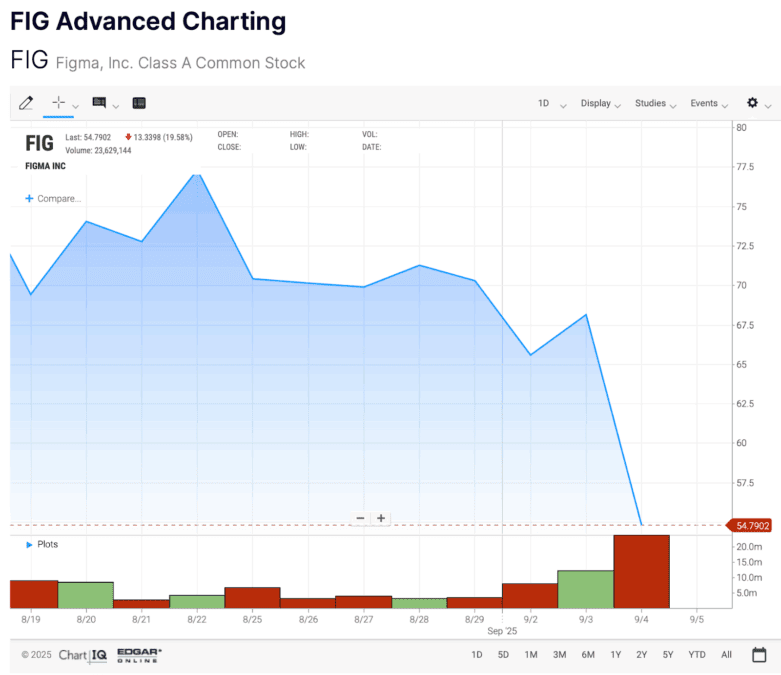

Figma’s 14% Plunge Exposes Bitcoin Portfolio Risks as Lockup Period Expires

Design platform's crypto bet backfires as market pressures mount

The Unlock Effect

Figma faces immediate selling pressure as 14% of its Bitcoin holdings become liquid—just as the cryptocurrency tests key support levels. The timing couldn't be worse for the design software giant that jumped headfirst into digital assets during the bull run.

Portfolio Pain

That 14% drop mirrors exactly the portion of Bitcoin positions now freed from lockup constraints. Early investors and employees suddenly hold liquid assets in a declining market, creating perfect conditions for a selloff cascade.

Corporate Crypto Reality Check

While treasury diversification sounded brilliant at Bitcoin's peak, the strategy now highlights why traditional finance types warn against mixing operational cash with speculative assets. Nothing says 'mature financial planning' like watching company reserves evaporate because a meme coin influencer had a bad week.

Market mechanics meet corporate strategy—with predictable results when hype collides with lockup expiry dates.

Figma Stocks. Source: Nasdaq

Figma Stocks. Source: Nasdaq

Bitcoin on the Balance Sheet

Among the most notable crypto-related disclosures: Figma holds $90.8 million in a bitcoin ETF, part of its $1.6 billion in cash and equivalents. Though CEO Dylan Field downplayed comparisons to firms like Strategy, he acknowledged the decision to allocate a slice of treasury reserves to BTC.

“We’re not trying to be Michael Saylor here,” Field said. “But we think there’s a place for it in the balance sheet.”

The statement positions Figma as one of several tech firms dipping into crypto-native treasury strategies, a growing trend among Nasdaq-listed companies. The move echoes similar balance sheet plays by digital asset treasuries like BitMine Immersion and Strategy, which hold ethereum and Bitcoin respectively.

Lockup Unwinds, Crypto Exposure Adds Volatility

Part of the investor sell-off stems from a post-IPO lockup expiring on September 4, which will make 25% of employee-held shares available for sale. Another 35% of shares come off lockup in August 2026 — a deadline markets aren’t ignoring. Figma’s Bitcoin stash, though small, only sharpens volatility as regulators close in on treasury crypto plays.

Figma’s earnings may have landed ahead of expectations, but its crypto disclosures and market reaction offer a case study in how digital asset exposure is being priced into public equity.

With treasury-linked crypto plays under increased Nasdaq scrutiny, and more firms turning to Bitcoin or token strategies as part of post-IPO capital deployment, Figma’s slide highlights a growing reality: holding BTC may be strategic—but it also raises questions Wall Street isn’t always ready to answer.

Also Read: Bitget Launches Tokenized Stock Trading with ONDO Finance