Ethereum ICO Whale Makes Monumental $646M Bet as ETH Defies Gravity Above $4,300

While traditional finance scrambles for yield, crypto's early adopters keep stacking—hard.

Whale Alert: Ethereum's Foundation Just Got Stronger

An original Ethereum ICO participant just staked a staggering $646 million worth of ETH, signaling unwavering confidence as the asset holds firm above the $4,300 psychological barrier. This isn't just a trade—it's a statement.

Price Stability Meets Institutional Conviction

ETH's resilience at these levels isn't accidental. Major players are locking in substantial positions, reducing circulating supply and creating underlying buy pressure that would make any traditional fund manager blush—if they understood it.

The Ultimate Hold Strategy

Staking this volume doesn't just earn yield—it anchors the entire network. While Wall Street pays 0.5% on "high-yield" savings accounts, Ethereum validators are earning real returns without asking permission from any central bank.

Funny how the "risky crypto" keeps outperforming the “safe” traditional instruments… almost like the entire legacy financial system is running on hopium and outdated rulebooks.

Dormant Ethereum Supply Comes Alive

This latest staking action follows a trend of long-term Ethereum whales reentering the market. Last month, another early participant transferred $19 million worth of ETH to Kraken, while a separate whale moved 2,300 ETH to the same exchange.

However, unlike those transfers, this week’s activity adds to Ethereum’s staking LAYER instead of fueling sell pressure. Ethereum staking now exceeds 33 million ETH as older investors seek stable yields through the proof-of-stake model.

Market Trends Reflect Bullish Sentiment

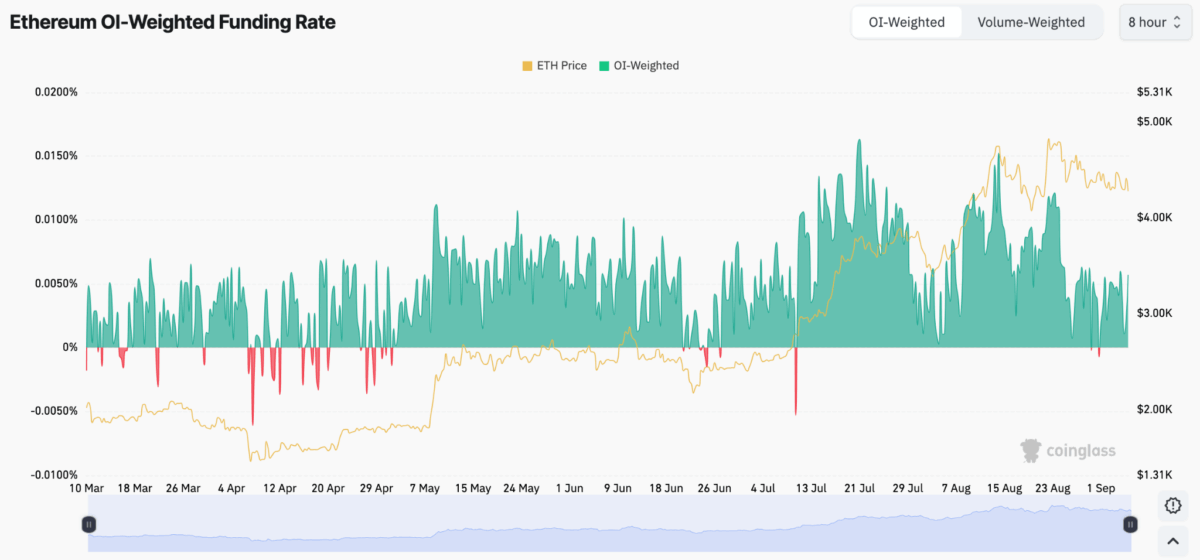

According to data from Coinglass, Ethereum’s funding rates have mostly remained in the positive territory over the past few months. Funding rates being positive means that long-term traders are paying short-term traders, which is a bullish signal.

According to the chart, Ethereum’s price surged from around $1,800 in early April to over $5,000 by mid-August. Since then, it has pulled back a bit, settling in the $3,000 to $3,200 range before bouncing back.

The rising funding rates have coincided with these price increases, suggesting a strong buying momentum. On the other hand, sharp declines in funding rates often indicate a cooling-off period when the market gets too hot.

Ethereum whale choosing to stake $646 million instead of selling is a sign of long-term confidence. Hence, this move supports Ethereum’s network security and alleviates concerns about sudden sell-offs.

Also Read: