Ethereum Shatters Records: Monthly Spot Volume Overtakes Bitcoin in Historic Market Shift

Ethereum just flipped the script—and the king of crypto.

The Unthinkable Happens

Monthly spot volume for Ethereum surges past Bitcoin's for the first time. No fluke, no anomaly—just pure market momentum shifting beneath our feet.

Traders Pivot to ETH

Institutions and retail alike are diving into Ethereum's ecosystem. Smart contracts, DeFi protocols, and NFT infrastructure are pulling weight Bitcoin can't match.

What’s Driving the Surge?

Speculation? Innovation? Let’s be real—it’s probably both. And sure, maybe a little fear of missing out as ETH’s utility narrative strengthens.

Bitcoin’s Still King, But…

Don’t count Bitcoin out. Store of value remains its game—but Ethereum is playing a different sport entirely. One that, this month, drew more action.

Of course, Wall Street will still call it ‘digital gold’ while quietly accumulating ETH. Some things never change—like finance’s love for hedging bets.

Bitcoin Shows Early September Recovery

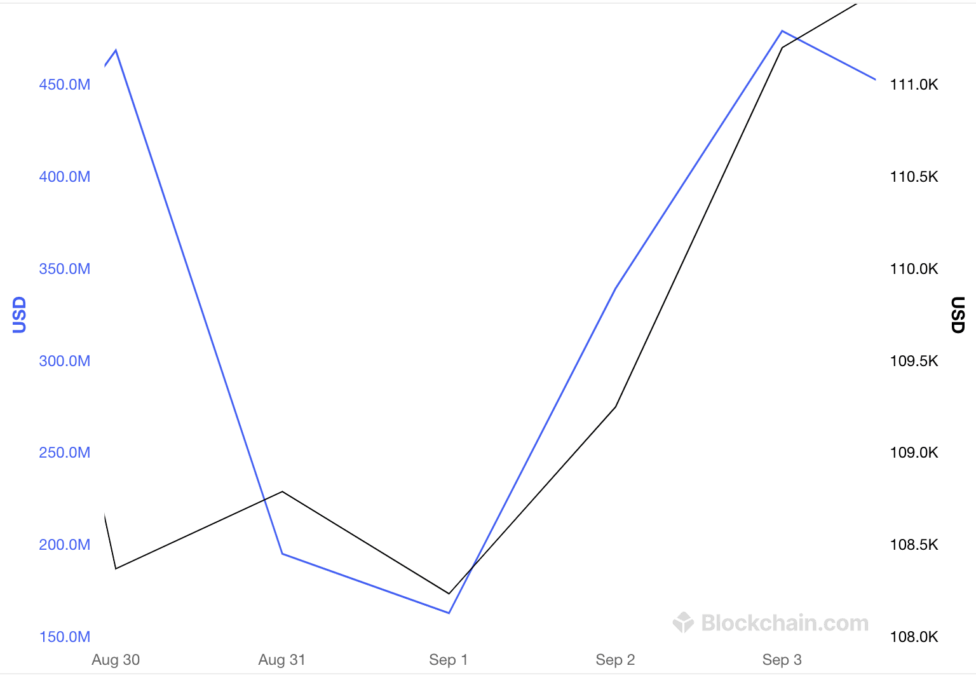

While Ethereum dominated August trading, Bitcoin showed signs of strength at the start of September. Blockchain.com data reveals a drop in trading volumes from $450 million to $150 million from August 30 through September 1. For this period, the price of Bitcoin remained steady, lingering just under $109,000.

In contrast, things got back into the groove on September 2 and saw a heavy comeback with volume and price. By September 3, trading volume once again went up to as much as $450 million, while Bitcoin surged past $111,000.

Institutional Demand Boosts ETH

Ethereum has seen a trading boom, which can largely be attributed to a few positive stories surrounding ETH. Big corporations are piling up on ETH through their digital asset treasury programs, and U.S. spot ETH ETFs are drawing in a lot of investors.

Last month, companies like BitMine Immersion and SharpLink Gaming disclosed multi-billion-dollar ether purchases, pushing public company ETH treasuries to new highs.

Paul Howard, senior director at crypto market maker Wincent, noted this shift could accelerate. “It would be worth keeping eyes on the Bitcoin whale wallets that have been switching to ETH this quarter,” he said. He added that potential U.S. rate cuts in Q4 could push ETH and other major cryptocurrencies to fresh all-time highs.

Ethereum’s historic trading surge signals a changing landscape in the crypto market. Rising institutional demand could drive ETH to more dominance as 2025 progresses.

Also Read: Jack Mallers Criticizes Ethereum’s Potential to Surpass Bitcoin