Figure Technology Stock Soars 40% in Explosive Nasdaq Debut - Fintech Disruption Arrives

Wall Street just got a crypto-infused wake-up call.

Figure Technology's Nasdaq debut ripped through conventional expectations—surging a staggering 40% out the gate. The fintech firm, known for blending blockchain efficiency with traditional lending, didn’t just enter the market; it kicked the door down.

Why Traders Are Buzzing

No shaky first-day performance here. Investors piled in, betting big on Figure’s promise to streamline financial services using distributed ledger tech. The debut wasn’t just successful—it was a statement.

Behind the Numbers

That 40% pop tells a story: either the market’s starved for blockchain innovation, or we’re witnessing another classic case of hype over fundamentals—take your pick. Either way, it got attention.

Where It Fits in the Finance Game

This isn’t just another IPO. It’s a test. Can a company rooted in crypto principles actually win over traditional investors? Day one says yes, but let’s see how it holds up once the Wall Street circus moves on.

One thing’s clear: when a fintech stock jumps 40% at open, somebody’s making money—and it’s probably not the retail traders chasing the momentum.

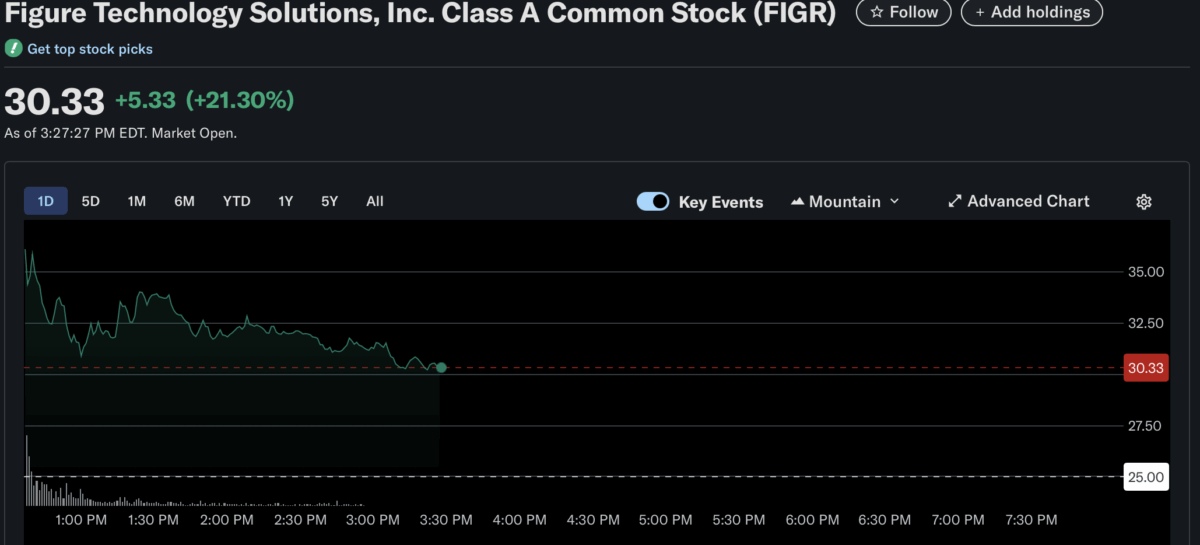

Figure Tech Shock Chart | Source: Yahoo Finance

Figure Tech Shock Chart | Source: Yahoo Finance

According to a report from Bloomberg, the offering included 23 million Class A common shares sold by the company and nearly 8 million more from existing shareholders, which raised $787.5 million in fresh capital. Goldman Sachs, Jefferies, and Bank of America led the underwriting team, while prominent investors such as Ribbit Capital and Stanley Druckenmiller’s Duquesne Family Office also participated.

Figure was co-founded in 2018 by Mike Cagney, the former CEO of SoFi Technologies, who retains control with super-voting Class B shares representing 68.6 percent of voting power.

“We were actually contemplating going public last year,” Cagney said in an interview with CNBC. “For a whole host of reasons, we didn’t do it. It wasn’t the most hospitable environment for a blockchain company to go public last year. That’s changed a lot.”

The company offers blockchain-powered lending products such as home equity lines of credit, crypto-backed loans, and a digital asset exchange. According to its filings, it has funded more than $16 billion in loans through blockchain rails. Customers for partner-branded HELOC loans recorded an average FICO score of 756, which is higher than the 749 average for Figure-branded loans.

In the six months ending June 30, 2024, Figure earned $29.1 million in profit on $190.6 million in revenue. The year before, it had a loss of $15.6 million on $156 million in revenue. The company is also using artificial intelligence like OpenAI to help check loan applications, while Google Gemini powers chatbots for customer service.

Meanwhile, there are other crypto companies that are lining up to go public. This includes Gemini, BitGo, Grayscale, and Kraken. Gemini has recently filed to raise its IPO price range from $17–$19 to $24–$26.

Also Read: Ethena Drops USDH Hyperliquid Bid to Focus on Product Innovation