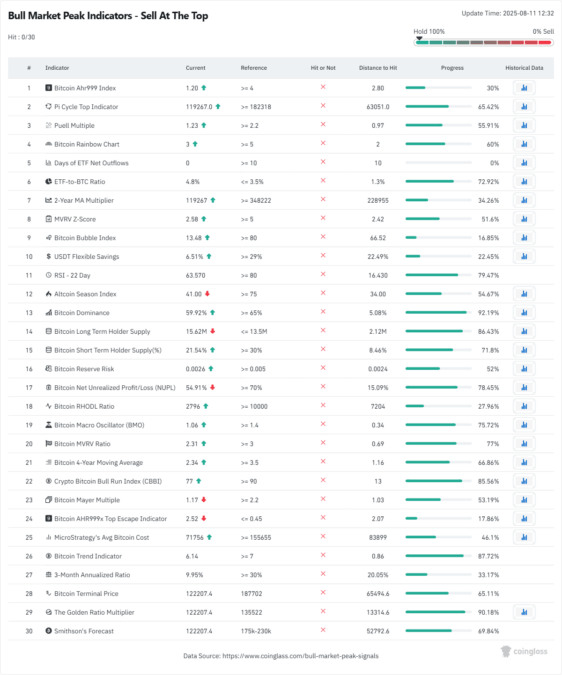

Crypto Bull Market Still Roaring: Key Indicators Suggest the Peak is Nowhere in Sight

The crypto bull market isn't just alive—it's thriving. Forget whispers of a top; on-chain metrics and institutional inflows scream 'early innings.' Here's why.

No Exit Signs Yet

Retail FOMO hasn't hit 2021-level hysterics. Exchange reserves are bleeding out—hodlers are bunkering up, not cashing out. Even the usual 'overheated' signals (looking at you, Bitcoin RSI) keep resetting higher.

Institutions Just Warming Up

BlackRock's BTC ETF crossed $50B AUM last week. Meanwhile, Ethereum staking yields still beat Treasury bonds—if you ignore the gas fees that would bankrupt a hedge fund intern.

The Bottom Line

Until your Uber driver starts pitching altcoin bags, this train's got miles to go. Just maybe hedge before Wall Street 'discovers' DeFi again.

Source: CoinGlass

Source: CoinGlass

After a brief profit-taking move, Bitcoin is currently trading at around $122,000 after trading at $116,500 just two days ago.

New Bitcoin High Soon?

Jason Pizzino, a well-known crypto analyst, said in a post on X earlier today that, “Bitcoin is 1% away from another new all-time high this cycle.” If this current bullish move continues, we may see bitcoin breaking the ATH from the previous month and creating a new one.

Bitcoin is 1% away from another new all-time high this cycle. #BTC pic.twitter.com/vQVui4G0x9

— Jason Pizzino 🌞 (@jasonpizzino) August 11, 2025Augustine Fan, Head of Insights at SignalPlus, said, “Crypto [saw] a rebound in prices this week, led by headline statements from Trump ordering regulators to ‘look into’ the possibility of including crypto (and private equity) into 401k portfolios.” By this move, the crypto market will likely see significant buying demand in coming days.

Crypto Market Cap Surges to $4 Trillion

Over the weekend, the total crypto market cap reached an all-time high of $4 trillion for the first time in history, with Bitcoin’s market cap taking the largest chunk of it at around $2.4 trillion. This happened as we saw increased crypto inflows starting from July.

This remaining uptrend can be traced to institutional demand keeping Bitcoin dominance high. Last week, Bitcoin ETFs saw a net inflow of $247 million, with BlackRock’s IBIT leading the way with a net inflow of $189 million, as per SosoValue.

Besides, the crypto market still remains in a bullish condition with bullish macro headlines and increasing institutional adoption. While this could be a long-term projection of the market, we can expect an increase in volatility amid this growing adoption.

Also Read: LayerZero Foundation Moves to Acquire Stargate in $110M Deal