Crypto Markets Stumble as U.S. PPI Data Sparks Bearish Sentiment

Crypto takes a hit after disappointing U.S. economic data—because apparently, digital assets still care about old-school inflation metrics.

Markets react to macro pressure

Bitcoin and altcoins dipped across the board as traders digested hotter-than-expected producer price figures. The 'decentralized' market remains oddly centralized around Fed policy.

Buy-the-dip crowd watches closely

While short-term traders panic, long-term holders see this as another entry point in crypto's volatile journey. After all, what's a 5% drop between friends in an asset class that routinely swings 20%?

Another day, another overreaction to government data that'll be forgotten by next week. Welcome to crypto—where the fundamentals are made up and the technicals don't matter (until they do).

Bitcoin price drops | Source: CoinMarketCap

Bitcoin price drops | Source: CoinMarketCap

The selloff illustrates the extent to which crypto markets now track U.S. macroeconomic indicators, as investors moved swiftly on signals that could influence borrowing costs and liquidity.

Labor market data was no comfort. New weekly jobless claims for August 9 tallied at 224,000, a bit below forecast, and ongoing claims were at 1.95 million. The still-consolidating labor market, coupled with strong inflation readings, makes the argument for the Fed to keep rates higher for longer even more compelling.

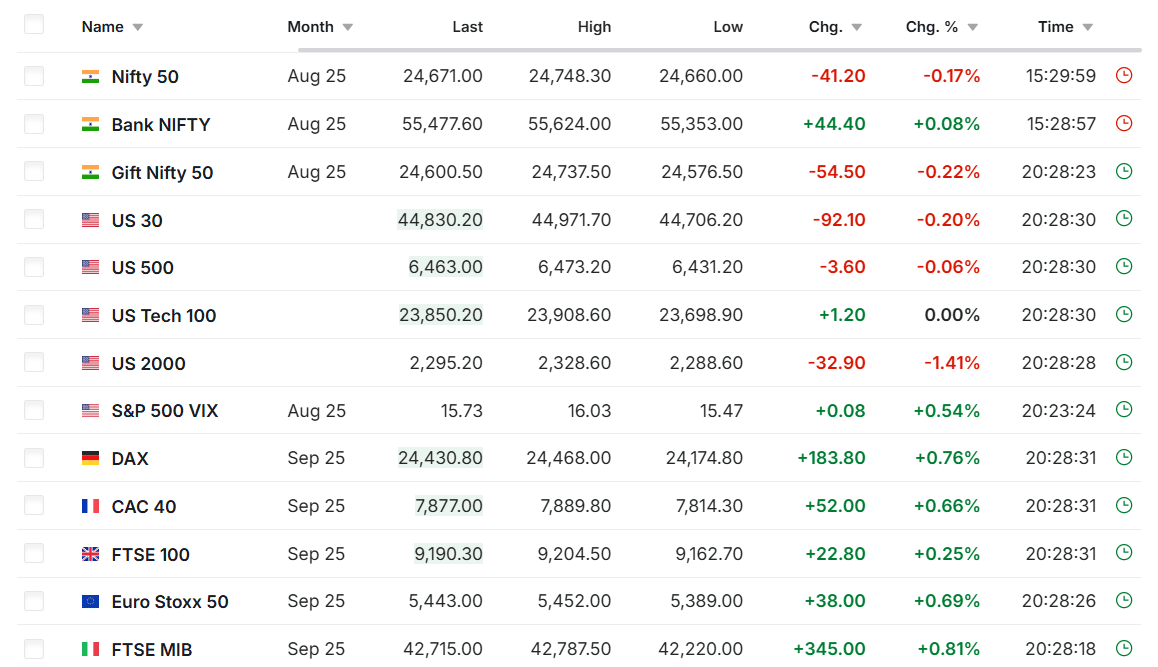

The U.S. equity index futures fell 0.5%, the dollar appreciated, and the 10-year Treasury yield rose by five basis points to 4.25%, showing a MOVE to safety assets.

The PPI surge reminds that inflation pressures are still recalcitrant and complicate the policy path of the Fed.

Also Read: Bitcoin, Ethereum Rally as Softer US Inflation Fuels Rate Cut Bets