$300 Million Crypto Shorts Wiped Out in Just 4 Hours—Market Chaos Unleashed

Crypto bears got absolutely crushed—$300 million in short positions liquidated in a historic four-hour frenzy.

When Markets Turn Savage

Leveraged traders betting against crypto didn’t stand a chance. A violent market surge triggered cascading liquidations, wiping out shorts at a breathtaking pace. No fancy algorithms or risk models could save them—just pure, old-fashioned volatility doing what it does best.

Zero Sympathy on the Blockchain

This is what happens when you underestimate crypto’s momentum. While shorts got rekt, long positions raked in gains—classic market Darwinism at play. Some called it a squeeze; others called it a bloodbath. Either way, it’s a stark reminder: in crypto, the market doesn’t care about your carefully crafted thesis.

Another day, another brutal lesson in leverage—almost makes you wonder why Wall Street still thinks traditional risk management applies here.

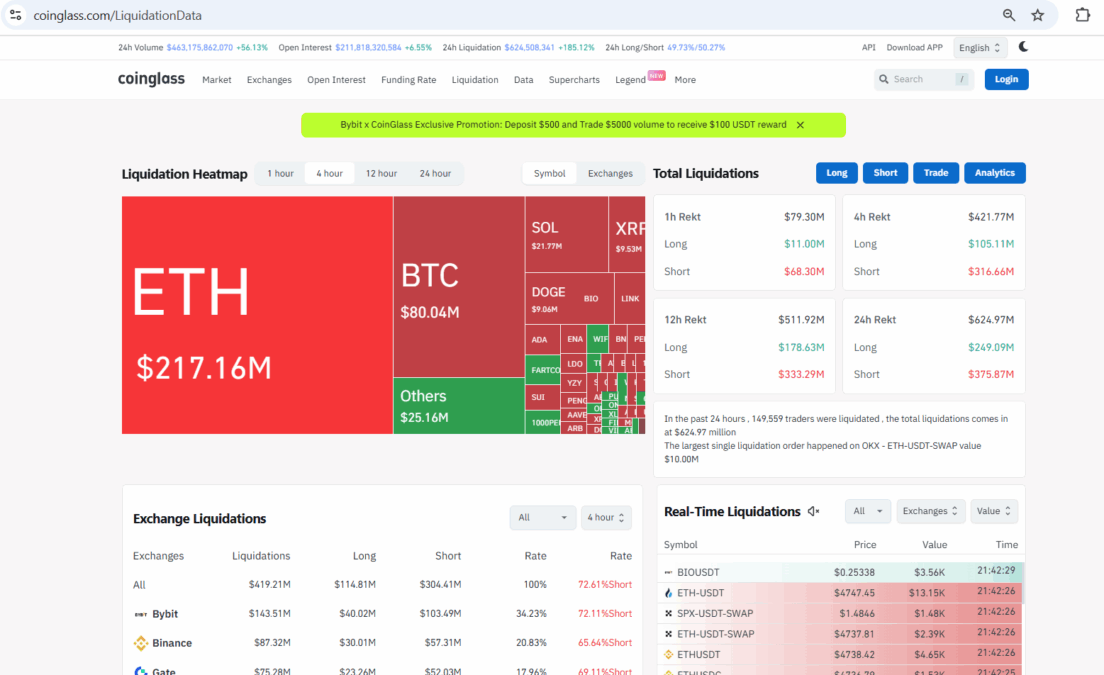

Crypto Liquidations | Source: Coinglass

Crypto Liquidations | Source: Coinglass

Ether (ETH) positions were the hardest hit, with a staggering $217.16 million liquidated as the price rose from $4,200 to $4,650, marking a 10% gain. Bitcoin (BTC) positions saw the second-highest liquidations at $80.04 million, while other altcoins like Solana (SOL) and Dogecoin (DOGE) also experienced significant pain, with $21.77 million and $9.06 million liquidated, respectively.

Data shows the liquidations were concentrated on a few major exchanges. Bybit led the activity with $143.51 million in total liquidations, followed by Binance at $87.32 million. According to CoinGlass, the largest single liquidation order of the day was a $10 million ETH-USDT-SWAP on the OKX exchange.

BTC bounced off the $111,800 support sharply by raising 4% to $116,183. This support was critical as it was a record high set in May. The bounce indicates a bullish reversal following a one-week downtrend from $124,500.

Despite fears that Powell’s speech would have a hawkish tone, he said “the downside risks to employment are rising,” and “If those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.” The comments suggest rate cuts could be on the table next month, which would directly benefit risk assets like Bitcoin and ether.

The market remains volatile following the speech, with BTC pulling back slightly from $115,700 to $114,800. While liquidations have taken derivatives positions out of the market, open interest has risen to its highest point in four days, suggesting that the bounce is also being backed by leverage.

Also Read: SharpLink Approves $1.5B Stock Buyback Tied to ETH Holdings