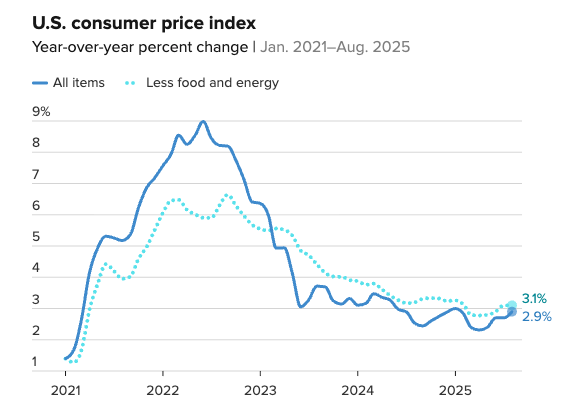

Bitcoin Defies Gravity at $114K as US Inflation Cools to 2.9% in August

Digital gold proves its mettle while traditional finance grapples with cooling inflation numbers.

Market Resilience

Bitcoin's holding pattern near record highs signals institutional confidence as inflation data comes in softer than expected. The flagship cryptocurrency didn't flinch when the August inflation print hit—instead, it maintained its stratospheric position like it's just another Tuesday.

Macro Dance

While traditional investors scramble to reinterpret Fed policy signals, crypto markets just keep doing their thing. That 2.9% inflation figure would typically trigger massive repositioning across legacy markets, but Bitcoin traders barely blinked. They're too busy counting gains that outpace inflation by about, oh, 39,200%.

Finance's New Reality

Wall Street analysts are probably still trying to figure out how to short something that doesn't care about their traditional metrics. Meanwhile, Bitcoin continues to serve as the ultimate inflation hedge—the one asset that actually works as advertised, unlike those 'diversified portfolios' that still can't beat a simple HODL strategy.

Because nothing says 'sound monetary policy' like watching digital assets outperform every traditional inflation hedge while bankers debate whether 2.9% is 'transitory' or 'structural.'

US CPI Data | Source: U.S. Bureau of Labor Statistics

US CPI Data | Source: U.S. Bureau of Labor Statistics

In response to the data, investor expectations for a more aggressive 50 basis point interest rate cut by the Federal Open Market Committee (FOMC) next week have declined. According to the CME FedWatch Tool, the probability of such a cut fell from 12% to 9%.

However, some analysts believe the Fed’s decision will be influenced by other factors, such as a separate report showing weekly jobless claims have risen to their highest level since October 2021. “Today’s CPI report has been trumped by the jobless claims report “… it will not give the Fed a moment of hesitation when they announce a rate cut next week,” commented Seema Shah, chief global strategist at Principal Asset Management.

ETF Inflows Counter Macro Pressure

While hotter inflation data typically poses a headwind for risk assets like cryptocurrencies, Bitcoin’s price remained firm. This stability has been largely credited to a powerful wave of institutional buying through spot bitcoin ETFs. On Wednesday, these funds recorded $757.1 million in net inflows, the highest single-day figure in eight weeks, according to data from SoSoValue. The total inflows for September have now reached $1.39 billion.

This high demand suggests that big investors are buying bitcoin in large amounts. They may see the current price as a good time to get in before the economy changes in the future. Market experts at the cryptocurrency exchange Bitunix say they are still worried that “rising tariff costs and food prices could continue to push inflation higher,” which could make people “reassess the scope for future rate cuts.”

The market’s muted reaction to the August CPI report highlights a growing divergence between short-term macroeconomic signals and strengthening structural demand for Bitcoin through regulated investment vehicles like ETFs.

While the inflation reading creates uncertainty, the crypto market’s focus is now squarely on the Federal Reserve’s upcoming policy meeting. As analysts at QCP Capital noted, “The more decisive event remains September’s FOMC, where the discussion on the pace of future rate cuts will likely be the key driver for asset classes”. What the group says in the future will have a big impact on how the market feels and on Bitcoin’s next big move.

Also Read: Federal Reserve to Host Payments Innovation Conference on Oct. 21