BNB Shatters $700 Barrier With Unstoppable Momentum—Is $1,100 The Next Target?

BNB isn't just climbing—it's rocketing past resistance levels with brutal efficiency. The $700 mark didn't stand a chance.

Momentum Builds Toward Historic Highs

Traders are watching every tick as buy pressure overwhelms the market. This isn't just a pump—it's a full-scale assault on previous resistance zones.

The Path To $1,100

If volume holds and the bulls maintain control, that four-digit price target becomes more than just speculation. We've seen this pattern before—breakouts beget more breakouts.

Meanwhile, traditional finance still can't decide whether crypto is a scam or the future—classic hedge fund indecision while retail pockets the gains.

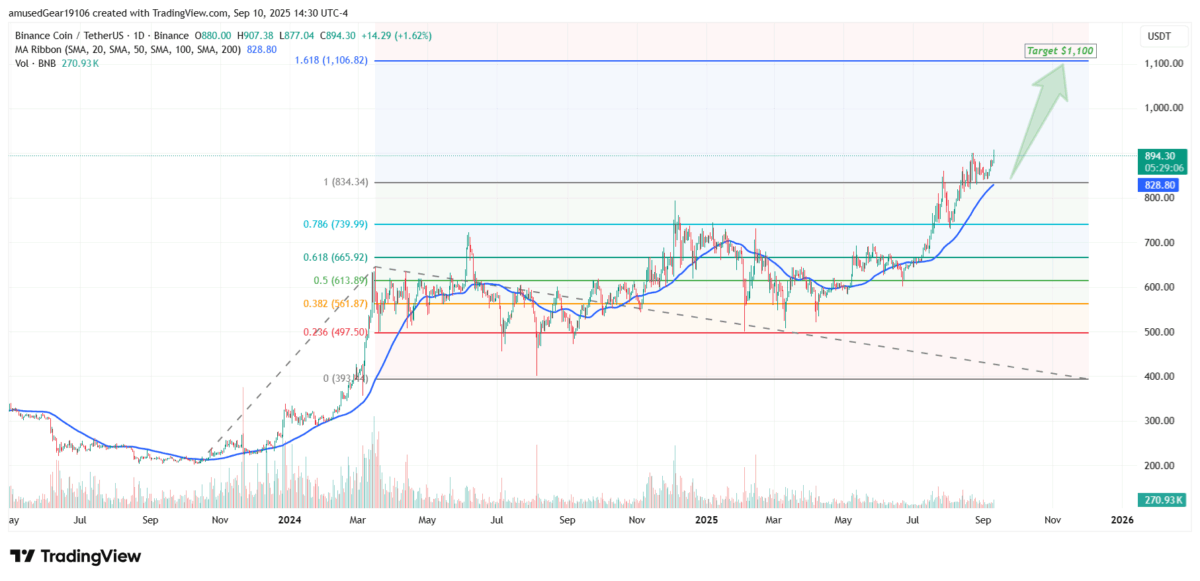

BNB coin targets $1100 (Fib extension 1.618) | Source: TradingView

BNB coin targets $1100 (Fib extension 1.618) | Source: TradingView

BNB’s breakout is more than just a chart anomaly, it’s a structural shift. The token is now trading in territory with no historical ceiling, and bulls have shown no signs of exhaustion. As long as price stays above $700, bulls have control. With volume backing the move and key resistance zones cleared, the market is now watching one number: $1,100. Unless momentum fades or rejection sets in, the path remains open.

The breakout comes alongside a surge of capital. On September 8, Binance reported $6.2 billion in stablecoin inflows, its largest single-day intake of 2025. That wave of liquidity has added real weight to BNB’s price action, supporting the rally with actual market flows.

Meanwhile, Binance isn’t just drawing in volume, it’s expanding infrastructure. Binance Pay is now live on Zapper’s 31,000+ merchant network, letting users spend crypto at real-world checkout counters with a scan. That kind of utility gives BNB more than just momentum, it gives it relevance.

Also Read: Crypto Price Today (August 10): Market in Total Green as Bitcoin Tops $113K

The Crypto Times publishes news, analysis, and educational content for informational purposes only. We do not offer financial, investment, legal, or trading advice of any kind. All content on our website is intended to be neutral and fact-based. Readers should always do their own research, consult with licensed professionals, and evaluate risks independently. The Crypto Times does not endorse or recommend any specific cryptocurrencies, tokens, projects, financial products, or investment strategies. We do not accept legal liability for any financial losses incurred as a result of reliance on information published by us.