SharpLink Goes All-In: 740,760 ETH Accumulation Follows Massive $537M Capital Raise

Ethereum's institutional adoption narrative just got another heavyweight backer—and they're putting real money behind the bet.

The Mega-Buy Strategy

SharpLink isn't dipping toes; it's diving in headfirst with a quarter-million-ETH purchase that screams conviction. This isn't casual accumulation—it's a strategic fortress-building move that dwarfs most corporate treasury plays.

Market Impact & Liquidity Drain

Pulling 740,760 ETH off the market doesn't just signal confidence—it actively tightens supply. Exchanges feel the pinch when whales like this swallow liquidity whole, leaving smaller traders scrambling for scraps.

The $537M War Chest

That raise wasn't for show—it's pure fuel for aggressive expansion into digital assets. Because why bother with boring bonds when you can chase asymmetric returns in the crypto wild west?

Institutional Domino Effect

Watch others follow—nothing gets traditional finance moving like FOMO dressed up as 'strategic allocation.' Next thing you know, every hedge fund will need an ETH position to avoid looking outdated at yacht parties.

Because nothing says 'financial innovation' like throwing half a billion at an asset class that still gives traditional bankers night sweats—but hey, at least they're not stuck with negative-yielding bonds.

ETH Purchases and Treasury Growth

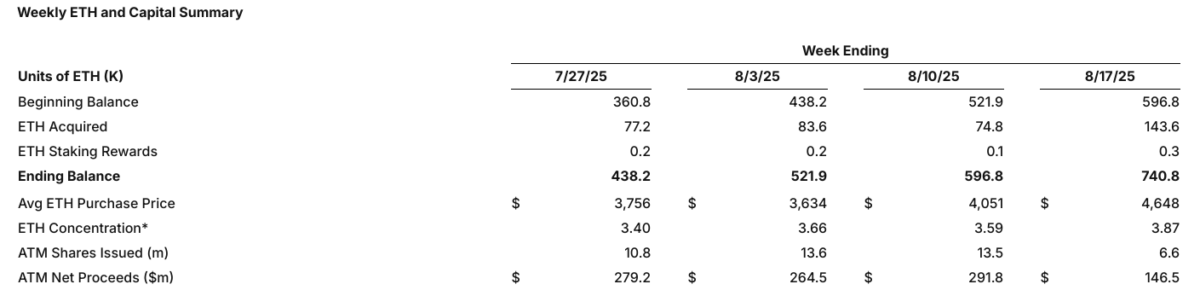

The company’s weekly summary shows a sharp rise in ETH acquisitions compared to previous weeks. SharpLink added 143,593 ETH, more than doubling its previous week’s purchases.

Since the treasury strategy kicked off on June 2, staking rewards have shot up to 1,388 ETH, which is a boost for acquisitions. However, there’s a bit of a hiccup with a short-term unrealized loss, as the average purchase price of $4,648 is still above the current ethereum price of $4,282.

Interestingly, ETH concentration—a unique internal metric—has surged by 94% since June, but management doesn’t seem too worried about it. A current concentration of 3.87 indicates accumulation in relation to the number of outstanding shares.

Funding Strengthens Strategy

Furthermore, SharpLink’s funding activities remain a Core driver of its expansion. The ATM facility generated $146.5 million in net proceeds last week alone. Meanwhile, the direct offering closed at $390 million, giving the company liquidity to pursue further Ethereum buys.

Additionally, ATM share issuance dropped to 6.6 million, compared to 13.5 million the week before. Hence, the company managed to balance shareholder dilution while raising capital efficiently.

According to Yahoo Finance data, SharpLink’s stock was down 4.08% for the day, trading at $19.30 at 9:45 AM EDT at the time of writing.

This move shows how more companies are now treating Ethereum as a serious treasury asset. And even with the recent price swings, SharpLink’s big Ethereum bet signals that institutional confidence in crypto is growing.

Also Read: MicroStrategy Faces Backlash From Investors Over New Equity Policy