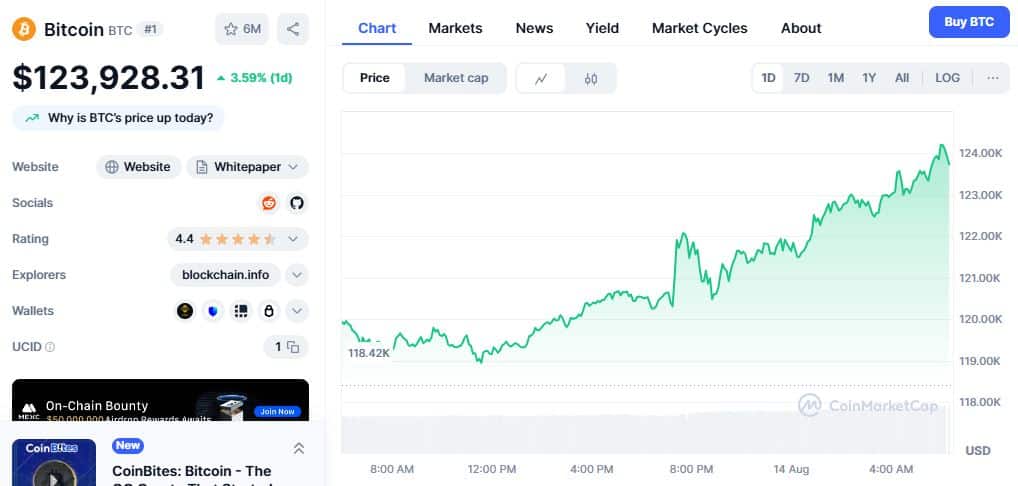

🚀 Bitcoin Smashes $123K Barrier—Next Stop $125K as Bull Run Accelerates

Bitcoin just ripped through another psychological milestone—$123K—like a hot knife through institutional FUD. The king of crypto isn’t asking for permission; it’s taking names.

Why this rally won’t apologize

No pullbacks, no mercy. Traders are piling in faster than a hedge fund manager chasing performance fees. Liquidity? Thin as a banker’s patience for regulatory scrutiny.

The $125K magnet

Every resistance level is now just a suggestion. With shorts getting vaporized, the path to $125K looks clearer than a VC’s exit strategy.

Remember: This is the same asset that ‘serious investors’ called a bubble at $50K. Now they’re quietly rebalancing their portfolios—between golf swings.

Source: CoinMarketCap

Source: CoinMarketCap

Currently, Bitcoin trades at $123,928; its market capitalization now stands at $2.46 trillion, with 24-hour trading volume reaching $94.16 billion. The broader digital asset market is also gaining ground, with total crypto market value climbing 2.84% to $4.17 trillion.

Institutional buying remains a major driver. US-listed Bitcoin ETFs have pulled in $1 billion in net inflows over the past five days, led by BlackRock’s IBIT fund, which added $111 million on Tuesday and now manages $58.07 billion. Total Bitcoin ETF exposure has climbed above $153 billion. ethereum ETFs have also drawn strong interest, recording a $1 billion single-day inflow on Tuesday and $523.9 million earlier this week.

Corporate activity is adding fuel to the rally. Japan’s Metaplanet purchased 518 BTC for $61.4 million at an average price of $118,519. Large company wallets accumulated almost 3,000 BTC in just two days. Michael Saylor’s Bitcoin-focused company, Strategy, has taken its holdings to an all-time high of $77.2 billion, almost double its previous peak of $41.8 billion set in 2024.

The market’s momentum is clear. Bitcoin has pushed through important resistance points, with charts showing higher lows and a bullish crossover between the 100-day and 200-day moving averages. Traders say a strong close above $123,682 could pave the way toward $126,875.

With economic conditions tilting in Bitcoin’s favor, ETF inflows picking up pace, and more corporations adding BTC to their reserves, this rally is being built on solid ground. The next test for the market will be whether it can maintain momentum and push through to a clean break above $125,000.

Also Read: Kazakhstan’s Fonte Capital Launches Central Asia’s First bitcoin ETF