Chainlink Unleashes On-Chain Reserve to Supercharge Network Growth

Chainlink just dropped a game-changer—an on-chain reserve designed to turbocharge its oracle network's expansion. No more begging traditional finance for liquidity crumbs.

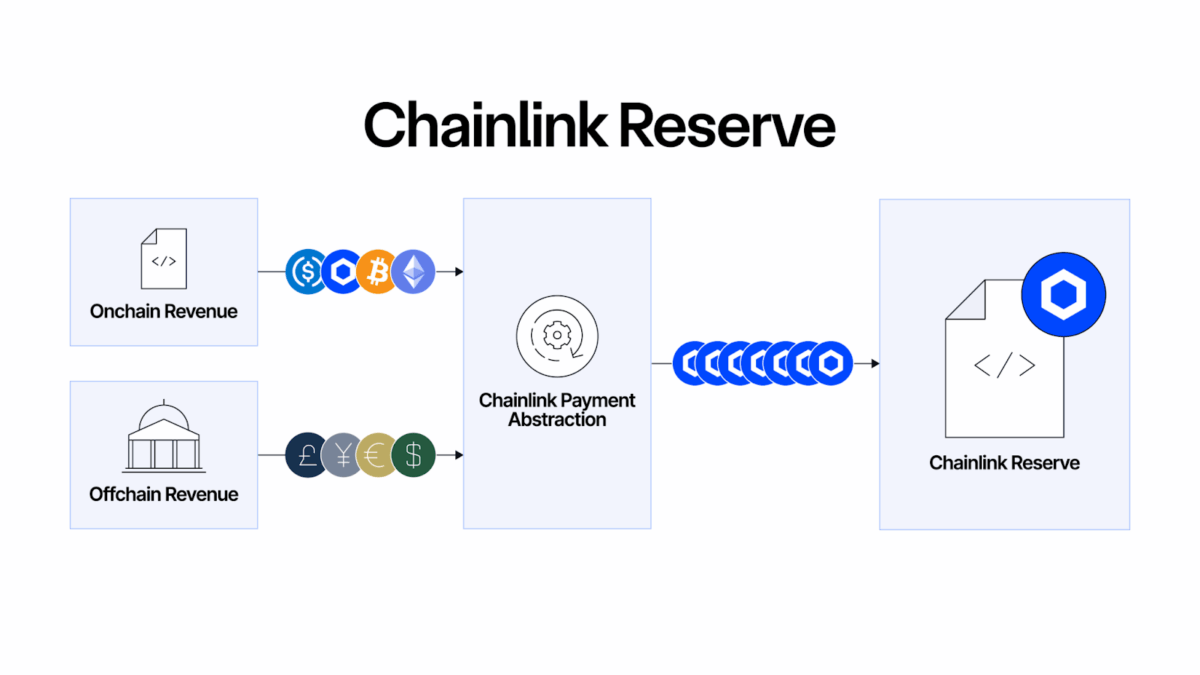

How it works: The reserve acts as a decentralized treasury, funding node operators and incentivizing data providers without middlemen. Think of it as a self-sustaining engine for Web3's most critical infrastructure.

Why it matters: With 75% of DeFi relying on Chainlink's price feeds, this move could finally break the 'oracle problem' once and for all. Unless, of course, the crypto bros find a way to gamble this into oblivion too.

The kicker? It's all automated. No hedge fund managers taking 2-and-20 cuts for moving digital numbers around. The network now pays its own way—like a grown-up protocol should.

Strategic Accumulation and Transparency

To date, the Chainlink Reserve has amassed over $1 million in LINK within its initial launch phase, and Chainlink anticipates ongoing growth with no withdrawals scheduled for years.

Large enterprises, such as several of the world’s leading banking and capital markets organizations, have already supplied substantial offchain income to Chainlink and are converting it to LINK and depositing it in the reserve.

In order to promote transparency, Chainlink has introduced a public analytics dashboard and opened the Reserve’s smart contract on Etherscan to access.

It’s part of Chainlink’s economic vision of lowering cost of operation through architectural innovation and driving user fee growth through enterprise integration, on-chain payment of services, and usage-based strategies.

Chainlink’s Competitive Edge:

The platform’s market leadership was initially established through its invention of the decentralized oracle network and its industry-standard Price Feeds, which secured over $80 billion in Total Value Secured across 60+ blockchains.

Beyond market data, Chainlink has expanded to offer a modular suite of services (including CCIP, Automation, VRF, and Functions) that address complex requirements for advanced blockchain applications. This unified platform enables institutions to combine different blockchains, external data sources, and legacy systems, embedding critical compliance and privacy capabilities into a unified workflow.

The new reserve is intended to support the growth of the Chainlink Network in future years. Keeping in mind, key goals for sustainability that were initially defined in Chainlink Economics.

As blockchain-based finance and tokenization grows, Chainlink Reserve makes the protocol more prepared for use in both traditional finance (TradFi) and decentralized finance (DeFi).

Also Read: Chainlink Launches Real-Time U.S. Equities Data on 37 Blockchains