The High-Stakes Battle for USDH: Inside the Fierce Race to Dominate Hyperliquid’s Native Stablecoin

Hyperliquid's stablecoin war just went nuclear—and the entire DeFi landscape is watching.

Who Controls the Stablecoin?

Multiple heavyweight players are scrambling to issue USDH, each bringing massive liquidity pools and institutional backing to the table. This isn't just about bragging rights—it's about controlling the native stablecoin infrastructure on one of DeFi's fastest-growing perpetual exchanges.

Billions at Stake

The winners capture perpetual trading fees, lending revenue, and governance influence. The losers get relegated to also-ran status in a market that rewards only absolute dominance. Traditional finance veterans would call this reckless—crypto natives call it Tuesday.

Because nothing says 'financial revolution' like a half-dozen VC-backed teams fighting over who gets to print digital dollars.

The Rise of Hyperliquid and the Need for a Native Stablecoin

Hyperliquid has taken the DeFi world by storm, carving out a dominant position in the decentralized perpetual futures market. Its success is built on a high-performance LAYER 1 blockchain that offers the speed and efficiency of a centralized exchange while retaining the self-custody and transparency of a decentralized one. Currently, the platform heavily relies on Circle’s USDC as the primary collateral and settlement asset. With over $5 billion in USDC residing on Hyperliquid, a significant amount of potential yield revenue flows out of the ecosystem and into the hands of Circle.

The Hyperliquid Foundation recognized this value leakage and announced a groundbreaking initiative: to launch a native, “Hyperliquid-first” stablecoin, USDH. This move is designed to create a more integrated and efficient ecosystem, but most importantly, to capture the substantial yield generated from the stablecoin’s reserves for the benefit of its own community.

What is USDH?

USDH is the name of Hyperliquid’s proposed official, native stablecoin. It is designed to be a fully collateralized digital asset that maintains a stable 1:1 peg with the U.S. dollar.

Once launched, USDH will become the primary collateral asset for trading perpetual futures and the main medium for settlement and fee payments within the Hyperliquid ecosystem. Its Core purpose is to replace the platform’s dependence on third-party stablecoins like USDC.

While the stablecoin market is growing rapidly, especially after the passage of the GENIUS Act in the US in July, the launch of USDH marks a key milestone for the DeFi ecosystem.

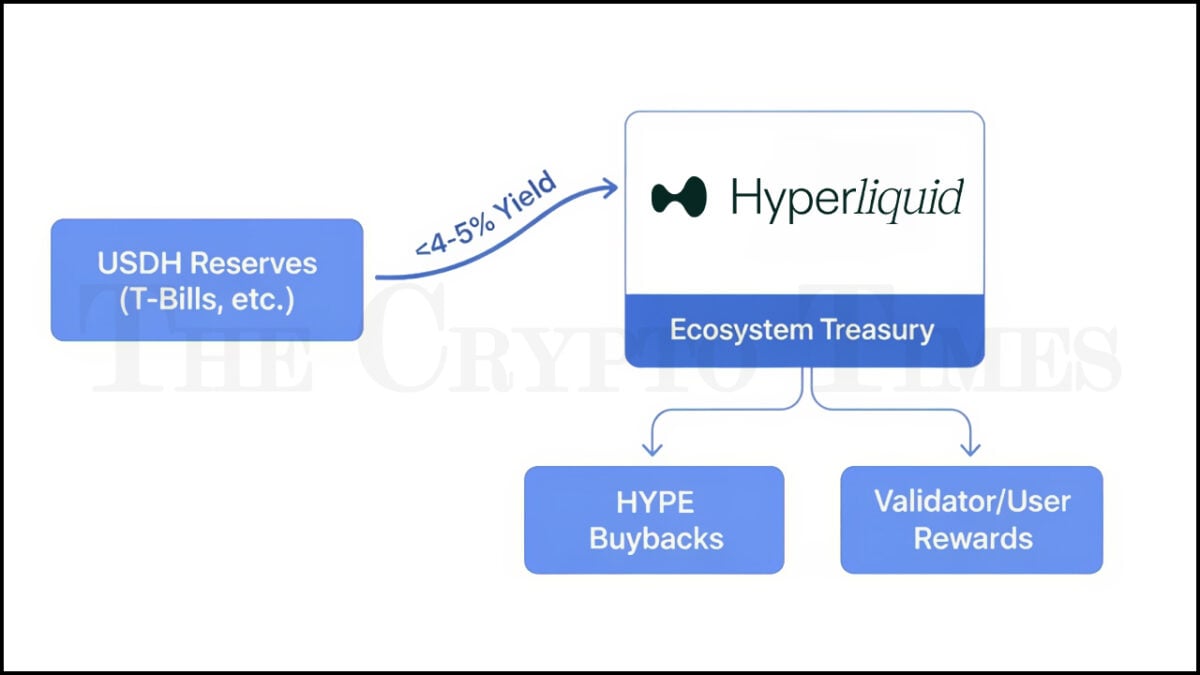

The key innovation of USDH lies in its value-capture mechanism. By creating its own native stablecoin, the Hyperliquid ecosystem can internalize the revenue generated from the billions of dollars held in its reserves. Instead of the yield from these assets (typically held in U.S. Treasury bills) flowing to an external company, it will be directed back to the Hyperliquid protocol.

According to the proposals, this revenue stream will be used for HYPE token buybacks, funding ecosystem development, and rewarding network validators, creating a powerful, self-sustaining economic loop that benefits all participants. The entity chosen through the competitive bidding process will be responsible for issuing, redeeming, and transparently managing the reserves that back USDH, ensuring its stability and integrity.

The Contenders: A Crowded Field of Stablecoin Giants

The call for USDH proposals has attracted a diverse and formidable lineup, each bringing a unique value proposition. The key players in this race include:

Native Markets (The Frontrunner):

A new entity seemingly formed specifically for this competition, Native Markets has surged to become the favorite to win the issuance rights. Backed by Hyperliquid advisor Max Fiege and linked to Stripe’s stablecoin issuer, Bridge, their proposal has gained significant traction. Native Markets secured a crucial endorsement from the Nansen x HypurrCollective validator, which controls over 17% of the total vote. As of the latest validator declarations, Native Markets commands roughly 70% of the committed votes, giving them a commanding lead. Their perceived “home-field advantage” as an ecosystem-native team appears to be resonating strongly with the community.

Paxos:

A well-established and regulated stablecoin issuer, Paxos is a powerhouse known for its partnerships with giants like PayPal and its issuance of PAX Dollar (USDP). Paxos put forth a compelling proposal leveraging its regulatory compliance and vast distribution network.

Paxos submitted its first proposal for USDH on September 6, introducing Hyperliquid’s inaugural native stablecoin to drive ecosystem growth on the decentralized perpetuals exchange. It noted that the USDH will be fully compliant with the U.S. GENIUS Act and EU MiCA, and it will be backed by high-quality reserves like Treasury bonds. It will be issued via Paxos’s network of over 70 global financial partners in markets including the US, EU, Singapore, Abu Dhabi, and Latin America. The model allocated 95% of reserve interest earnings to buy back Hyperliquid’s HYPE token, redistributing them to users, validators, projects, and partners to bootstrap liquidity through initial AMM pools like USDC-USDH.

Later in its “V2” proposal on September 10, Paxos added a strategic partnership with PayPal, which WOULD see PayPal and Venmo list Hyperliquid’s native HYPE token and support USDH with free on- and off-ramps. Besides offering a 95% revenue share of the interest generated from USDH reserves to be used for HYPE token buybacks, it also included PayPal’s commitment to add an additional $20 million in incentives. The proposal emphasizes global regulatory compliance, positioning USDH for widespread adoption. Additionally, PayPal also lended support to Paxos’s USDH stablecoin proposal in a recent X post.

Further strengthening their case, Paxos secured a commitment from the major cryptocurrency exchange Kraken, which announced it would list both USDH and HYPE from day one if Paxos wins the bid, contingent on standard due diligence. Despite these powerful alliances, Paxos is currently the runner-up with approximately 23% validator support.

OpenEden:

As a forerunner in institutional-grade tokenized real-world assets and Asia’s largest issuer of on-chain U.S. Treasury bills, OpenEden brings a compliance-first, institutional-grade proposal to the table. Their bid focuses on anchoring USDH in regulatory compliance, independent credit ratings, and Tier-1 banking partnerships.

OpenEden operates under a Class M Digital Asset Business License from the Bermuda Monetary Authority (BMA), ensuring robust regulatory oversight. A key feature of their structure is the use of a bankruptcy-remote segregated accounts company (SAC), which legally segregates the assets backing USDH from the issuer’s liabilities, offering holders stronger protection.

The proposal promises a 100% pass-through of all minting/redemption fees and underlying yield from its tokenized T-Bill fund, “TBILL,” directly to the Hyperliquid ecosystem for HYPE buybacks and initiatives. The reserves backing USDH would be under the custody and investment management of BNY (Bank of New York), the world’s largest custodian bank. To further sweeten the deal, OpenEden has earmarked 3% of its total EDEN token supply as additional incentives for USDH users. Their bid is strengthened by a consortium of partners including chainlink for oracle services, AEON Pay for real-world payment integrations, and Monarq (majority-owned by FalconX) as a dedicated liquidity provider.

Ethena Labs:

The issuer of the rapidly growing synthetic dollar, USDe, Ethena Labs entered the fray with an innovative and aggressive proposal. However, it later dropped plans to focus on product innovation. Ethena planned to back USDH with its recently launched USDtb, a stablecoin collateralized by U.S. Treasury bills held in a BlackRock-managed fund.

The protocol was offering a 95% revenue share back to the Hyperliquid community and pledged to cover the costs of migrating existing USDC trading pairs to USDH. To further incentivize adoption, Ethena also committed a substantial $75 million in ecosystem incentives, with the potential to increase this to $150 million. A unique aspect of Ethena’s proposal was the creation of a “guardian network” of Hyperliquid validators to oversee USDH operations, adding a layer of decentralized governance.

Other Notable Bidders:

The competition for USDH is not limited to these four. Other prominent names that have thrown their hats into the ring include:

- Frax Finance: Proposing to back USDH with its frxUSD stablecoin.

- Agora: Shared a proposal backed by investment management firm VanEck.

- Sky (formerly MakerDAO): The DeFi OG also submitted a competitive proposal with notable terms, including a 4.85% return on all USDH held in Hyperliquid.

The Voting Process and Community Engagement

The selection of the USDH issuer is a landmark governance event for Hyperliquid. The decision rests in the hands of the network’s validators, whose voting power is proportional to their staked HYPE. The final on-chain vote is scheduled to occur on September 14 between 10:00 and 11:00 UTC. The vote requires a two-thirds quorum to pass, and the Hyperliquid Foundation has stated it will abstain from voting, honoring the choice made by the non-Foundation validators.

This process has sparked intense debate within the Hyperliquid community and has driven significant market activity, with the price of the HYPE token surging to an all-time high of $56 in the days leading up to the vote.

The Road Ahead: A New Era for Hyperliquid

The bidding war for Hyperliquid’s USDH stablecoin is more than just a competition; it’s a testament to the platform’s success and its potential to reshape the DeFi landscape. The winning issuer will gain access to a massive and highly active user base, while Hyperliquid will finally have a native stablecoin that aligns with its long-term vision.

Regardless of who wins the vote, the Hyperliquid ecosystem is the ultimate beneficiary. The intense competition has led to incredibly favorable proposals for the community, with massive revenue shares, ecosystem incentives, and strategic partnerships being offered. The launch of USDH will mark a new chapter for Hyperliquid, one where it transitions from a rapidly growing DEX to a mature and self-sustaining DeFi ecosystem. The world will be watching as the Hyperliquid community makes its choice and ushers in a new era of DeFi.