Mantle & OKB Surge While Bitcoin Stumbles – Aug 16 Crypto Pulse

Crypto markets flashed divergence today as altcoins stole the spotlight. Mantle and OKB ripped higher while Bitcoin bled—classic 'risk-on' behavior that’ll have maxis grinding their teeth.

Alts Flex, BTC Wobbles

No surprises here: Traders rotated out of the old guard faster than a DeFi exploit drains liquidity. The real question? Whether this is a healthy altseason kickoff or just another fakeout before the next BTC ETF narrative takes over.

Wall Street’s Crypto Nostalgia

Watching institutional money chase yesterday’s alts feels like hedge funds discovering floppy disks. But hey—if it keeps the Tether printers humming, who are we to judge?

Top Gainers and Losers

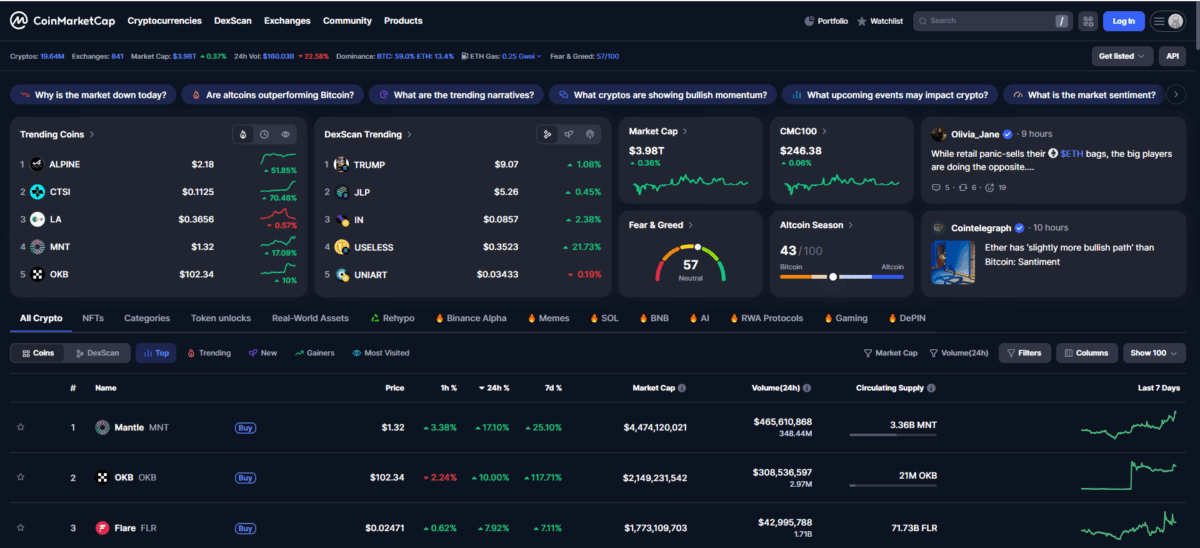

Some altcoins had high gains today despite the decline. At the time of writing, Mantle rose 17% to $.32, having $465.6 million in trading volume. OKB followed with a 10.96% rise to $102.2, while Flare climbed 8.64% to $0.02423. The Sandbox also advanced 2.20% to $0.2917.

However, declines dominated the broader market. Pump.fun dropped 8.26% to $0.003391, while Fartcoin lost 6.35% to $0.9519. Arbitrum fell 5.85% to $0.4809 despite recording $570.71 million in volume. Aerodrome Finance slid 5.40% to $1.33, extending losses among altcoins.

Market Sentiment and Indicators

On the market as a whole, the Fear and Greed index stands at 57, with a neutral sentiment in the market. The Altcoin Season Index is currently 43, meaning Bitcoin is still going strong while altcoins are lagging.

Moreover, the CoinMarketCap 100 Index slipped by 0.81% to $245.99, reflecting a general weakening trend in the market. The dominance of Bitcoin stands strong at 59.1%, which is trailed by ethereum with 13.4%.

Crypto ETFs saw net outflows of $73.4 million an indication of cautious market. Open interest is still quite substantial, hitting $864.12 billion in perpetual contracts and $4.15 billion in futures.

The recent pullback is a result of profit-taking after bitcoin hit its all-time high of around $124,000.Additionally, there is some ambiguity around the liquidation of derivatives and U.S. Bitcoin reserves, which has increased pressure.

Also Read: