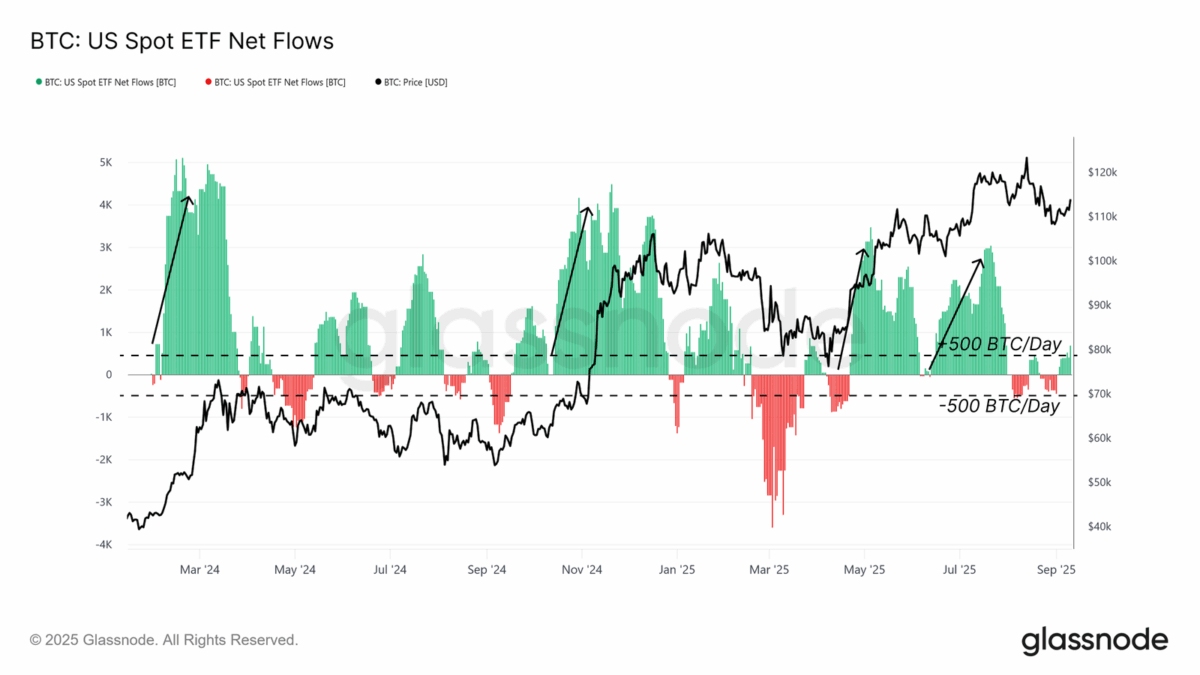

In a sharp contrast to the aggressive inflows that fueled earlier rallies, daily netflows are currently sitting around a subdued ±500 BTC, signaling a clear shift in investor sentiment.

Data from crypto analytics platform, Glassnode, reveals the reversal of fortune. After consistently attracting hundreds of millions and sometimes billions of dollars daily this year, the 14-day moving averages for netflows have collapsed, now hovering around the break-even point.

The daily netflows have struggled to stay positive, and a dramatic drop from the intense buying pressure that characterized the first half of 2025, suggests a potential exhaustion of this initial wave of institutional interest.

Profit-taking adds to market fragility

Beyond the economic headwinds, simple profit-taking is also at play right now. Many early institutions poured money into ETFs at prices NEAR $50,000 are now sitting on more than 2x gains as Bitcoin recently hit a high above $123,000 in mid-August. As they continue to cash in their profits, the resulting selling pressure combined with the slowdown in new inflows has left the market in a fragile state.

The ability for the market to absorb this selling and attract renewed interest will be a key determinant of whether bitcoin can break out of its current consolidation and continue its historic bull run.

Also Read: Bitcoin Holds Near $114K as US Inflation Hits 2.9% in August