SEC Pushes Franklin Solana ETF Decision to November 2025 - What’s Behind the Delay?

Regulators hit pause on crypto innovation—again.

The Waiting Game Continues

Franklin Templeton's Solana ETF proposal gets shoved to November 2025. Another 14 months of regulatory limbo for an asset that's been trading 24/7 for years.

Pattern Recognition

SEC delays crypto ETFs like clockwork. First bitcoin, then ether, now Solana. Traditional finance moves at bureaucratic speed while digital markets operate at light speed.

The Institutional Conundrum

Wall Street wants crypto exposure without the hassle of self-custody. Main Street already buys SOL directly. Another case of institutions playing catch-up with retail.

November 2025 or Bust

The new deadline gives regulators 14 months to study an asset that's existed since 2020. Because nothing says efficient markets like requiring five years of data for approval.

Meanwhile, SOL keeps trading—ETF or not. The SEC protects investors from returns while traditional finance figures out how to charge 2% management fees on crypto. How thoughtful.

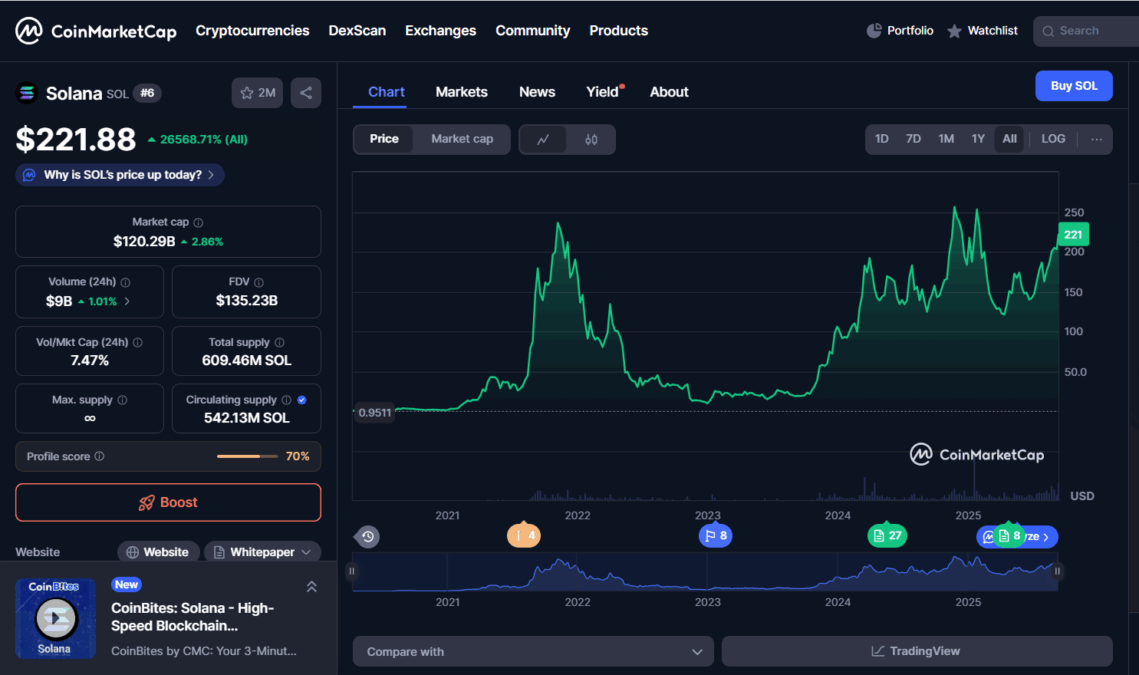

Solana Price Chart | Source: CoinMarketCap

Solana Price Chart | Source: CoinMarketCap

Optimism around the ETF filings is seen as one reason for the rally. Bloomberg ETF analyst James Seyffart has said on X that the “odds haven’t really changed much if at all” and maintained his prediction of a 95% chance that a Solana ETF will be approved by the end of 2025.

Also Read: SEC Delays Decision on BlackRock ethereum ETF Staking